1040es Form 2016

What is the 1040es Form

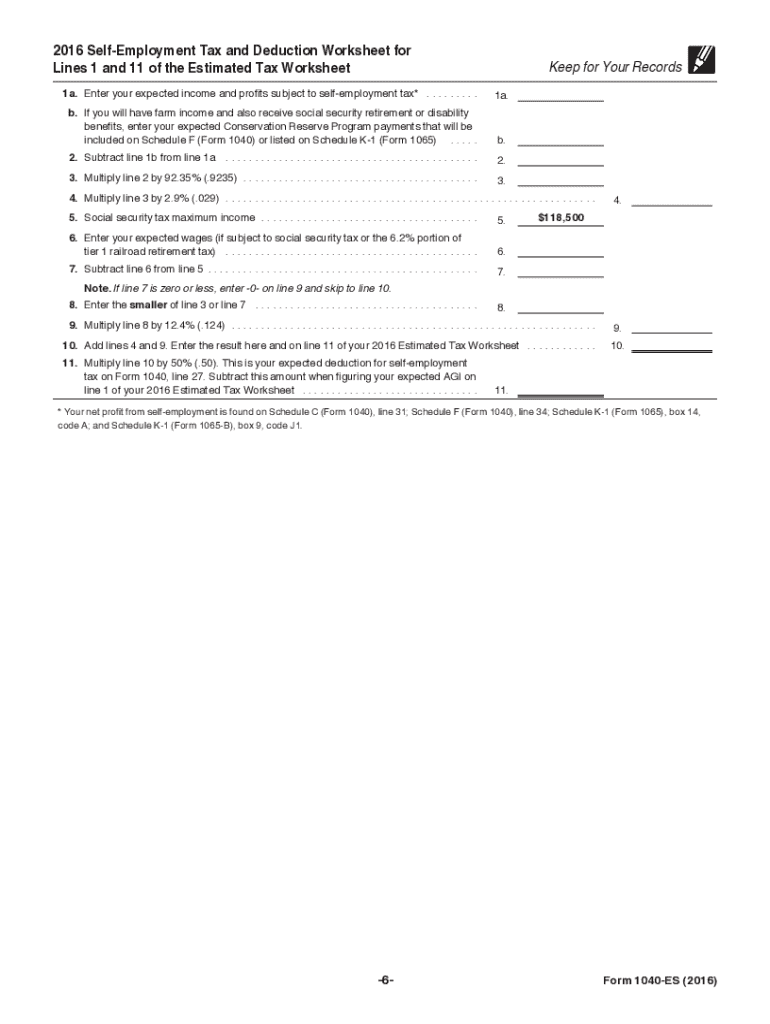

The 1040es Form is a tax document used by individuals in the United States to report estimated tax payments. This form is essential for those who expect to owe tax of one thousand dollars or more when they file their annual tax return. The 1040es Form allows taxpayers to make quarterly estimated tax payments, helping to avoid penalties for underpayment. It is particularly relevant for self-employed individuals, freelancers, and those with income not subject to withholding.

How to use the 1040es Form

Using the 1040es Form involves several steps to ensure accurate reporting of estimated taxes. Taxpayers must first calculate their expected income for the year, considering all sources of income. Next, they determine the estimated tax liability based on current tax rates. The form provides a worksheet to assist in these calculations. Once the estimated tax is calculated, payments can be made using the vouchers included with the form, either by mail or electronically. It is important to keep records of all payments made for future reference.

Steps to complete the 1040es Form

Completing the 1040es Form requires careful attention to detail. Here are the steps:

- Gather necessary financial documents, including income statements and expense records.

- Calculate your expected annual income and tax liability using the IRS guidelines.

- Fill out the 1040es Form, ensuring all information is accurate and complete.

- Use the payment vouchers provided to submit your estimated tax payments.

- Keep a copy of the completed form and payment records for your files.

Legal use of the 1040es Form

The 1040es Form is legally recognized for reporting estimated taxes and must be used in accordance with IRS regulations. To ensure legal compliance, taxpayers should accurately report their income and follow the guidelines for estimated payments. Failure to comply with these regulations may result in penalties or interest charges. It is crucial to stay informed about any changes in tax laws that may affect the use of the 1040es Form.

Filing Deadlines / Important Dates

Timely filing of the 1040es Form is essential to avoid penalties. The estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure they meet the deadlines. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these important dates can help maintain compliance and avoid unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The 1040es Form can be submitted through various methods to accommodate different preferences. Taxpayers can file the form electronically using approved e-filing services, which is often the fastest method. Alternatively, the form can be mailed directly to the IRS using the address specified in the form instructions. For those who prefer in-person submissions, visiting a local IRS office is also an option. Each method has its own processing times, so choosing the right one is important for timely compliance.

Quick guide on how to complete 1040es 2016 form

Complete 1040es Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 1040es Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign 1040es Form seamlessly

- Obtain 1040es Form and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign 1040es Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040es 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1040es 2016 form

How to create an eSignature for your 1040es 2016 Form in the online mode

How to create an eSignature for your 1040es 2016 Form in Google Chrome

How to generate an electronic signature for signing the 1040es 2016 Form in Gmail

How to make an eSignature for the 1040es 2016 Form from your smart phone

How to generate an eSignature for the 1040es 2016 Form on iOS

How to generate an eSignature for the 1040es 2016 Form on Android OS

People also ask

-

What is the 1040es Form and who needs it?

The 1040es Form is a tax form used by individuals to report estimated tax payments to the IRS. It's essential for self-employed individuals or those with income not subject to withholding, ensuring they pay the correct amount of taxes throughout the year. Understanding the 1040es Form helps prevent underpayment penalties.

-

How can airSlate SignNow help me with the 1040es Form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out and eSign your 1040es Form online. Our solution streamlines the document signing process, making it quick and hassle-free, so you can focus on your finances instead of paperwork.

-

What features does airSlate SignNow offer for handling the 1040es Form?

With airSlate SignNow, you can securely upload, edit, and eSign your 1040es Form from any device. Our platform also includes features like templates, document sharing, and tracking, making it easier to manage your tax documents efficiently.

-

Is airSlate SignNow a cost-effective solution for filing the 1040es Form?

Yes, airSlate SignNow provides a cost-effective solution for managing your 1040es Form and other documents. Our pricing plans are designed to fit various budgets, ensuring you can access premium features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my 1040es Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to import and export your 1040es Form data easily. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of eSigning the 1040es Form with airSlate SignNow?

eSigning your 1040es Form with airSlate SignNow offers numerous benefits, including increased security and faster processing times. Our platform ensures that your documents are legally binding and securely stored, giving you peace of mind.

-

How secure is the data I submit with my 1040es Form using airSlate SignNow?

Data security is a top priority at airSlate SignNow. We use industry-standard encryption and security protocols to protect your sensitive information when you submit your 1040es Form, ensuring that your data is safe from unauthorized access.

Get more for 1040es Form

Find out other 1040es Form

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation