Form 1040 ES Form 1040 ES, Estimated Tax for Individuals 2023

What is the Form 1040 ES

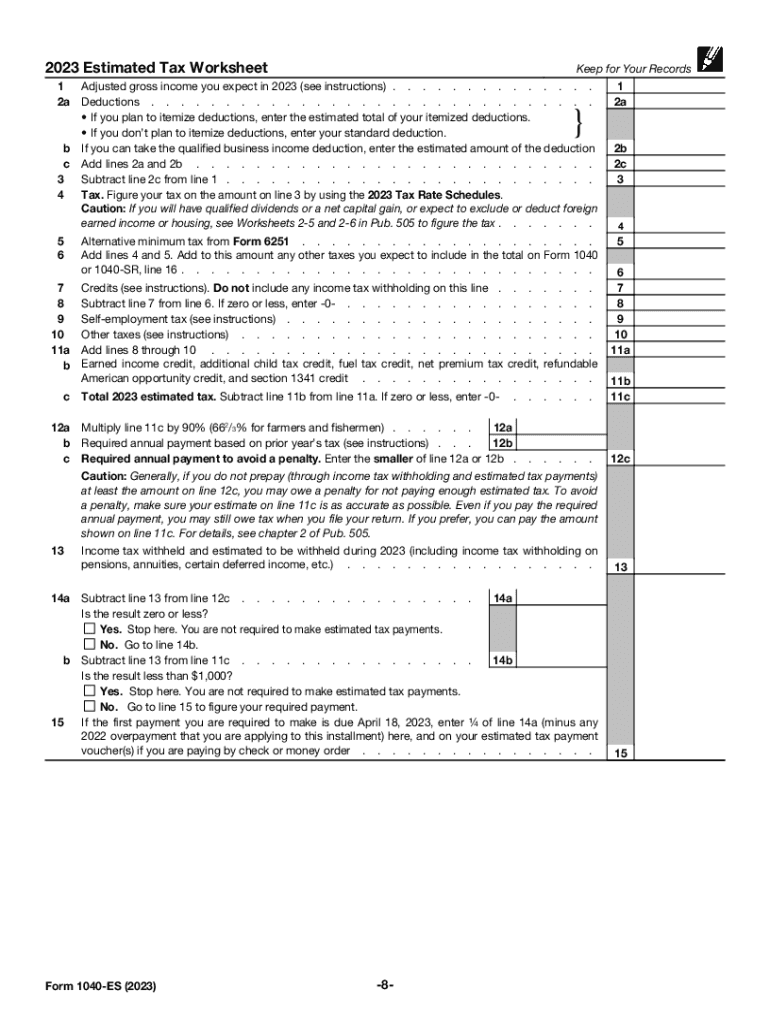

The Form 1040 ES is used by individuals to report estimated tax payments to the Internal Revenue Service (IRS). This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It is particularly relevant for self-employed individuals, freelancers, and those with income not subject to withholding. By using the Form 1040 ES, taxpayers can avoid penalties for underpayment and ensure they meet their tax obligations throughout the year.

How to use the Form 1040 ES

To effectively use the Form 1040 ES, individuals must first determine their expected tax liability for the year. This involves estimating their income, deductions, and credits. Once the estimated tax is calculated, taxpayers can divide this amount by four to determine quarterly payments. The completed form can then be submitted to the IRS along with the payment, either online or by mail. It is crucial to keep track of payment due dates to avoid late fees and penalties.

Steps to complete the Form 1040 ES

Completing the Form 1040 ES involves several key steps:

- Estimate your total income for the year.

- Calculate your expected deductions and credits.

- Determine your estimated tax liability using the IRS tax tables.

- Divide the total estimated tax by four to find the quarterly payment amount.

- Fill out the Form 1040 ES with your personal information and payment details.

- Submit the form along with your payment to the IRS by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 ES are crucial for compliance. Typically, estimated tax payments are due on the following dates:

- First payment: April 15

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

It is important to note that if a due date falls on a weekend or holiday, the deadline is extended to the next business day.

Penalties for Non-Compliance

Failure to file the Form 1040 ES on time or to make the required estimated tax payments can result in penalties. The IRS may impose a penalty for underpayment of estimated tax if you do not pay at least 90% of your current year's tax liability or 100% of the previous year's tax liability. Additionally, interest may accrue on any unpaid balance. It is advisable to stay informed about your tax obligations to avoid these penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 1040 ES. Taxpayers should refer to the IRS instructions for Form 1040 ES for detailed information on eligibility, payment methods, and filing requirements. Following these guidelines helps ensure compliance and minimizes the risk of errors in tax reporting.

Quick guide on how to complete 2023 form 1040 es form 1040 es estimated tax for individuals

Complete Form 1040 ES Form 1040 ES, Estimated Tax For Individuals effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Form 1040 ES Form 1040 ES, Estimated Tax For Individuals on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Form 1040 ES Form 1040 ES, Estimated Tax For Individuals without hassle

- Find Form 1040 ES Form 1040 ES, Estimated Tax For Individuals and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that function.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to retain your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1040 ES Form 1040 ES, Estimated Tax For Individuals and guarantee outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 1040 es form 1040 es estimated tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 1040 es form 1040 es estimated tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2023 form tax?

The 2023 form tax is critical as it outlines your tax obligations for the year. Understanding it ensures that you remain compliant with state and federal tax laws. Utilizing airSlate SignNow can help you eSign and send necessary documents related to your 2023 form tax efficiently.

-

How can airSlate SignNow help with the 2023 form tax process?

airSlate SignNow simplifies the 2023 form tax process by allowing users to send, sign, and manage documents electronically. This streamlines the workflow and reduces delays typically associated with manual processes. Our easy-to-use platform saves you time during tax season.

-

What features does airSlate SignNow offer for handling the 2023 form tax documents?

airSlate SignNow offers features such as customizable templates for 2023 form tax documents, real-time tracking, and secure eSignature capabilities. These tools enhance your ability to manage tax documents efficiently and ensure accuracy in submissions. This is particularly beneficial during the busy tax filing season.

-

What are the pricing options for using airSlate SignNow for 2023 form tax management?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. Depending on the features you require for managing the 2023 form tax, you can choose a plan that fits your budget while gaining access to our robust document management tools. Check our website for the latest pricing details.

-

Is airSlate SignNow compliant with tax regulations for the 2023 form tax?

Yes, airSlate SignNow adheres to the latest compliance standards necessary for eSigning documents, including those related to the 2023 form tax. Our platform ensures that all documents are executed securely and comply with federal and state regulations, giving you peace of mind.

-

Can I integrate airSlate SignNow with other software for my 2023 form tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software to help streamline your 2023 form tax processes. This integration allows for easy import and export of documents, enhancing your overall efficiency during tax preparation and filing.

-

What benefits does airSlate SignNow provide for small businesses managing their 2023 form tax?

For small businesses, airSlate SignNow offers a cost-effective solution to manage the 2023 form tax effortlessly. Our platform not only saves time but also reduces errors by automating many tedious aspects of document handling. This allows business owners to focus more on their core operations.

Get more for Form 1040 ES Form 1040 ES, Estimated Tax For Individuals

Find out other Form 1040 ES Form 1040 ES, Estimated Tax For Individuals

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online