Form 1040 Es 2014

What is the Form 1040 ES

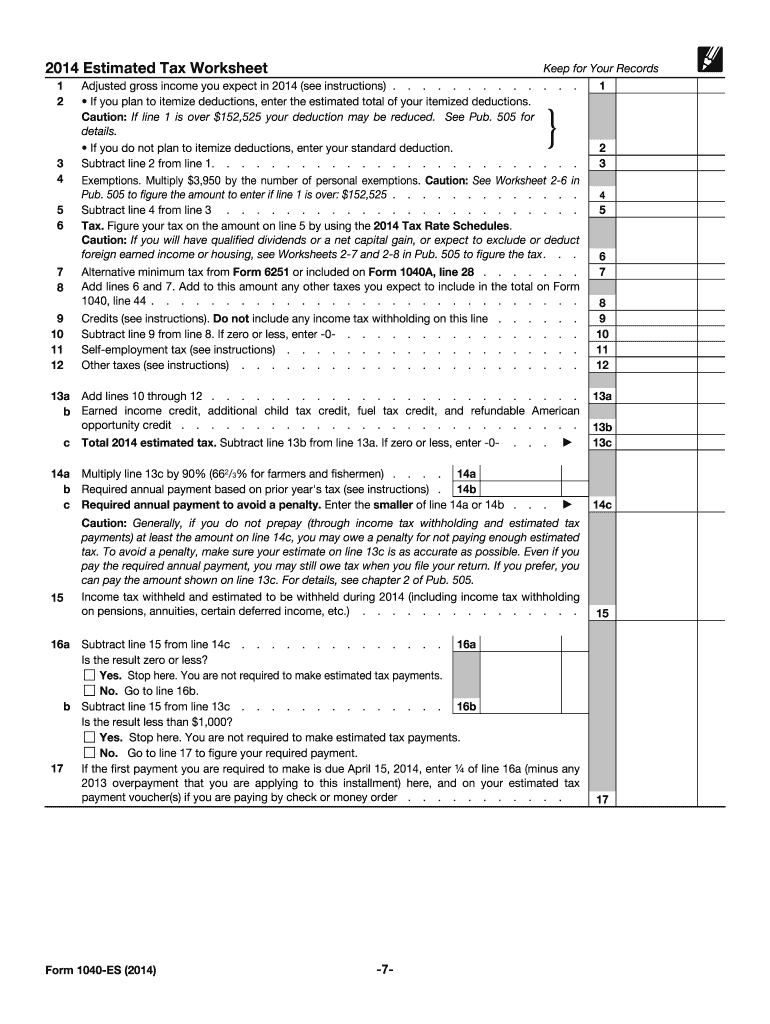

The Form 1040 ES is a crucial document used by individuals in the United States to estimate and pay their federal income tax throughout the year. It is particularly important for self-employed individuals, freelancers, and those who do not have taxes withheld from their income. This form allows taxpayers to make quarterly estimated tax payments, ensuring they meet their tax obligations and avoid penalties for underpayment. The estimated payments are based on the taxpayer's expected income, deductions, and credits for the year.

How to use the Form 1040 ES

To effectively use the Form 1040 ES, taxpayers should first estimate their annual income and applicable deductions. This estimation will help determine the amount owed for each quarter. The form consists of a worksheet that guides users through the calculation process. Once the estimated tax amount is calculated, taxpayers can submit payments using the provided payment vouchers. It is essential to keep track of due dates for each quarter to avoid late fees.

Steps to complete the Form 1040 ES

Completing the Form 1040 ES involves several key steps:

- Gather financial information, including income sources, deductions, and credits.

- Use the worksheet included with the form to estimate your total tax liability for the year.

- Divide the estimated tax liability by four to determine the quarterly payment amount.

- Fill out the payment vouchers included with the form, ensuring all information is accurate.

- Submit the vouchers along with your payments by the specified deadlines.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Form 1040 ES to avoid penalties. The estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to ensure timely submission. If these dates fall on a weekend or holiday, the due date is usually extended to the next business day.

Legal use of the Form 1040 ES

The Form 1040 ES is legally recognized as a valid method for taxpayers to report and pay estimated taxes. To ensure compliance, it is important to follow IRS guidelines regarding the use of this form. Proper completion and timely submission of the form and payments can help avoid penalties and interest charges. Additionally, maintaining accurate records of payments made is crucial for future tax filings.

Key elements of the Form 1040 ES

Several key elements are essential to understand when dealing with the Form 1040 ES:

- Payment Vouchers: Each quarter requires a separate voucher to accompany the payment.

- Estimated Tax Calculation: The form includes a worksheet to help calculate the estimated tax liability.

- Due Dates: Awareness of the quarterly due dates is vital for compliance.

- Record Keeping: Keeping copies of submitted forms and payments is important for future reference.

Quick guide on how to complete form 1040 es 2014

Handle Form 1040 Es seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to draft, modify, and electronically sign your papers quickly and without interruptions. Manage Form 1040 Es on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Form 1040 Es effortlessly

- Find Form 1040 Es and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1040 Es while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 es 2014

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es 2014

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the Form 1040 Es and why is it important?

The Form 1040 Es is an essential tax form used by individuals to make estimated tax payments. It's important because it helps taxpayers avoid penalties by paying their taxes throughout the year instead of in a lump sum at tax time.

-

How does airSlate SignNow simplify the submission of Form 1040 Es?

airSlate SignNow simplifies the submission of Form 1040 Es by providing an intuitive interface for eSigning and sending documents electronically. This reduces paperwork and streamlines the process, helping you manage your tax obligations efficiently.

-

Can I use airSlate SignNow to send Form 1040 Es securely?

Yes, airSlate SignNow offers robust security features to ensure your Form 1040 Es and other sensitive documents are transmitted securely. With advanced encryption and tamper-proof signatures, you can have peace of mind knowing your tax information is protected.

-

What are the pricing options for using airSlate SignNow for Form 1040 Es?

airSlate SignNow provides flexible pricing plans to accommodate various business needs, making it cost-effective for sending Form 1040 Es. Whether you're a small business or a large corporation, there is a plan that fits your budget and usage requirements.

-

Does airSlate SignNow integrate with tax software for Form 1040 Es?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tax software, enhancing your ability to manage Form 1040 Es. This integration allows you to streamline your workflows and ensure accurate data transfer across platforms.

-

What are the benefits of using airSlate SignNow for eSigning Form 1040 Es?

Using airSlate SignNow for eSigning Form 1040 Es offers numerous benefits, including faster turnaround times and reduced administrative burdens. It allows you to collect electronic signatures quickly, ensuring timely submissions and compliance.

-

Is it easy to track the status of Form 1040 Es sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 1040 Es. You can receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form 1040 Es

- Cd 415 form

- Texas electrical contractor license form

- Notice of lien new york dmv new york state form

- Texas international registration plan apportioned registration form

- Handgun licensing change of address name change replacement modification form

- Fillable online oregon non auto tort claim form oregongov

- Certificate of amendment to the articles of organization form

- Officer or parole officer position you are required to complete and submit a pers 282b or pers 282c statement of form

Find out other Form 1040 Es

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure