Form 2019

What is the 2018 Tax Form?

The 2018 tax form primarily refers to the Form 1040, which is used by individuals to file their annual income tax returns with the Internal Revenue Service (IRS). This form allows taxpayers to report their income, claim deductions, and determine their tax liability. The 2018 version of the form includes various schedules that taxpayers may need to complete based on their financial situations, such as Schedule A for itemized deductions or Schedule C for self-employment income.

How to Obtain the 2018 Tax Form

Taxpayers can obtain the 2018 tax form from several sources. The IRS website provides downloadable versions of the Form 1040 and its associated schedules. Additionally, taxpayers can request a physical copy by calling the IRS or visiting a local IRS office. Many tax preparation services and software also include the 2018 tax form within their platforms, making it easy to fill out and submit electronically.

Steps to Complete the 2018 Tax Form

Completing the 2018 tax form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Choose the appropriate version of the form, such as the standard Form 1040 or the simplified 1040EZ.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Calculate your total tax liability and determine if you owe money or are due a refund.

- Sign and date the form before submitting it to the IRS.

Legal Use of the 2018 Tax Form

The legal use of the 2018 tax form is essential for compliance with U.S. tax laws. Taxpayers must ensure that they use the correct version of the form and report accurate information. Filing an incorrect or outdated form can lead to penalties or delays in processing. It is crucial to keep copies of all submitted forms and supporting documentation for at least three years in case of an audit by the IRS.

Filing Deadlines / Important Dates

The deadline for filing the 2018 tax form was April 15, 2019. However, taxpayers could request an extension, allowing them to file by October 15, 2019. It is important to note that an extension to file does not extend the time to pay any taxes owed. Taxpayers should ensure they meet all deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods

Taxpayers have several methods for submitting the 2018 tax form:

- Online: Many taxpayers choose to file electronically using tax preparation software, which can simplify the process and ensure accuracy.

- Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address based on their state of residence.

- In-Person: Some individuals may opt to file their taxes in person at a local IRS office or through a tax professional.

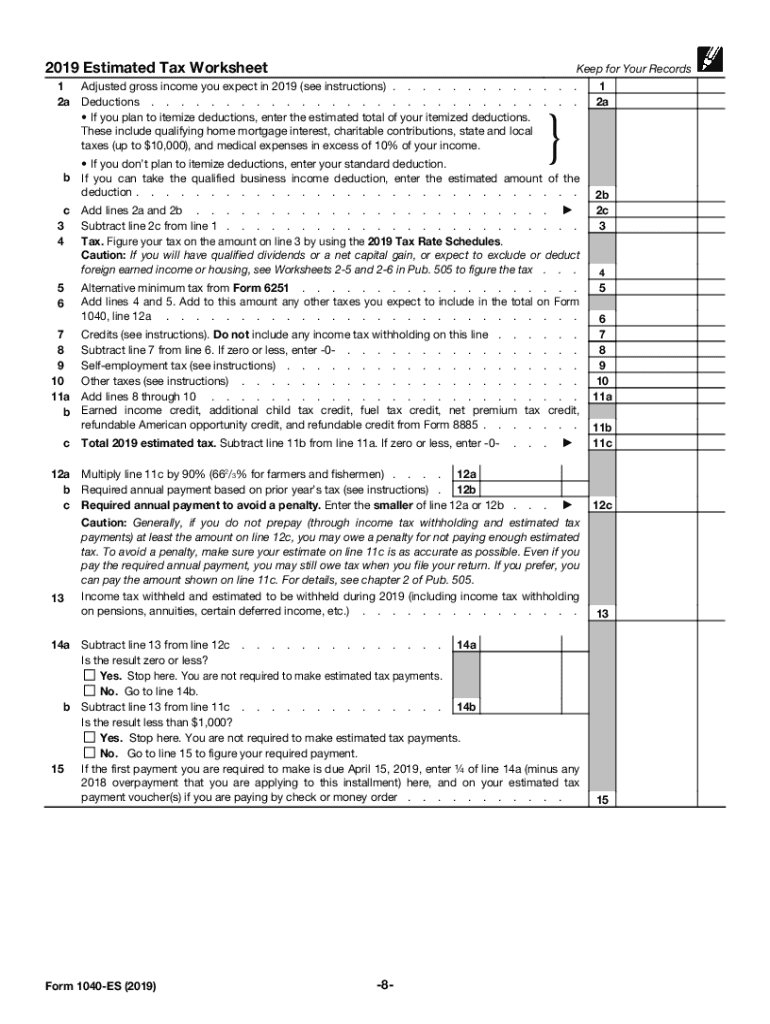

Quick guide on how to complete 2019 form 1040 es form 1040 es estimated tax for individuals

Explore the most straightforward method to complete and endorse your Form

Are you still spending time preparing your official documents on paper instead of managing them online? airSlate SignNow provides a superior approach to finalize and endorse your Form and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle documentation swiftly and in compliance with formal regulations - robust PDF editing, administration, security, signing, and sharing tools all available within a user-friendly interface.

Only a few steps are required to complete and endorse your Form:

- Insert the editable template into the editor by utilizing the Get Form button.

- Identify what details you need to supply in your Form.

- Move between the fields with the Next button to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the fields with your information.

- Update the content using Text boxes or Images from the upper toolbar.

- Emphasize the crucial parts or Eclipse sections that are no longer relevant.

- Press Sign to create a legally recognized electronic signature using any method of your choice.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finalized Form in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our service also provides adaptable form sharing. There’s no requirement to print your templates when you need to submit them to the competent public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 1040 es form 1040 es estimated tax for individuals

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

Is it more beneficial to file Form 709 Gift Tax than the 1040 (A -X -EZ) for 2019?

Form 709 is for the giver of gifts exceeding $15,000 per person per year (double that for spouses giving jointly, double again if the recipients are married and the gift is to both). Instructions for Form 709 (2018)Form 1040 is for your own income tax - and gifts are not taxable income to the recipient.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Why is the individual mandate on the current tax form (2018 1040 individual tax return to be filed in 2019 page one under spouse's SSN) when it was supposed to be done away with?

The penalty for not having health insurance was set to 0 for 2019 and later years. You must still pay a penalty for not having health insurance during any months of 2018. Since you are filing taxes for 2018 tax year now, you will have to calculate (and pay, if applicable) the penalty for 2018 on there.

-

A Self-Employed S-Corporation owner who pays himself a quarterly salary. Who is responsible for payment of the quarterly social security and Medicare tax, the S-Corporation on Form 941 or the business owner on Form 1040-ES?

First of all, he can't be a "self-employed S-Corporation owner." If he owns and performs services for an S-corp, he is not self-employed -- he is an employee of the S-corp. His salary is subject to withholding (income tax and FICA), and the S-corp is liable for the employer share of FICA. So the S-corp would pay the social security and Medicare tax on the owner's salary on its quarterly 941's.(Anything that the owner receives from the S-corp other than as salary is not wages subject to FICA, so there is not withholding and no tax to pay with the 941. It is income to the owner, though,)

-

An S-Corp owner pays himself a salary on a quarterly basis. Does the business he owns need to file a Form 941 and he the individual file a 1040-ES, each needing to be filed quarterly?

An S-Corp “owner” doesn’t have to pay themselves at all if they don’t actively work in the business. If they actively work in the business, they need to pay themselves a reasonable salary (which is quite a subjective concept.) Whether the salary is paid weekly, bi-weekly, semi-monthly, monthly, or quarterly is, for the most part, irrelevant. Theoretically you might even be able to justify an annual payment, but that’s not really the topic here. (I do believe you’d have some explaining to do if the “owner” is actively working, and not being paid on the same timetable as the employees, but, again, that’s a different topic.)And, yes, the business will have to file a 941 form, pay the company’s share of taxes, AND forward the employee’s share of taxes collected, too.When the business pays the “owner” their salary, the business should be withholding taxes just as the business would when paying any other manager or executive receiving a salary.So if this is the only money that the “owner” is being paid, they probably don’t need to file estimated taxes because a sufficient amount of taxes are being withheld already. If the “owner” is also paying themselves unearned income as a dividend, then they may need to file estimated taxes on the amount of this equity distribution, from which taxes are not withheld. But I would be very, very careful about taking an equity draw in addition to the salary you need to take. This is territory that you don’t want to get into without the advice of a competent CPA.Now, if the “owner” is not actively involved in operating the business, they may not need to be paid a salary. That is another topic to discuss with your CPA.Note that I’ve put “owner” in quotes because technically, corporations are owned by stockholders, just like LLC’s don’t have “owners”, but rather members, and partnerships have partners. The different terms tell us that the roles are different, as are the responsibilities. Calling any of them an “owner” implies a certain level of participation that may or may not match their actual role in the company.

-

In the USA, how do full-time stock traders estimate their taxes given unpredictability of income every year? I assume 1040-ES is the only way to withhold taxes.

Full time stock traders, or Day Traders, are self employed and are required to determine their income on a continual basis. The first quarter’s estimated tax payment is due April 15th and is based on income for the first three months of the year. The second payment, due June 15th, is based on the income from January 1st through May 31st. The payment due September 15th is based on the net income for the first 8 months of the year. The last payment, due January 15th of the next year is based on net income for the year. The sum of your estimated payments should be at least 90% of the final tax due on your return in order to avoid penalties.Remember that the income for each period should be reduced by any expenses or deductions incurred during the period. Including the deduction for a portion of the self-employment social security tax.The estimated income tax plus the expected self-employment tax are both due together on the same dates.

-

If an undocumented resident wants to pay taxes and she is paid in cash by her employer, how can she file taxes when she applies for an ITIN? Does she use a Schedule C Form 1040 or a Form 4852?

Schedule C is used if the person is self-employed. Form 4852 is used for employment. There is a difference.

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1040 es form 1040 es estimated tax for individuals

How to generate an electronic signature for your 2019 Form 1040 Es Form 1040 Es Estimated Tax For Individuals in the online mode

How to generate an electronic signature for your 2019 Form 1040 Es Form 1040 Es Estimated Tax For Individuals in Chrome

How to make an electronic signature for signing the 2019 Form 1040 Es Form 1040 Es Estimated Tax For Individuals in Gmail

How to make an eSignature for the 2019 Form 1040 Es Form 1040 Es Estimated Tax For Individuals right from your smart phone

How to make an electronic signature for the 2019 Form 1040 Es Form 1040 Es Estimated Tax For Individuals on iOS

How to generate an electronic signature for the 2019 Form 1040 Es Form 1040 Es Estimated Tax For Individuals on Android devices

People also ask

-

What features does airSlate SignNow offer for managing 2018 tax forms?

airSlate SignNow provides a range of features for handling 2018 tax forms, including eSignature capabilities, automated workflows, and document storage. These tools streamline the process, ensuring you can easily prepare and send your tax forms for signature. Additionally, the platform helps maintain the legality and security of your documents.

-

How does airSlate SignNow improve the process of signing 2018 tax forms?

With airSlate SignNow, signing 2018 tax forms is quick and efficient. Users can sign documents electronically from any device, eliminating the need for printing and mailing. This accelerates the process, allowing you to meet deadlines without hassle.

-

Is airSlate SignNow affordable for small businesses needing 2018 tax forms?

Yes, airSlate SignNow offers cost-effective pricing plans that are suitable for small businesses handling 2018 tax forms. The subscription options ensure you only pay for the features you need, which can signNowly reduce administrative costs associated with document management.

-

Can I integrate airSlate SignNow with other software to manage 2018 tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various software to enhance how you manage 2018 tax forms. This includes popular platforms like Google Drive, Dropbox, and Salesforce, allowing for a smooth transfer of documents and data.

-

What benefits can I expect when using airSlate SignNow for 2018 tax forms?

Using airSlate SignNow for your 2018 tax forms brings signNow benefits, including increased efficiency and reduced turnaround time for document signing. The platform enhances collaboration among team members and clients, making tax form management both streamlined and secure.

-

How secure is airSlate SignNow when handling sensitive 2018 tax forms?

Security is a priority at airSlate SignNow. The platform uses advanced encryption and complies with industry standards to safeguard your 2018 tax forms and other sensitive documents. You can confidently manage your forms, knowing your data is protected.

-

Can I use airSlate SignNow for multiple 2018 tax forms at once?

Yes, airSlate SignNow allows you to manage multiple 2018 tax forms simultaneously. You can create templates, send several forms for signature at once, and track their status easily, simplifying the overall management process during tax season.

Get more for Form

Find out other Form

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document