Form 1040 ES Form 1040 ES, Estimated Tax for Individuals 2020

What is the Form 1040 ES?

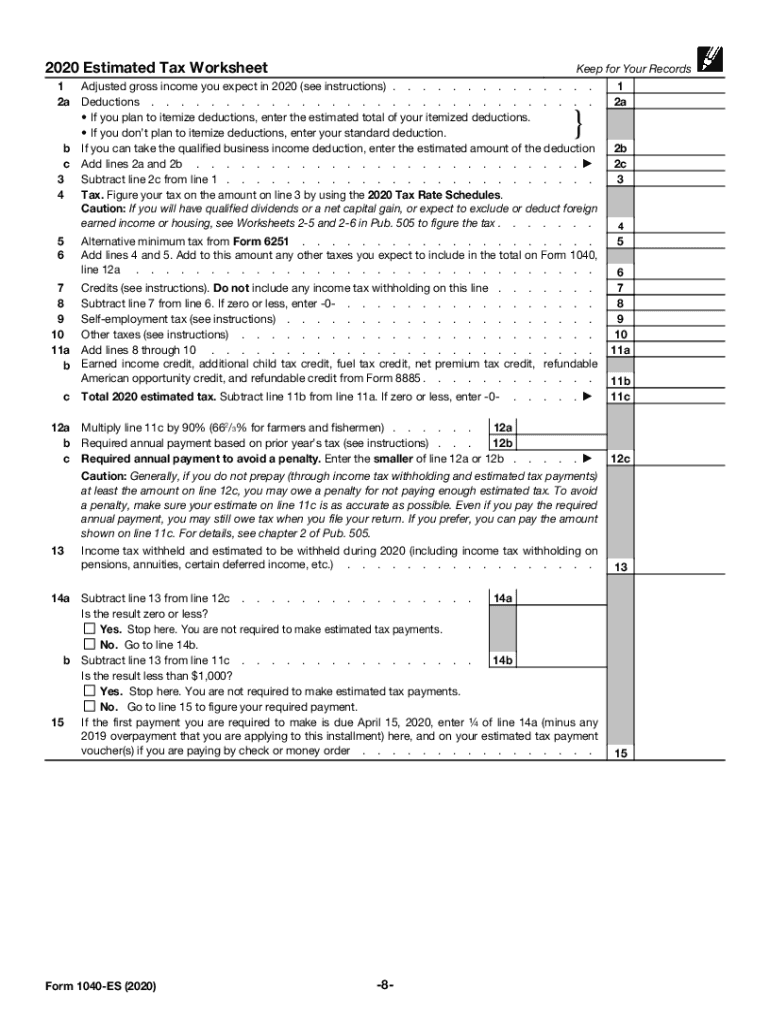

The Form 1040 ES is used for estimating and paying individual income taxes throughout the year. This form is particularly important for those who do not have taxes withheld from their income, such as self-employed individuals, freelancers, or those with significant investment income. The 1040 ES allows taxpayers to calculate their estimated tax liability and submit payments in four quarterly installments, helping to avoid penalties for underpayment at tax time.

How to use the Form 1040 ES

Using the Form 1040 ES involves several steps. First, individuals must determine their expected income for the year, which includes wages, dividends, and any other sources of income. Next, they will need to calculate their estimated tax liability based on current tax rates. The form provides worksheets to assist in this calculation. Once the estimated tax is determined, taxpayers can submit their payments using the vouchers included with the form for each quarter, ensuring they meet the deadlines to avoid penalties.

Steps to complete the Form 1040 ES

Completing the Form 1040 ES requires careful attention to detail. Follow these steps:

- Gather all income information, including W-2s and 1099s.

- Use the worksheets provided with the form to estimate your total income and deductions.

- Calculate your estimated tax liability based on the current tax rates.

- Fill out the form, ensuring all information is accurate.

- Submit the completed form along with payment using the included vouchers.

Filing Deadlines / Important Dates

It is crucial to be aware of the deadlines for filing the Form 1040 ES to avoid penalties. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these dates ensures compliance and helps maintain good standing with the IRS.

Required Documents

To complete the Form 1040 ES accurately, certain documents are necessary. Taxpayers should have:

- Previous year’s tax return for reference.

- Income statements such as W-2s and 1099s.

- Records of any deductions or credits that may apply.

- Any additional documentation that supports income or deductions.

Penalties for Non-Compliance

Failure to file the Form 1040 ES or make the required estimated tax payments can result in penalties. The IRS may impose a penalty for underpayment if the total tax owed is not paid by the due date. Additionally, there may be interest charges on any unpaid amounts. It is essential to stay informed about these penalties to avoid unnecessary financial burdens.

Quick guide on how to complete 2020 form 1040 es form 1040 es estimated tax for individuals

Manage Form 1040 ES Form 1040 ES, Estimated Tax For Individuals seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle Form 1040 ES Form 1040 ES, Estimated Tax For Individuals on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 1040 ES Form 1040 ES, Estimated Tax For Individuals with ease

- Find Form 1040 ES Form 1040 ES, Estimated Tax For Individuals and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 1040 ES Form 1040 ES, Estimated Tax For Individuals and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1040 es form 1040 es estimated tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1040 es form 1040 es estimated tax for individuals

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What are the steps to get the South Carolina tax forms 2019 using airSlate SignNow?

To get the South Carolina tax forms 2019, simply log in to airSlate SignNow, navigate to the template library, and search for the specific forms you need. Once located, you can easily download or eSign them directly within the platform, ensuring a smooth and efficient process.

-

Is there a cost associated with getting the South Carolina tax forms 2019 through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While you can access certain documents at no cost, premium features related to managing and eSigning the South Carolina tax forms 2019 come with a subscription plan designed to provide greater value.

-

Can I integrate airSlate SignNow with other software to help manage my South Carolina tax forms 2019?

Absolutely! airSlate SignNow integrates seamlessly with several software solutions, including popular accounting and document management tools. This integration allows you to streamline the process and access your South Carolina tax forms 2019 alongside your other business documents.

-

What benefits does airSlate SignNow provide for handling the South Carolina tax forms 2019?

Using airSlate SignNow to handle the South Carolina tax forms 2019 offers numerous benefits, such as enhanced security, easy eSigning, and efficient document management. The platform ensures that your forms are stored safely, allowing for quick retrieval and submission.

-

How does airSlate SignNow ensure the security of my South Carolina tax forms 2019?

airSlate SignNow prioritizes security with advanced encryption and compliance features designed to protect sensitive information. When you use airSlate SignNow to get the South Carolina tax forms 2019, you can trust that your data is secure and only accessible to authorized users.

-

Can I track the status of my South Carolina tax forms 2019 with airSlate SignNow?

Yes, airSlate SignNow provides a tracking feature that allows you to monitor the status of your South Carolina tax forms 2019. You will receive notifications when the documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Is there customer support available if I need help getting the South Carolina tax forms 2019?

Definitely! airSlate SignNow offers a dedicated customer support team that can assist you with any inquiries regarding getting the South Carolina tax forms 2019. Whether you have questions about features or need help troubleshooting, the support team is available to help.

Get more for Form 1040 ES Form 1040 ES, Estimated Tax For Individuals

- Instructions for preparing form dr 908 florida insurance

- Tc 69c notice of change for a tax account utah state tax form

- Form it 1099 r taxnygov

- It 214 2018 2019 form

- Git rep 3 2015 2019 form

- Dr 601g page 1 tc florida department of revenue form

- Sc1120 t sc1120 t sc department of revenue form

- Pwh wa form

Find out other Form 1040 ES Form 1040 ES, Estimated Tax For Individuals

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free