Dr15n Form 2016

What is the Dr15n Form

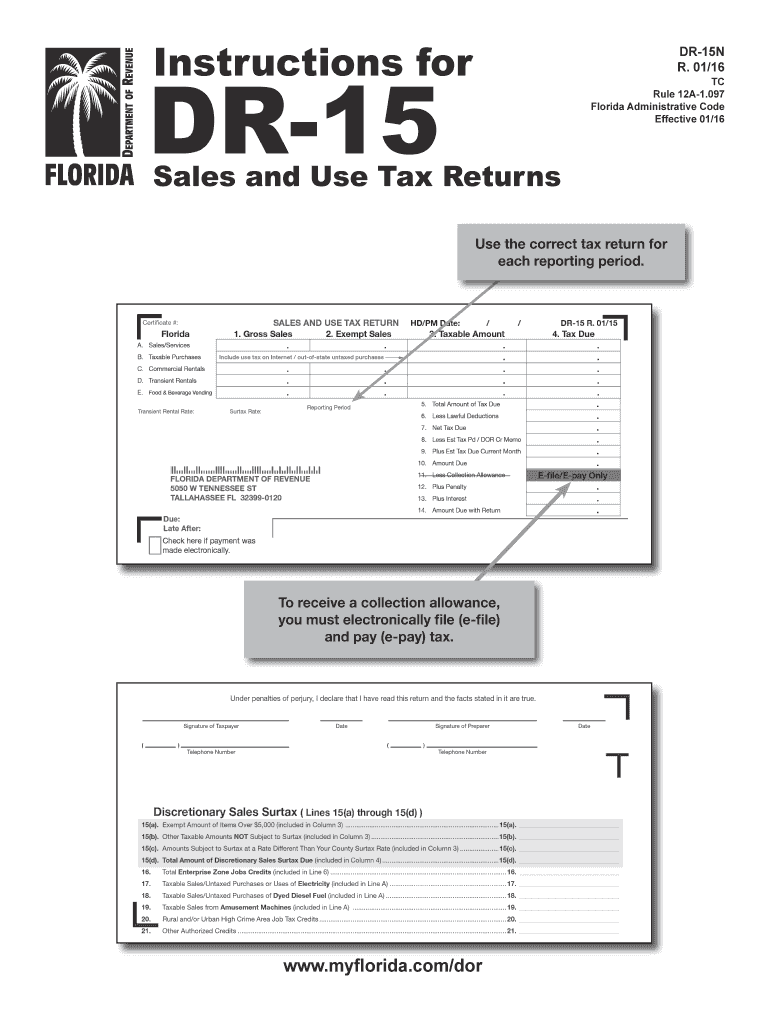

The Dr15n Form is a specific document used primarily for tax-related purposes in the United States. It serves as a declaration or request form that individuals or businesses may need to complete to comply with certain regulations or to claim specific benefits. Understanding the purpose of the Dr15n Form is essential for ensuring proper filing and adherence to tax obligations.

How to use the Dr15n Form

Using the Dr15n Form involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from official sources. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the form with accurate details, ensuring all sections are completed as instructed. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Steps to complete the Dr15n Form

Completing the Dr15n Form requires attention to detail. Here are the essential steps:

- Gather necessary information, including personal identification and financial details.

- Download or obtain a physical copy of the Dr15n Form.

- Read the instructions thoroughly to understand the requirements.

- Fill in the form, ensuring all fields are accurately completed.

- Review the form for any errors before submission.

- Submit the form as directed, keeping a copy for your records.

Legal use of the Dr15n Form

The Dr15n Form is legally binding when completed correctly and submitted according to the relevant laws and regulations. It is essential to ensure compliance with all legal requirements associated with the form, including accurate information and appropriate signatures. Understanding the legal implications of the form helps to avoid potential penalties or issues with tax authorities.

Who Issues the Form

The Dr15n Form is typically issued by a government agency, such as the Internal Revenue Service (IRS) or a state tax authority. These agencies provide the necessary documentation and guidelines for completing the form correctly. It is important to obtain the form directly from these official sources to ensure that you are using the most current and valid version.

Required Documents

When completing the Dr15n Form, certain documents may be required to support the information provided. Commonly needed documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Financial statements or records relevant to the information being reported.

- Previous tax returns, if applicable, to provide context or support for claims made on the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Dr15n Form to avoid penalties. Typically, these deadlines align with the annual tax filing schedule, but specific dates may vary based on the type of form and the individual's circumstances. Always check the latest guidelines from the issuing agency to ensure timely submission.

Quick guide on how to complete dr15n 2016 form

Complete Dr15n Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Dr15n Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to alter and eSign Dr15n Form with ease

- Obtain Dr15n Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive details using tools that airSlate SignNow has specifically designed for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to store your changes.

- Choose how you wish to submit your form, via email, text (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Dr15n Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr15n 2016 form

Create this form in 5 minutes!

How to create an eSignature for the dr15n 2016 form

How to create an electronic signature for your Dr15n 2016 Form in the online mode

How to make an electronic signature for the Dr15n 2016 Form in Chrome

How to generate an electronic signature for signing the Dr15n 2016 Form in Gmail

How to create an electronic signature for the Dr15n 2016 Form from your smart phone

How to create an electronic signature for the Dr15n 2016 Form on iOS devices

How to make an electronic signature for the Dr15n 2016 Form on Android OS

People also ask

-

What is the Dr15n Form and how does it work?

The Dr15n Form is a digital document designed for easy eSigning and management through airSlate SignNow. It simplifies the process of collecting signatures by allowing users to send, sign, and store documents securely online. With its user-friendly interface, you can complete the Dr15n Form quickly, ensuring efficiency in your business transactions.

-

How can I create a Dr15n Form using airSlate SignNow?

Creating a Dr15n Form with airSlate SignNow is straightforward. Simply log in to your account, choose the option to create a new document, and upload your template or start from scratch. You can then customize the form with fields for signatures, dates, and other necessary information, making it tailored to your specific needs.

-

What are the pricing options for using the Dr15n Form?

AirSlate SignNow offers a variety of pricing plans that cater to different business needs when using the Dr15n Form. You can choose from monthly or annual subscriptions, each providing access to robust features like unlimited eSigning, document storage, and integrations. Visit our pricing page for detailed options and to find the plan that suits your business best.

-

What features does the Dr15n Form offer?

The Dr15n Form comes equipped with multiple features to enhance your document management experience. These include customizable templates, real-time tracking of signatures, automated reminders, and secure storage. All these features work together to streamline your workflow and boost productivity.

-

Can the Dr15n Form be integrated with other applications?

Yes, airSlate SignNow allows seamless integration of the Dr15n Form with various applications including CRMs, cloud storage services, and project management tools. This connectivity helps you sync data across platforms, ensuring a cohesive workflow. Check our integrations page for a full list of compatible applications.

-

What are the benefits of using the Dr15n Form for my business?

Using the Dr15n Form can signNowly improve your business operations by reducing paperwork and speeding up the signing process. It enhances collaboration among team members and clients, while also ensuring compliance with legal standards. Overall, the Dr15n Form is a cost-effective solution that fosters efficiency and accuracy in document handling.

-

Is the Dr15n Form secure for sensitive information?

Absolutely! The Dr15n Form is designed with security in mind, utilizing encryption and secure storage protocols to protect your sensitive information. AirSlate SignNow complies with industry standards to ensure that your documents are safe from unauthorized access. You can confidently use the Dr15n Form knowing that your data is well protected.

Get more for Dr15n Form

Find out other Dr15n Form

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast