Sales and Use Tax Returns Florida Department of Revenue 2021

What is the Florida Sales and Use Tax Return?

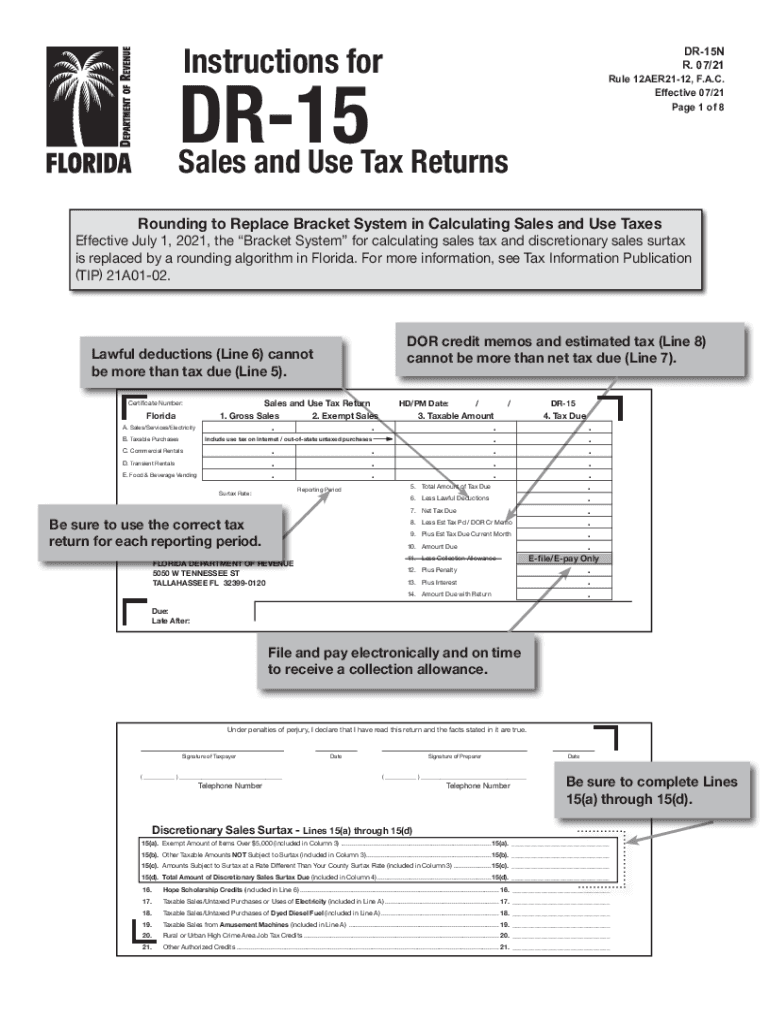

The Florida Sales and Use Tax Return, commonly referred to as the Florida sales tax form DR-15, is a document required by the Florida Department of Revenue for reporting sales and use tax collected by businesses. This form is essential for businesses operating in Florida to ensure compliance with state tax regulations. It allows businesses to report their taxable sales, calculate the amount of tax due, and remit the payment to the state. Understanding the purpose and requirements of this form is crucial for maintaining good standing with state tax authorities.

Steps to Complete the Florida Sales and Use Tax Return

Completing the Florida sales tax form DR-15 involves several key steps to ensure accurate reporting and compliance. Here is a straightforward process to follow:

- Gather necessary information: Collect all relevant sales data, including total sales, exempt sales, and any applicable deductions.

- Fill out the form: Enter the required information in the appropriate sections of the DR-15 form, including your business details and sales figures.

- Calculate the tax due: Use the Florida state tax rate to determine the total sales tax owed based on your taxable sales.

- Review for accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the form: File the completed form either online or by mail, depending on your preference and the requirements set by the Florida Department of Revenue.

Key Elements of the Florida Sales and Use Tax Return

The Florida sales tax form DR-15 includes several key elements that must be accurately completed. These elements are critical for proper tax reporting:

- Business Information: Include your business name, address, and sales tax registration number.

- Sales Data: Report total sales, exempt sales, and any deductions applicable to your business.

- Tax Calculation: Calculate the total sales tax owed based on the applicable Florida state tax rate.

- Payment Information: Indicate the method of payment and ensure that the payment is submitted along with the form, if required.

Form Submission Methods for the Florida Sales and Use Tax Return

Businesses have several options for submitting the Florida sales tax form DR-15. These methods include:

- Online Submission: The Florida Department of Revenue offers an online portal for filing the DR-15 form, which is often the quickest and most efficient method.

- Mail Submission: Businesses can print the completed form and mail it to the designated address provided by the Florida Department of Revenue.

- In-Person Submission: Some businesses may choose to submit the form in person at their local Department of Revenue office, although this is less common.

Penalties for Non-Compliance with Florida Sales Tax Regulations

Failure to comply with Florida sales tax regulations, including the timely submission of the DR-15 form, can result in significant penalties. These may include:

- Late Filing Penalties: Businesses may incur fines for failing to file the form by the due date.

- Interest on Unpaid Taxes: Interest may accrue on any unpaid sales tax amounts, increasing the total amount owed.

- Legal Action: Continued non-compliance may lead to further legal action by the Florida Department of Revenue, including liens or garnishments.

Eligibility Criteria for Filing the Florida Sales and Use Tax Return

To be eligible to file the Florida sales tax form DR-15, businesses must meet certain criteria, including:

- Registered Business: The business must be registered with the Florida Department of Revenue and possess a valid sales tax registration number.

- Taxable Sales Activity: The business must engage in activities that result in taxable sales within the state of Florida.

- Compliance with Tax Laws: The business must adhere to all applicable Florida tax laws and regulations to maintain eligibility for filing.

Quick guide on how to complete sales and use tax returns florida department of revenue

Complete Sales And Use Tax Returns Florida Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Sales And Use Tax Returns Florida Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Sales And Use Tax Returns Florida Department Of Revenue with ease

- Find Sales And Use Tax Returns Florida Department Of Revenue and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about missing or lost files, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and eSign Sales And Use Tax Returns Florida Department Of Revenue and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and use tax returns florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax returns florida department of revenue

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Florida sales tax form DR 15?

The Florida sales tax form DR 15 is a document used by businesses to report and pay state sales tax. It details the taxable sales and computes the sales tax amount owed to the state. Using this form accurately helps ensure compliance with Florida tax laws.

-

How can airSlate SignNow assist with the Florida sales tax form DR 15?

airSlate SignNow simplifies the process of completing and eSigning the Florida sales tax form DR 15. With our user-friendly platform, you can easily fill out the form, affix your electronic signature, and send it securely to the relevant tax authorities. This streamlines your tax reporting process signNowly.

-

Is there a cost associated with using airSlate SignNow for the Florida sales tax form DR 15?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs, all of which include features for managing the Florida sales tax form DR 15. Our plans are designed to be cost-effective, ensuring that you get value while efficiently handling your tax documents.

-

Can I integrate airSlate SignNow with other software for managing the Florida sales tax form DR 15?

Absolutely! airSlate SignNow supports seamless integrations with various accounting software, making it easier to manage the Florida sales tax form DR 15 alongside your financial records. This capability enhances efficiency and ensures that all relevant data is synchronized.

-

What are the benefits of using airSlate SignNow for tax documents like the Florida sales tax form DR 15?

Using airSlate SignNow for the Florida sales tax form DR 15 provides numerous benefits, including time-saving features, secure document handling, and easy access from any device. The platform's intuitive design ensures that you can complete your tasks without hassle, enhancing overall productivity.

-

How secure is the information on my Florida sales tax form DR 15 when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols to protect sensitive information on your Florida sales tax form DR 15. Your data remains confidential and secure during transmission and storage.

-

Can I access my completed Florida sales tax form DR 15 from different devices?

Yes, you can access your completed Florida sales tax form DR 15 from any device with internet connectivity. airSlate SignNow allows you to work seamlessly whether you are on a desktop, tablet, or mobile phone, making it convenient for you to manage your documents on the go.

Get more for Sales And Use Tax Returns Florida Department Of Revenue

- Property contract land form

- Home inspection checklist form 481379847

- Michigan notice form

- Full conditional waiver 481379854 form

- Michigan assignment of mortgage by individual mortgage holder form

- 30 day notice 481379856 form

- Michigan notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- Michigan lien form

Find out other Sales And Use Tax Returns Florida Department Of Revenue

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form