Dr15n Form 2018

What is the Dr15n Form

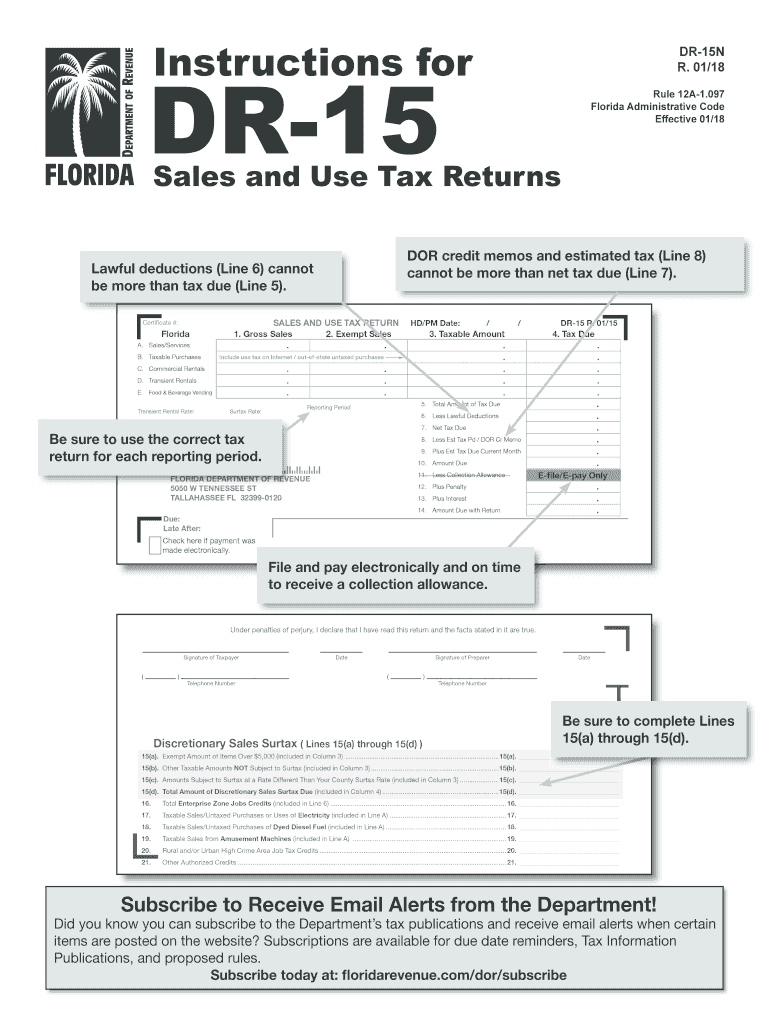

The Dr15n Form is a specific document used primarily for tax purposes in the United States. It is typically required for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). This form may be utilized in various scenarios, such as for reporting income, deductions, or credits. Understanding the purpose and requirements of the Dr15n Form is essential for compliance with federal tax regulations.

How to use the Dr15n Form

Using the Dr15n Form involves several key steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS.

Steps to complete the Dr15n Form

Completing the Dr15n Form requires a systematic approach. Follow these steps for a smooth process:

- Gather necessary documents, including income statements, previous tax returns, and other relevant financial records.

- Read the instructions provided with the form to understand the requirements and any specific guidelines.

- Fill out the form, ensuring that all information is accurate and corresponds with your financial documents.

- Double-check your entries for any mistakes or omissions.

- Submit the form by the designated deadline, either electronically or by mailing it to the appropriate IRS address.

Legal use of the Dr15n Form

The legal use of the Dr15n Form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the specified deadlines. Failure to comply with these regulations may result in penalties or delays in processing. It is crucial to ensure that all information provided is truthful and substantiated by relevant documentation, as the IRS may audit submitted forms.

Filing Deadlines / Important Dates

Filing deadlines for the Dr15n Form can vary based on the specific tax year and the taxpayer's circumstances. Generally, individual taxpayers must file their forms by April 15 of the following year. However, extensions may be available under certain conditions. It is important to stay informed about any changes to deadlines and to mark them on your calendar to avoid late submissions.

Required Documents

When completing the Dr15n Form, several documents are typically required to support the information reported. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant financial statements

Having these documents readily available can streamline the completion process and ensure accuracy.

Quick guide on how to complete dr15n 2018 2019 form

Complete Dr15n Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional paper documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without any hold-ups. Manage Dr15n Form across all devices with airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The simplest way to modify and eSign Dr15n Form with ease

- Find Dr15n Form and select Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature via the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your edits.

- Select your preferred method for delivering your form, whether via email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form hunts, or errors that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Dr15n Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr15n 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the dr15n 2018 2019 form

How to make an electronic signature for your Dr15n 2018 2019 Form in the online mode

How to create an electronic signature for your Dr15n 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the Dr15n 2018 2019 Form in Gmail

How to make an eSignature for the Dr15n 2018 2019 Form from your smartphone

How to create an eSignature for the Dr15n 2018 2019 Form on iOS

How to generate an eSignature for the Dr15n 2018 2019 Form on Android OS

People also ask

-

What is the Dr15n Form, and how can it be used?

The Dr15n Form is a customizable document format designed to streamline the signing process for various business needs. With airSlate SignNow, you can easily create, send, and eSign Dr15n Forms, ensuring efficient workflows and faster approvals.

-

How much does it cost to use the Dr15n Form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can access the Dr15n Form feature at an affordable monthly rate, with options for annual subscriptions that can save you more in the long run.

-

What features does the Dr15n Form offer?

The Dr15n Form comes equipped with essential features such as customizable templates, real-time tracking, and secure eSignature options. These features ensure that your documents are signed quickly and securely, enhancing your overall productivity.

-

Can I integrate the Dr15n Form with other applications?

Yes, airSlate SignNow allows seamless integrations of the Dr15n Form with popular applications like Google Drive, Salesforce, and more. This integration capability helps you manage your documents better and keeps your workflows smooth.

-

What are the benefits of using the Dr15n Form for my business?

Using the Dr15n Form can signNowly reduce the time spent on document management and improve accuracy through automated processes. This efficiency leads to faster decision-making and enhances customer satisfaction, ultimately benefiting your business.

-

Is the Dr15n Form secure for sensitive information?

Absolutely! The Dr15n Form employs advanced security measures, including encryption and compliance with regulations like GDPR. This ensures that your sensitive information remains protected, giving you peace of mind as you conduct business.

-

How can I customize the Dr15n Form to fit my needs?

Customizing the Dr15n Form is simple with airSlate SignNow's user-friendly interface. You can modify templates, add fields, and adjust settings to tailor the form to your specific requirements, ensuring it meets your business needs perfectly.

Get more for Dr15n Form

Find out other Dr15n Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile