DR 15 Sales and Use Tax Instructions 2024

What is the Florida Sales Tax Form DR 15?

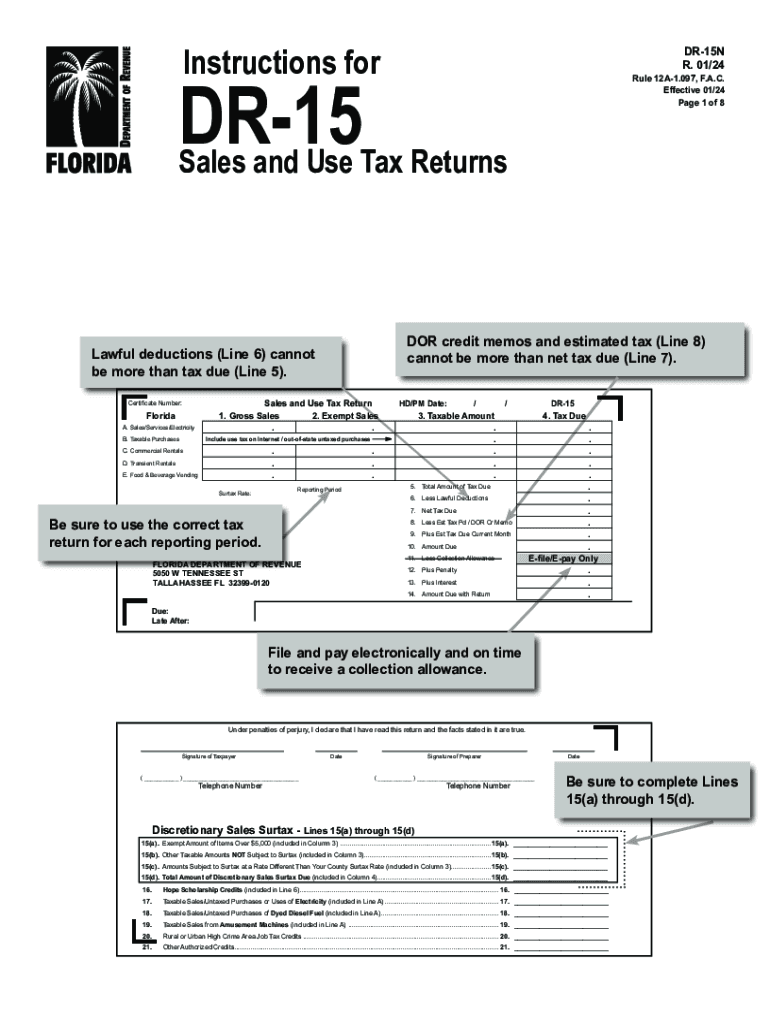

The Florida Sales Tax Form DR 15 is a crucial document used by businesses to report and pay sales and use tax in the state of Florida. This form is specifically designed for taxpayers who are required to collect sales tax on their taxable sales. It provides a comprehensive overview of the sales tax collected, deductions, and the total amount due to the Florida Department of Revenue. Understanding the purpose and function of the DR 15 is essential for compliance with state tax regulations.

Steps to Complete the Florida Sales Tax Form DR 15

Completing the Florida Sales Tax Form DR 15 involves several key steps:

- Gather necessary information: Collect sales records, tax rates, and any exemptions that apply.

- Report gross sales: Enter total sales figures in the appropriate sections of the form.

- Calculate taxable sales: Determine the amount of sales that are subject to tax.

- Apply deductions: Include any eligible deductions for exempt sales or other allowable reductions.

- Determine total tax due: Calculate the total sales tax owed based on taxable sales.

- Submit the form: File the completed form either online or by mail, ensuring it is submitted by the deadline.

Key Elements of the Florida Sales Tax Form DR 15

The Florida Sales Tax Form DR 15 includes several important sections that taxpayers must complete accurately:

- Taxpayer Information: Name, address, and account number of the business.

- Sales Summary: Breakdown of gross sales, taxable sales, and non-taxable sales.

- Deductions: Details of any deductions claimed, such as sales for resale or exempt sales.

- Total Tax Calculation: Final computation of sales tax owed based on reported figures.

- Signature: An authorized representative must sign the form to validate the submission.

Filing Deadlines for the Florida Sales Tax Form DR 15

Timely filing of the Florida Sales Tax Form DR 15 is essential to avoid penalties. The due date for filing typically aligns with the reporting period chosen by the taxpayer, which can be monthly, quarterly, or annually. It is important to check the specific deadlines for each reporting period, as late submissions may incur fines and interest on unpaid taxes.

Form Submission Methods for the Florida Sales Tax Form DR 15

Taxpayers can submit the Florida Sales Tax Form DR 15 through various methods:

- Online Submission: Many businesses opt to file electronically through the Florida Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Department of Revenue offices.

Legal Use of the Florida Sales Tax Form DR 15

The Florida Sales Tax Form DR 15 is a legally binding document that must be filled out accurately to ensure compliance with state tax laws. Misreporting or failing to file this form can lead to serious legal consequences, including fines, penalties, and potential audits. It is crucial for businesses to maintain accurate records and ensure that all information reported on the form is truthful and complete.

Quick guide on how to complete dr 15 sales and use tax instructions

Complete DR 15 Sales And Use Tax Instructions effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and eSign your documents swiftly and without delays. Manage DR 15 Sales And Use Tax Instructions on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to adjust and eSign DR 15 Sales And Use Tax Instructions with ease

- Obtain DR 15 Sales And Use Tax Instructions and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate producing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign DR 15 Sales And Use Tax Instructions and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 15 sales and use tax instructions

Create this form in 5 minutes!

How to create an eSignature for the dr 15 sales and use tax instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida sales tax form DR 15?

The Florida sales tax form DR 15 is a document used by businesses to report and pay sales tax collected during a specific period. It is essential for compliance with Florida tax regulations and ensures that your business remains in good standing.

-

How do I complete the Florida sales tax form DR 15?

To complete the Florida sales tax form DR 15, you need to gather your sales data for the reporting period. Fill out the required fields accurately, including total sales, taxable sales, and any exemptions, then submit the form as instructed by the Florida Department of Revenue.

-

Can airSlate SignNow help me with the Florida sales tax form DR 15?

Yes, airSlate SignNow is designed to simplify the process of signing and sending documents, including the Florida sales tax form DR 15. With our intuitive platform, you can easily prepare, eSign, and submit your form seamlessly.

-

What are the benefits of using airSlate SignNow for the Florida sales tax form DR 15?

Using airSlate SignNow for the Florida sales tax form DR 15 offers multiple benefits such as enhanced security, ease of use, and faster processing times. You can manage all your tax forms electronically, reducing paperwork and ensuring timely submission.

-

Is there a fee to use airSlate SignNow for the Florida sales tax form DR 15?

While airSlate SignNow offers cost-effective pricing, there may be fees associated with subscription plans. However, consider these fees as an investment in a more efficient signing process, helping ensure timely submission of your Florida sales tax form DR 15.

-

What integrations does airSlate SignNow offer to streamline the Florida sales tax form DR 15?

airSlate SignNow integrates with various accounting and financial software to help manage your documents and data easily. These integrations ensure that you can seamlessly pull necessary sales data for the Florida sales tax form DR 15 from your accounts.

-

Can I store my completed Florida sales tax form DR 15 in airSlate SignNow?

Yes, airSlate SignNow provides a secure cloud storage option for your completed documents, including the Florida sales tax form DR 15. You can access these documents anytime, ensuring that you have all your tax forms readily available when needed.

Get more for DR 15 Sales And Use Tax Instructions

- I am reserving all of my legal rights and remedies under applicable form

- Pursuing eviction remedies form

- Communication and interaction with me in the future in only a business like and professional form

- Rental of or otherwise make unavailable or deny a dwelling to any person because of race color religion form

- Furthermore my security deposit must be form

- Situation immediately you will leave me no choice but to evict you from the premises form

- Do so will result in your eviction from the premises for violation of our lease agreement form

- Condition and should have and did recognize it as dangerous form

Find out other DR 15 Sales And Use Tax Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors