Instructions for DR 15 Florida Department of Revenue 2023

Understanding the Florida DR 15 Form

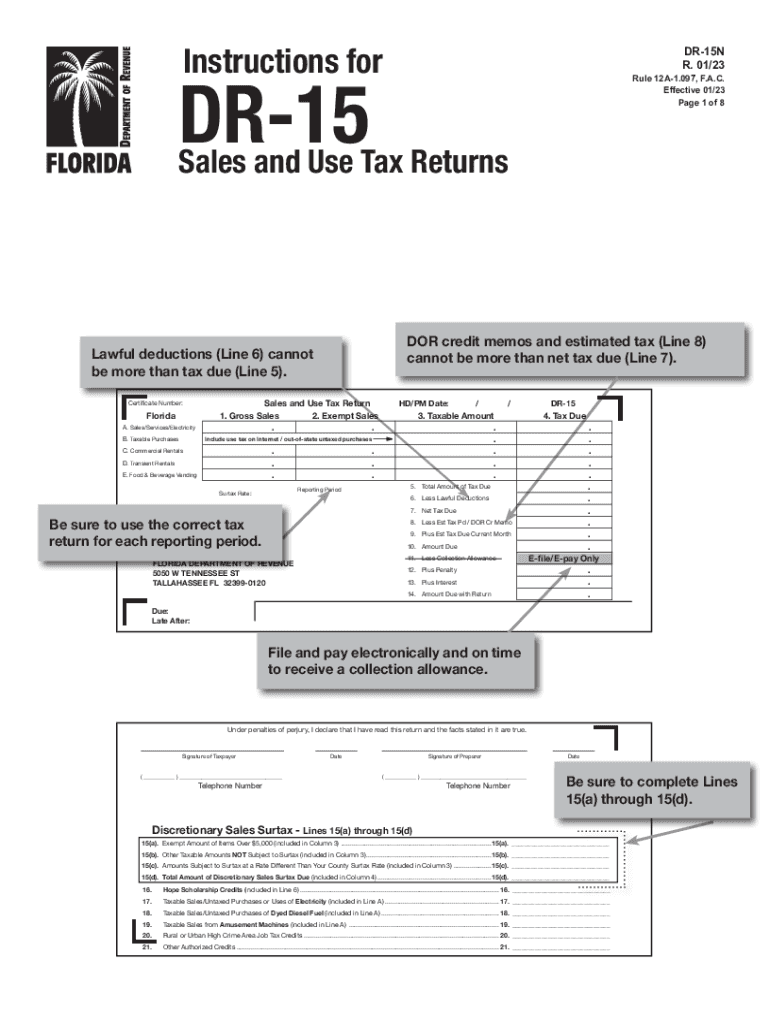

The Florida DR 15 form is essential for businesses that need to report and remit sales tax in Florida. This form is specifically designed for sales tax returns, allowing businesses to calculate their tax obligations accurately. The form includes sections for reporting taxable sales, exemptions, and the total amount of sales tax due. Understanding the structure and requirements of the DR 15 is crucial for compliance with Florida state tax laws.

Steps to Complete the Florida DR 15 Form

Completing the Florida DR 15 form involves several key steps to ensure accuracy and compliance. Businesses should start by gathering all necessary sales records and documentation. Next, they will need to fill out the form by entering total sales, taxable sales, and any exemptions. After calculating the total sales tax due, businesses must review the form for accuracy before submission. It is also important to keep a copy of the completed form for record-keeping purposes.

Key Elements of the Florida DR 15 Form

The Florida DR 15 form consists of several important elements that businesses must understand. Key sections include:

- Taxable Sales: The total amount of sales that are subject to sales tax.

- Exempt Sales: Any sales that are exempt from sales tax, which must be documented.

- Total Tax Due: The calculated amount of sales tax that must be remitted to the state.

- Signature: The form must be signed by an authorized representative of the business to validate the information provided.

Filing Deadlines for the Florida DR 15 Form

Timely filing of the Florida DR 15 form is crucial to avoid penalties. The filing deadlines typically align with the reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should be aware of their specific deadlines to ensure compliance and avoid late fees. It is advisable to check the Florida Department of Revenue's website for any updates or changes to filing deadlines.

Form Submission Methods for the Florida DR 15

Businesses have several options for submitting the Florida DR 15 form. The form can be filed online through the Florida Department of Revenue's website, which is the most efficient method. Alternatively, businesses can submit the form by mail or in person at designated locations. Each submission method has its own processing times, so businesses should choose the method that best suits their needs and timelines.

Penalties for Non-Compliance with the Florida DR 15

Failure to file the Florida DR 15 form on time or accurately can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for businesses to maintain their good standing with the Florida Department of Revenue. Regularly reviewing sales tax obligations and ensuring timely submissions can help mitigate these risks.

Legal Use of the Florida DR 15 Form

The Florida DR 15 form is legally binding when completed accurately and submitted in accordance with state laws. Businesses must ensure that all information is truthful and complete, as providing false information can lead to severe penalties. Utilizing a reliable electronic signature solution can enhance the security and legality of the form submission process, ensuring compliance with federal and state eSignature laws.

Quick guide on how to complete instructions for dr 15 florida department of revenue

Complete Instructions For DR 15 Florida Department Of Revenue seamlessly on any device

Online document management has become popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Instructions For DR 15 Florida Department Of Revenue on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to change and eSign Instructions For DR 15 Florida Department Of Revenue effortlessly

- Find Instructions For DR 15 Florida Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or mislaid files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For DR 15 Florida Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for dr 15 florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the instructions for dr 15 florida department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow handle florida sales tax for electronic signatures?

airSlate SignNow ensures compliance with florida sales tax regulations by providing a systematic process for eSigning documents that includes automatic calculations of applicable taxes. This means that businesses can seamlessly manage sales tax obligations while streamlining their document workflows. Our platform simplifies the compliance process to help you avoid fines and delays.

-

What pricing plans does airSlate SignNow offer for businesses dealing with florida sales tax?

airSlate SignNow offers flexible pricing plans that are designed to accommodate businesses of all sizes managing florida sales tax related transactions. Each plan provides essential features for electronic signatures and document management with clear pricing structures, ensuring no hidden fees. This transparency is vital for businesses looking to manage costs associated with sales tax.

-

Can I integrate airSlate SignNow with my accounting software that tracks florida sales tax?

Yes, airSlate SignNow offers seamless integrations with popular accounting software that track florida sales tax, such as QuickBooks and Xero. This integration enables automatic updates of sales tax calculations directly within your accounting system, enhancing accuracy and efficiency. You can focus on your business while our platform handles the complexities of sales tax.

-

What are the key benefits of using airSlate SignNow for florida sales tax documents?

Using airSlate SignNow for florida sales tax documents provides signNow benefits including enhanced efficiency, cost savings, and secure document storage. The platform allows businesses to easily eSign and manage crucial documents while ensuring they comply with florida sales tax requirements. This not only saves time but also reduces the risk of errors associated with manual processes.

-

Is airSlate SignNow secure for handling sensitive florida sales tax information?

Absolutely, airSlate SignNow prioritizes security and compliance, protecting sensitive florida sales tax information with advanced encryption and secure data handling practices. We ensure that all documents shared through our platform are stored safely, giving you peace of mind while managing your sales tax obligations. Compliance with relevant data protection regulations further strengthens our security measures.

-

How quickly can I implement airSlate SignNow for my florida sales tax needs?

You can implement airSlate SignNow almost immediately, as our user-friendly platform is designed for quick setup and integration with your existing systems. Businesses can start eSigning documents and managing florida sales tax processes within minutes of registration. Our comprehensive support and resources will assist you throughout the implementation phase.

-

Does airSlate SignNow offer customer support for florida sales tax inquiries?

Yes, airSlate SignNow provides excellent customer support to assist users with any florida sales tax inquiries and other related issues. Our knowledgeable support team is available to guide you through any challenges and provide information on best practices for managing sales tax documentation. We are committed to helping you maximize the benefits of our eSigning solution.

Get more for Instructions For DR 15 Florida Department Of Revenue

- Warning notice due to complaint from neighbors rhode island form

- Lease subordination agreement rhode island form

- Apartment rules and regulations rhode island form

- Agreed cancellation of lease rhode island form

- Amendment of residential lease rhode island form

- Agreement for payment of unpaid rent rhode island form

- Commercial lease assignment from tenant to new tenant rhode island form

- Tenant consent to background and reference check rhode island form

Find out other Instructions For DR 15 Florida Department Of Revenue

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT