DR 15NR 06 24 1 PDF 2024

What is the DR 15N?

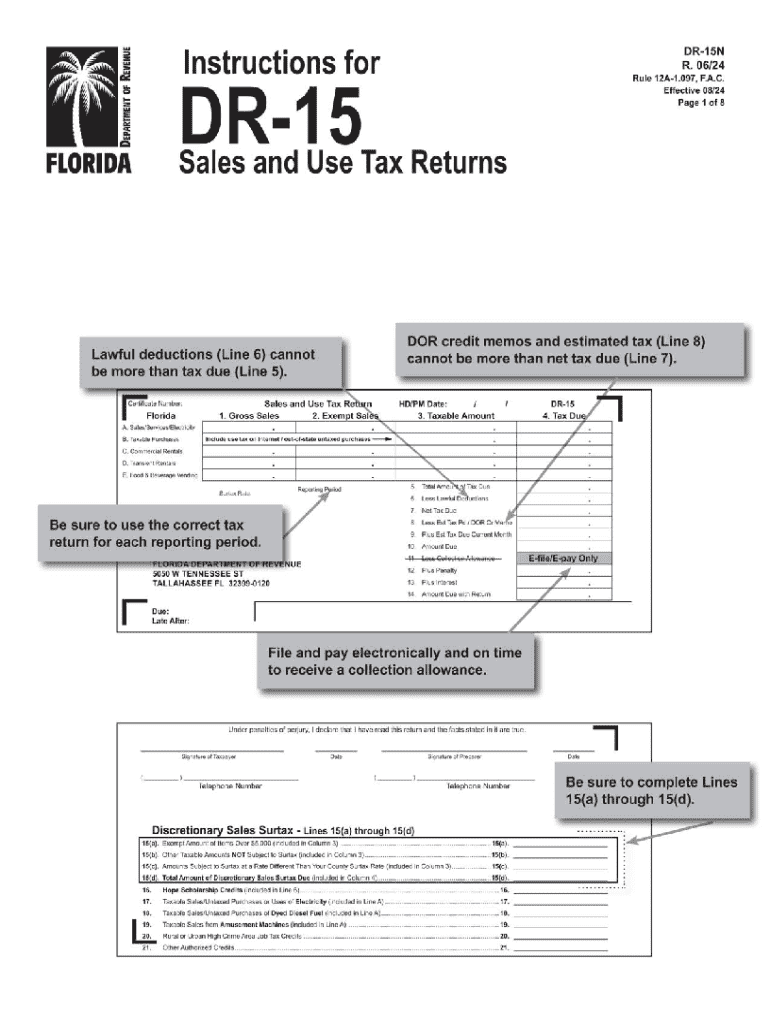

The DR 15N is a sales and use tax return form used in the state of Florida. This form is specifically designed for businesses to report and remit sales tax collected on taxable transactions. It is essential for maintaining compliance with state tax regulations and ensuring that the appropriate taxes are paid to the Florida Department of Revenue. The form captures crucial information about sales made, tax collected, and any exemptions that may apply.

How to use the DR 15N

Using the DR 15N involves several key steps. First, businesses must gather all relevant sales data for the reporting period, including total sales, taxable sales, and any exempt sales. Next, accurately complete the form by entering the required information, such as the business name, address, and sales figures. After filling out the form, businesses must calculate the total tax due and ensure that all figures are correct before submission. Finally, the completed form can be submitted online, by mail, or in person to the appropriate state office.

Steps to complete the DR 15N

Completing the DR 15N involves a systematic approach:

- Gather all sales records for the reporting period.

- Identify and categorize sales as taxable or exempt.

- Fill in the business information section on the form.

- Input the total sales figures, including taxable sales.

- Calculate the total sales tax due based on the applicable rate.

- Review the form for accuracy and completeness.

- Submit the form by the designated deadline.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the DR 15N. Typically, the form is due on the first day of the month following the end of the reporting period, with a grace period extending to the 20th of that month. For example, sales made in January must be reported by February 20. Missing these deadlines can result in penalties and interest charges, so timely submission is essential.

Required Documents

To complete the DR 15N, businesses must have certain documents on hand. These include:

- Sales records for the reporting period.

- Invoices and receipts for taxable and exempt sales.

- Previous sales tax returns for reference.

- Any documentation supporting exemptions claimed.

Having these documents readily available will facilitate accurate completion of the form and ensure compliance with state requirements.

Penalties for Non-Compliance

Failure to file the DR 15N on time or inaccuracies in reporting can lead to significant penalties. The Florida Department of Revenue may impose fines for late submissions, which can accumulate over time. Additionally, businesses may face interest charges on any unpaid tax amounts. It is important for businesses to understand these consequences and take proactive measures to ensure compliance with all filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct dr 15nr 06 24 1 pdf

Create this form in 5 minutes!

How to create an eSignature for the dr 15nr 06 24 1 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 15n and how does it relate to airSlate SignNow?

dr 15n is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, ensuring that documents are processed efficiently and securely. By utilizing dr 15n, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with dr 15n features?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective even with the advanced dr 15n features. Users can select from different subscription tiers that best fit their needs, ensuring they get the most value for their investment. For detailed pricing information, visit our pricing page.

-

What are the key features of dr 15n in airSlate SignNow?

dr 15n includes features such as customizable templates, automated workflows, and secure eSigning options. These features are designed to simplify the document signing process and enhance user experience. With dr 15n, businesses can easily manage their documents from start to finish.

-

What benefits does dr 15n offer for businesses?

By implementing dr 15n, businesses can enjoy increased efficiency, reduced paper usage, and improved compliance with legal standards. This feature helps organizations save time and resources while ensuring that all documents are securely signed and stored. Ultimately, dr 15n contributes to a more streamlined operation.

-

Can I integrate dr 15n with other software applications?

Yes, airSlate SignNow with dr 15n can be integrated with various software applications, enhancing its functionality. This includes popular CRM systems, cloud storage services, and productivity tools. These integrations allow for a seamless workflow, making it easier to manage documents across different platforms.

-

Is dr 15n suitable for small businesses?

Absolutely! dr 15n is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for small teams looking to enhance their document management processes without breaking the bank.

-

How secure is the dr 15n feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and dr 15n is no exception. The feature employs advanced encryption and compliance with industry standards to ensure that all documents are protected. Users can confidently send and sign documents knowing that their information is secure.

Get more for DR 15NR 06 24 1 pdf

- Correction statement and agreement mississippi form

- Closing statement mississippi form

- Flood zone statement and authorization mississippi form

- Name affidavit of buyer mississippi form

- Name affidavit of seller mississippi form

- Non foreign affidavit under irc 1445 mississippi form

- Owners or sellers affidavit of no liens mississippi form

- Mississippi occupancy form

Find out other DR 15NR 06 24 1 pdf

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe