Form DR 15N Florida Department of Revenue 2021

What is the Form DR 15N Florida Department Of Revenue

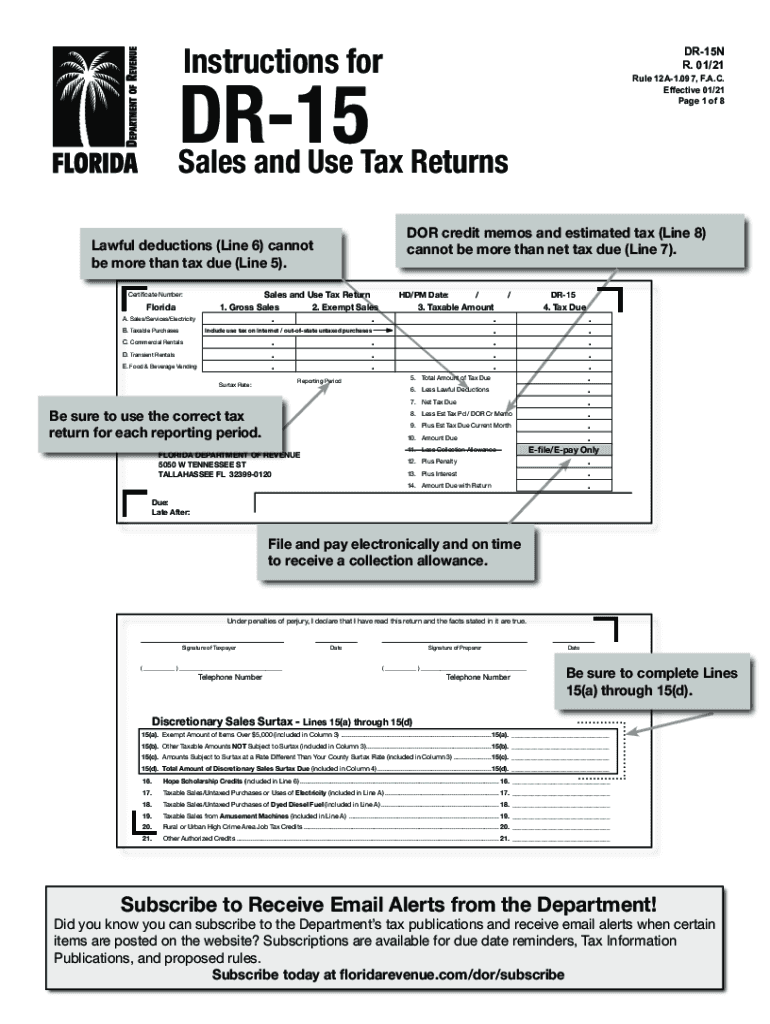

The DR 15N form is a sales tax return used by businesses in Florida to report and remit sales tax collected during a specific reporting period. It is essential for compliance with Florida's sales tax laws, ensuring that businesses accurately report their taxable sales and remit the appropriate amount of tax to the Florida Department of Revenue. This form is primarily utilized by retailers and service providers who are required to collect sales tax from their customers.

How to use the Form DR 15N Florida Department Of Revenue

Using the DR 15N form involves several key steps. First, businesses must gather their sales data for the reporting period, including total sales, taxable sales, and any exemptions. Next, they fill out the form, entering the required information in the designated fields. It is crucial to ensure that all figures are accurate to avoid potential penalties. Finally, the completed form must be submitted to the Florida Department of Revenue by the specified deadline, along with any tax due.

Steps to complete the Form DR 15N Florida Department Of Revenue

Completing the DR 15N form requires careful attention to detail. Here are the steps to follow:

- Gather sales records for the reporting period.

- Calculate total sales and taxable sales.

- Identify any tax-exempt sales and document them accordingly.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for errors before submission.

- Submit the form online or by mail, along with the payment for any sales tax due.

Legal use of the Form DR 15N Florida Department Of Revenue

The DR 15N form is legally binding when completed and submitted according to Florida's sales tax regulations. Businesses must ensure compliance with state laws regarding sales tax collection and remittance. Failure to accurately complete and submit the form can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations and maintain accurate records to support their filings.

Filing Deadlines / Important Dates

Filing deadlines for the DR 15N form vary depending on the frequency of tax reporting assigned to the business. Most businesses are required to file monthly, while others may qualify for quarterly or annual filing. It is essential to adhere to these deadlines to avoid late fees. The Florida Department of Revenue provides a calendar of important dates, including the due dates for each reporting period, which businesses should consult regularly.

Form Submission Methods (Online / Mail / In-Person)

The DR 15N form can be submitted through various methods to accommodate different business needs. Businesses may choose to file online via the Florida Department of Revenue's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submissions are also accepted at designated locations. Each method has its own processing times and requirements, so businesses should select the option that best suits their circumstances.

Quick guide on how to complete form dr 15n florida department of revenue

Complete Form DR 15N Florida Department Of Revenue effortlessly on any device

Online document administration has become popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Form DR 15N Florida Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form DR 15N Florida Department Of Revenue without hassle

- Find Form DR 15N Florida Department Of Revenue and click Get Form to start.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form DR 15N Florida Department Of Revenue and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dr 15n florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form dr 15n florida department of revenue

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the DR 15N form, and how is it used?

The DR 15N form is a document used for tax filings in specific jurisdictions. It helps businesses report their tax obligations accurately and efficiently. airSlate SignNow streamlines the signing process of the DR 15N form, ensuring quick and easy completion.

-

How can I integrate the DR 15N form with other documents?

With airSlate SignNow, you can easily integrate the DR 15N form into your existing document workflows. Our platform allows you to combine it with other forms and contracts for a seamless process. This integration improves efficiency by reducing the time spent on paperwork.

-

What features does airSlate SignNow offer for the DR 15N form?

airSlate SignNow offers various features for managing the DR 15N form, including electronic signatures, document templates, and secure cloud storage. Our user-friendly interface makes it simple to navigate and complete the form with just a few clicks. Additional features also enhance your overall document management experience.

-

Is there a cost associated with using the DR 15N form on airSlate SignNow?

Yes, there is a subscription cost for using airSlate SignNow, which includes access to the DR 15N form functionalities. Our pricing is competitive and designed to offer cost-effective solutions for businesses of all sizes. You can choose a plan that best fits your organization's needs.

-

What are the benefits of using airSlate SignNow for the DR 15N form?

Using airSlate SignNow for the DR 15N form provides numerous benefits, such as faster processing times, improved accuracy, and reduced paper usage. The electronic signing process ensures that your documents are legally binding and secure. Additionally, our platform enhances overall workflow efficiency.

-

Can I track the status of my DR 15N form through airSlate SignNow?

Absolutely! airSlate SignNow enables you to track the status of your DR 15N form in real-time. You can monitor when the document is sent, viewed, and signed, ensuring you stay informed throughout the process. This transparency simplifies document management and follow-up.

-

Is airSlate SignNow compliant with regulations for the DR 15N form?

Yes, airSlate SignNow complies with all necessary regulations related to the DR 15N form and electronic signatures. Our platform adheres to industry standards, providing a reliable solution for document management. This compliance gives businesses peace of mind when handling sensitive information.

Get more for Form DR 15N Florida Department Of Revenue

- Personal fitness merit badge worksheet word document 92606577 form

- Lohnausweis online form

- Ellaone questionnaire pdf form

- Advocate id card download form

- Corpiq formulaire demande de location

- Pharmacology viva questions with answers pdf form

- Apgvb account opening form

- Gluometer maintenance and quality control record form

Find out other Form DR 15N Florida Department Of Revenue

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template