DR 15N R 0125 Instructions for Rule 12A 1 097, F 2025-2026

Understanding the Florida Sales Tax Form DR-15

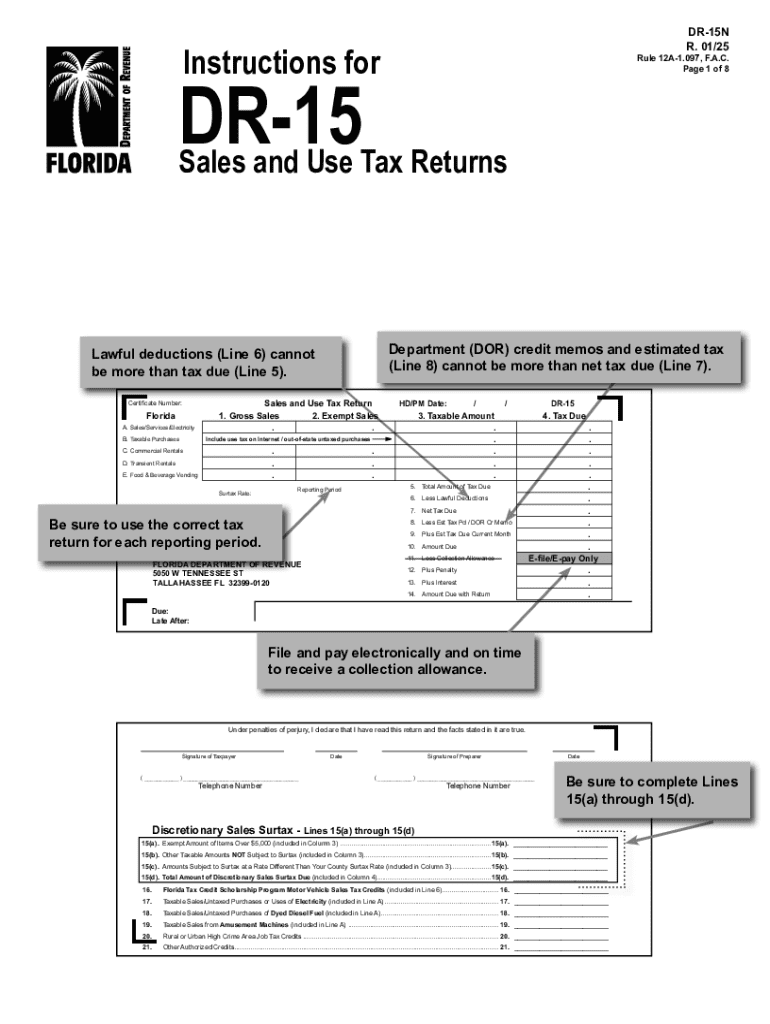

The Florida Sales Tax Form DR-15 is essential for businesses that need to report and remit sales tax collected from customers. This form is used to file sales and use tax returns, ensuring compliance with Florida tax regulations. It is crucial for businesses to accurately complete this form to avoid penalties and ensure proper tax reporting.

How to Complete the Florida Sales Tax Form DR-15

To successfully fill out the Florida Sales Tax Form DR-15, follow these steps:

- Gather all necessary sales records for the reporting period.

- Calculate total sales, taxable sales, and any exempt sales.

- Determine the total sales tax collected based on applicable rates.

- Complete each section of the form, ensuring all figures are accurate.

- Review the form for any errors before submission.

Filing Deadlines for the Florida Sales Tax Form DR-15

It is important to adhere to filing deadlines for the Florida Sales Tax Form DR-15 to avoid penalties. Generally, the form is due on the first day of the month following the reporting period. For example, the return for sales made in January is due by February 1. Businesses should also be aware of any specific deadlines that may apply based on their filing frequency, whether monthly, quarterly, or annually.

Submission Methods for the Florida Sales Tax Form DR-15

The Florida Sales Tax Form DR-15 can be submitted through various methods:

- Online via the Florida Department of Revenue's website.

- By mail, sending the completed form to the designated address provided by the Department of Revenue.

- In-person at local Department of Revenue offices, if preferred.

Key Elements of the Florida Sales Tax Form DR-15

When completing the Florida Sales Tax Form DR-15, it is essential to include key elements such as:

- Business name and address.

- Sales tax registration number.

- Total sales and taxable sales amounts.

- Sales tax collected during the reporting period.

- Any applicable exemptions or deductions.

Penalties for Non-Compliance with the Florida Sales Tax Form DR-15

Failure to file the Florida Sales Tax Form DR-15 on time or inaccuracies in the form can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid sales tax amounts.

- Potential audits by the Florida Department of Revenue.

Examples of Situations Requiring the Florida Sales Tax Form DR-15

Various business scenarios necessitate the use of the Florida Sales Tax Form DR-15. Examples include:

- Retail businesses collecting sales tax on goods sold.

- Service providers offering taxable services.

- Online businesses selling products to Florida residents.

Create this form in 5 minutes or less

Find and fill out the correct dr 15n r 0125 instructions for rule 12a 1 097 f

Create this form in 5 minutes!

How to create an eSignature for the dr 15n r 0125 instructions for rule 12a 1 097 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida sales tax form DR 15?

The Florida sales tax form DR 15 is a document used by businesses to report and pay sales tax to the state of Florida. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately calculate their tax obligations.

-

How can airSlate SignNow help with the Florida sales tax form DR 15?

airSlate SignNow simplifies the process of completing and submitting the Florida sales tax form DR 15 by providing an easy-to-use platform for eSigning and managing documents. With our solution, you can quickly fill out the form, obtain necessary signatures, and submit it electronically, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Florida sales tax form DR 15?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage your Florida sales tax form DR 15 and other documents without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the Florida sales tax form DR 15?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are all beneficial for managing the Florida sales tax form DR 15. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for the Florida sales tax form DR 15?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Florida sales tax form DR 15. This means you can connect with accounting software, CRM systems, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Florida sales tax form DR 15?

Using airSlate SignNow for the Florida sales tax form DR 15 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your tax documents seamlessly, ensuring compliance and saving you valuable time.

-

How secure is airSlate SignNow when handling the Florida sales tax form DR 15?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data while handling the Florida sales tax form DR 15, ensuring that your sensitive information remains confidential and secure throughout the process.

Get more for DR 15N R 0125 Instructions For Rule 12A 1 097, F

Find out other DR 15N R 0125 Instructions For Rule 12A 1 097, F

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors