Irs Form 13844 2020

What is the IRS Form 13844?

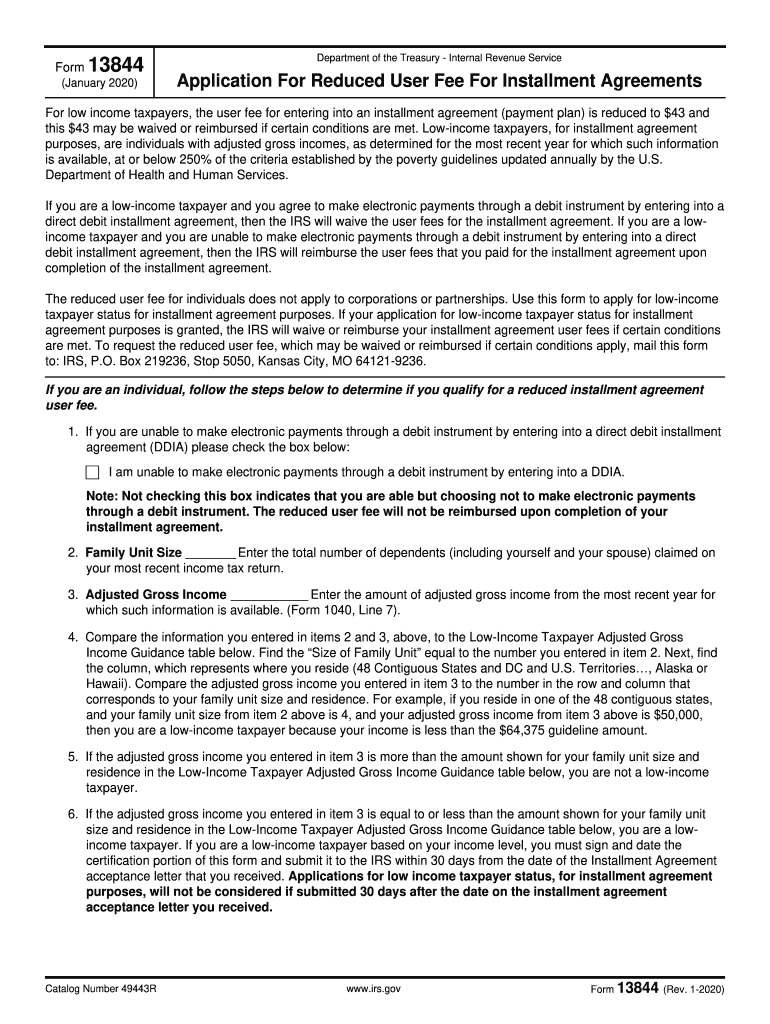

The IRS Form 13844 is a federal tax form used to apply for a reduced user fee for certain tax-related services. This form is particularly relevant for taxpayers who may qualify for a fee reduction based on specific criteria set by the IRS. Understanding the purpose of this form is essential for those seeking to minimize their tax-related expenses while ensuring compliance with federal regulations.

How to Use the IRS Form 13844

Using the IRS Form 13844 involves completing the form accurately and submitting it according to IRS guidelines. Taxpayers should first determine their eligibility for the reduced user fee. Once eligibility is confirmed, the form must be filled out with personal information, including name, address, and taxpayer identification number. It is important to provide all required documentation to support the request for a fee reduction.

Steps to Complete the IRS Form 13844

Completing the IRS Form 13844 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including proof of income and any relevant tax records.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate IRS address as indicated in the instructions.

Legal Use of the IRS Form 13844

The IRS Form 13844 must be used in accordance with federal tax laws. It is legally binding when completed correctly and submitted to the IRS. This form allows taxpayers to formally request a reduced user fee, which can lead to significant savings. Compliance with IRS regulations is crucial to ensure that the request is honored and that the taxpayer remains in good standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 13844 vary depending on the specific tax year and the nature of the fee reduction being requested. Taxpayers should be aware of these important dates to ensure timely submission. Generally, it is advisable to submit the form as early as possible to avoid any potential delays in processing and to ensure eligibility for the reduced fee.

Required Documents

When completing the IRS Form 13844, certain documents are required to support the application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver's license or Social Security card.

- Any additional documentation that verifies eligibility for the reduced user fee.

Form Submission Methods

The IRS Form 13844 can be submitted through various methods, including:

- Online submission through the IRS e-filing system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Quick guide on how to complete irs form 13844 application for reduced user fee for

Complete Irs Form 13844 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Irs Form 13844 on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to alter and eSign Irs Form 13844 effortlessly

- Obtain Irs Form 13844 and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 13844 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 13844 application for reduced user fee for

Create this form in 5 minutes!

How to create an eSignature for the irs form 13844 application for reduced user fee for

How to generate an eSignature for the Irs Form 13844 Application For Reduced User Fee For in the online mode

How to create an electronic signature for your Irs Form 13844 Application For Reduced User Fee For in Google Chrome

How to make an electronic signature for putting it on the Irs Form 13844 Application For Reduced User Fee For in Gmail

How to make an electronic signature for the Irs Form 13844 Application For Reduced User Fee For straight from your mobile device

How to generate an eSignature for the Irs Form 13844 Application For Reduced User Fee For on iOS devices

How to make an eSignature for the Irs Form 13844 Application For Reduced User Fee For on Android

People also ask

-

What is Form 13844 2019?

Form 13844 2019 is a document used for submitting certain financial information to the IRS. It streamlines the process of e-signing and allows for quicker approvals. Utilizing airSlate SignNow simplifies managing Form 13844 2019 effectively.

-

How can airSlate SignNow assist with Form 13844 2019?

airSlate SignNow offers an intuitive platform to e-sign and send Form 13844 2019 efficiently. It provides features that facilitate document tracking, reminders, and secure e-signatures, ensuring that your submissions are handled promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 13844 2019?

Yes, airSlate SignNow offers various pricing plans designed to suit different business needs for managing documents like Form 13844 2019. Each plan includes key features such as e-signing, document templates, and integrations, ensuring a cost-effective solution.

-

What features does airSlate SignNow provide for managing documents like Form 13844 2019?

For Form 13844 2019, airSlate SignNow provides features such as advanced document routing, customizable templates, and real-time tracking. These features enhance the signing process and ensure that all stakeholders are kept informed throughout.

-

Can I integrate airSlate SignNow with other applications for Form 13844 2019?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage Form 13844 2019 alongside your favorite tools. This integration capability enhances workflow efficiency while ensuring your documents remain secure and accessible.

-

What benefits does airSlate SignNow offer for e-signing Form 13844 2019?

By using airSlate SignNow for e-signing Form 13844 2019, you benefit from increased speed and convenience. The platform ensures secure transactions, reduces paperwork, and facilitates easy collaboration among team members, which can lead to improved productivity.

-

Is airSlate SignNow compliant with regulations for Form 13844 2019?

Yes, airSlate SignNow is compliant with industry regulations for e-signatures, ensuring that your use of Form 13844 2019 meets all legal requirements. This compliance provides peace of mind and helps protect your business from potential legal issues.

Get more for Irs Form 13844

- Mesa underwriters terrorism form cox specialty markets

- Form ppq 0 2011

- Tb form skin

- Nigeria visa application form

- Saudi visa form pdf

- Siprnet security annual refresher training 1 hr fouo form

- Physical activity readiness questionnaire zumba fitness classes zumbafitnessfleet co form

- Employee change form employee namecompany nameef

Find out other Irs Form 13844

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online