Irs Form 13844 2012

What is the Irs Form 13844

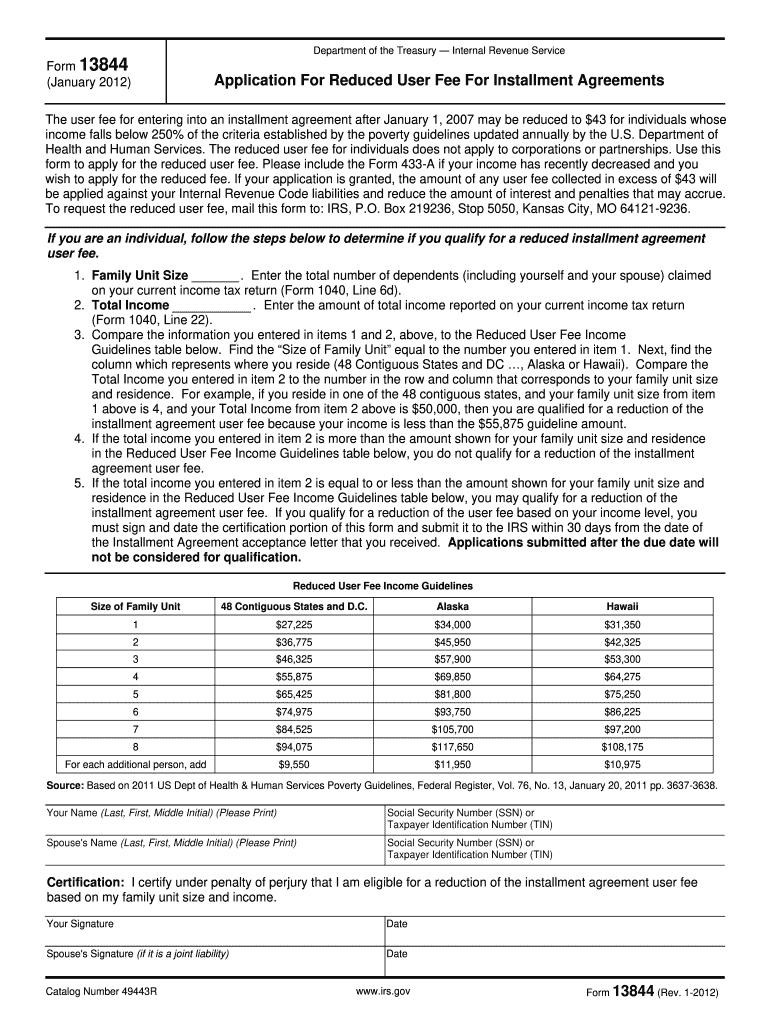

The Irs Form 13844 is a tax form used by eligible taxpayers to request a refund of certain amounts withheld from their income. This form is particularly relevant for those who may have overpaid their taxes or are seeking to claim specific tax credits. Understanding the purpose of this form is essential for ensuring accurate tax filings and maximizing potential refunds.

How to use the Irs Form 13844

Using the Irs Form 13844 involves filling out the required information accurately to facilitate the refund process. Taxpayers should gather all necessary documentation, including income statements and any relevant tax credits they wish to claim. Once the form is completed, it can be submitted to the IRS for processing. Ensuring that all information is correct will help avoid delays in receiving any refunds.

Steps to complete the Irs Form 13844

Completing the Irs Form 13844 requires a series of methodical steps:

- Gather necessary documents, such as W-2s and 1099s.

- Carefully read the instructions provided with the form.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your income and any tax credits you are claiming.

- Review the completed form for accuracy before submission.

Legal use of the Irs Form 13844

The Irs Form 13844 is legally recognized for tax purposes in the United States. To ensure its validity, it must be filled out completely and submitted according to IRS guidelines. Compliance with tax laws is crucial, as improper use of the form can lead to penalties or delays in processing refunds. Utilizing a reliable eSignature solution can enhance the legal standing of the form when submitted electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 13844 are typically aligned with the annual tax filing season. It is important for taxpayers to be aware of these dates to ensure timely submissions. Generally, forms should be filed by April 15 of the following tax year, but specific deadlines may vary based on individual circumstances. Staying informed about these dates helps avoid penalties and ensures eligibility for refunds.

Eligibility Criteria

To qualify for using the Irs Form 13844, taxpayers must meet specific eligibility criteria. This includes having income that is subject to withholding and being able to demonstrate that they have overpaid their taxes. Additionally, certain tax credits may apply, which can further influence eligibility. Understanding these criteria is essential for taxpayers to determine if they can effectively use this form to claim refunds.

Quick guide on how to complete irs form 13844 2012

Easily Prepare Irs Form 13844 on Any Device

Managing documents online has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Handle Irs Form 13844 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Effortlessly Modify and eSign Irs Form 13844

- Obtain Irs Form 13844 and select Get Form to begin.

- Use the tools available to fill out your form.

- Select signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Irs Form 13844 to ensure exceptional communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 13844 2012

Create this form in 5 minutes!

How to create an eSignature for the irs form 13844 2012

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Irs Form 13844?

Irs Form 13844 is a document used by taxpayers to apply for the Employee Retention Credit (ERC) as part of the COVID-19 relief efforts. This form allows eligible employers to claim a refundable tax credit on wages paid to employees during the pandemic. Understanding how to properly file Irs Form 13844 can signNowly impact your tax position.

-

How can airSlate SignNow help with Irs Form 13844?

airSlate SignNow enables users to easily eSign and send Irs Form 13844 and other important documents securely. With its intuitive interface, you can streamline the process, ensuring timely submission and compliance with IRS requirements. This can save you time and reduce the risk of errors in your application.

-

Is there a cost associated with using airSlate SignNow for Irs Form 13844?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can select a plan that best suits your budget to access features that facilitate the secure signing and management of Irs Form 13844. It's designed to offer cost-effective solutions for businesses of all sizes.

-

What features does airSlate SignNow provide for handling Irs Form 13844?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage to efficiently manage Irs Form 13844. These tools enhance collaboration by allowing multiple parties to sign and share the document seamlessly. Additionally, real-time tracking helps ensure no steps are missed along the way.

-

Can I integrate airSlate SignNow with other applications for managing Irs Form 13844?

Absolutely! airSlate SignNow supports integration with various applications and software such as CRMs, document management systems, and email platforms. This allows you to enhance your workflow while managing Irs Form 13844 and ensures a seamless experience across all your tools.

-

What are the benefits of using airSlate SignNow for Irs Form 13844?

Using airSlate SignNow for Irs Form 13844 offers numerous benefits, including enhanced security, improved efficiency, and better document tracking. You'll eliminate the hassles of physical paperwork and streamline the workflow, making it easier to meet deadlines. This digital solution also provides peace of mind with encryption and compliance features.

-

How secure is airSlate SignNow when handling Irs Form 13844?

airSlate SignNow prioritizes security by implementing advanced encryption standards and robust compliance measures. Your Irs Form 13844 and other sensitive documents are protected to ensure unauthorized access is prevented. This commitment to security helps you confidently manage your eSigned documents.

Get more for Irs Form 13844

- Transfer death deed in form

- Indiana transfer deed form

- Demand for discharge of lien individual indiana form

- Quitclaim deed from corporation to husband and wife indiana form

- Warranty deed from corporation to husband and wife indiana form

- Indiana 6 1 form

- Indiana affidavit form

- Quitclaim deed from corporation to individual indiana form

Find out other Irs Form 13844

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document