Irs Form 13844 Fill Out & Sign Online 2023

What is the IRS Form 13844?

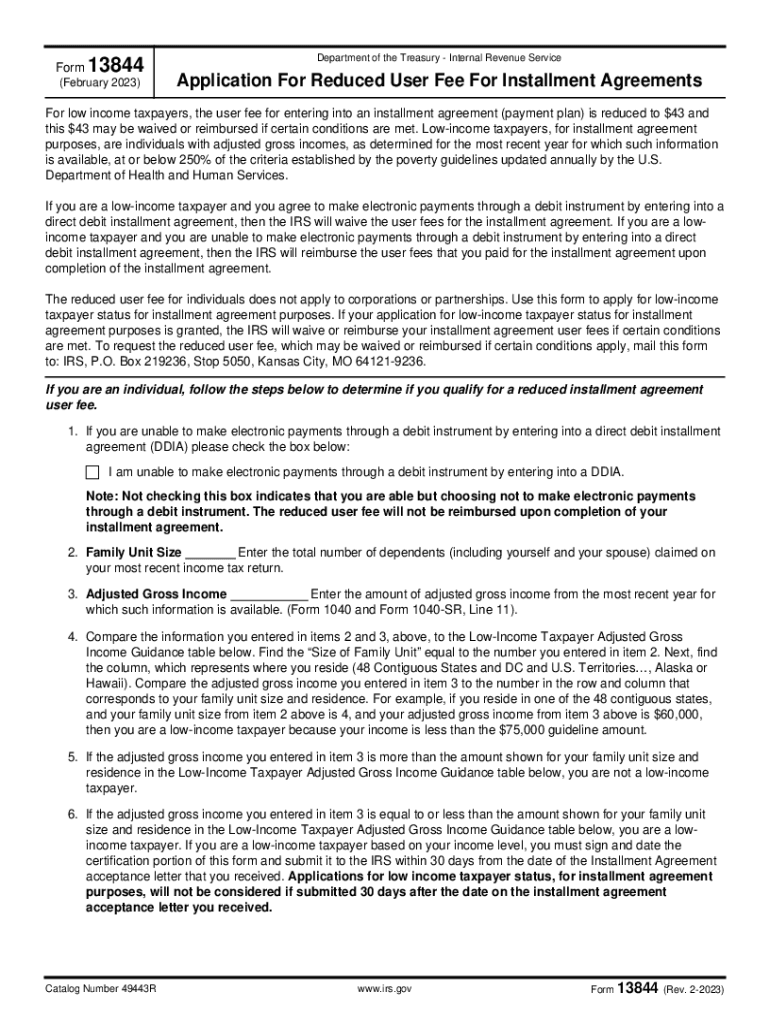

The IRS Form 13844, also known as the Application for Reduction of Fees, is a tax form used by individuals seeking to reduce the fees associated with certain IRS applications. This form is particularly relevant for taxpayers who may face financial hardship and are unable to pay the standard fees required for various IRS services. By submitting Form 13844, taxpayers can request a fee reduction based on their financial situation, ensuring access to necessary tax services.

Steps to Complete the IRS Form 13844

Completing the IRS Form 13844 involves several key steps to ensure accurate submission. First, gather all necessary financial documents, including income statements and any relevant tax returns. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to clearly indicate the fee you are requesting to reduce and provide a detailed explanation of your financial circumstances. After completing the form, review it for accuracy before submitting it to the IRS.

Legal Use of the IRS Form 13844

The legal use of the IRS Form 13844 is governed by federal tax regulations. To ensure that your submission is valid, it is essential to comply with all IRS guidelines regarding fee reductions. This includes providing truthful information about your financial status and ensuring that all required fields on the form are completed. Submitting false information can lead to penalties or denial of your request, so it is crucial to be honest and thorough in your application.

Eligibility Criteria for IRS Form 13844

To qualify for a fee reduction through IRS Form 13844, taxpayers must meet specific eligibility criteria. Generally, individuals facing financial hardship, such as unemployment or significant medical expenses, may be eligible. The IRS evaluates each application based on the provided financial information, including income, expenses, and overall financial situation. It is important to provide comprehensive documentation to support your request for a fee reduction.

Form Submission Methods

The IRS Form 13844 can be submitted through various methods, ensuring flexibility for taxpayers. The primary submission options include mailing the completed form to the designated IRS address or submitting it electronically through the IRS e-file system, if applicable. When mailing the form, it is advisable to use a trackable mailing service to confirm receipt by the IRS. Ensure that you keep a copy of the submitted form for your records.

Filing Deadlines for IRS Form 13844

Filing deadlines for the IRS Form 13844 may vary based on the specific circumstances of the taxpayer. It is essential to submit the form as soon as you determine the need for a fee reduction, especially if you are facing an impending deadline for the associated IRS application. Keeping track of any relevant IRS deadlines can help ensure that your request is processed in a timely manner, allowing you to access necessary services without delay.

Quick guide on how to complete irs form 13844 fill out ampamp sign online

Complete Irs Form 13844 Fill Out & Sign Online effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to discover the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle Irs Form 13844 Fill Out & Sign Online on any device using airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

The easiest method to edit and eSign Irs Form 13844 Fill Out & Sign Online seamlessly

- Locate Irs Form 13844 Fill Out & Sign Online and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your choice. Edit and eSign Irs Form 13844 Fill Out & Sign Online and ensure outstanding communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 13844 fill out ampamp sign online

Create this form in 5 minutes!

How to create an eSignature for the irs form 13844 fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 13844 and how can it benefit my business?

Form 13844 is a streamlined way to handle electronic signatures for documents. By using Form 13844, businesses can signNowly speed up their transaction processes, reduce paperwork, and improve compliance with legal standards. This form facilitates hassle-free eSigning, ensuring safe and efficient document management.

-

How does airSlate SignNow ensure the security of Form 13844?

airSlate SignNow takes security seriously and employs advanced encryption standards to protect all documents, including Form 13844. The platform is equipped with features such as secure access controls and audit trails to monitor document activity, making sure that your information remains confidential and secure.

-

What features does airSlate SignNow offer for using Form 13844?

With airSlate SignNow, users can easily create, send, and track Form 13844 within a user-friendly interface. Key features include customizable templates, automated workflows, and real-time notifications, all designed to enhance efficiency and save time in the signing process.

-

Is there a free trial available for using Form 13844 on airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the functionalities of Form 13844 without any commitment. This trial gives prospective users the opportunity to see how the platform can streamline their signing process and improve their document management workflows.

-

What is the pricing structure for using Form 13844 with airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses of all sizes. The pricing structure is transparent, with options for monthly and annual subscriptions, allowing users to choose the best fit for utilizing Form 13844 efficiently and cost-effectively.

-

Can I integrate airSlate SignNow with other software while using Form 13844?

Absolutely! airSlate SignNow supports seamless integration with various software applications such as CRM systems, productivity tools, and cloud storage services. This allows users to enhance their workflows while managing Form 13844 and ensures a cohesive experience across platforms.

-

What are the advantages of using airSlate SignNow for Form 13844?

Using airSlate SignNow for Form 13844 simplifies document signing and accelerates approval times. The advantages include reduced turnaround times, ease of access, and improved tracking of document statuses, making it an essential tool for businesses aiming to enhance efficiency in their processes.

Get more for Irs Form 13844 Fill Out & Sign Online

- Is it realhttpsdormogovformsmo

- Rev 10 19 form

- Power of attorney authorization to disclose information

- Free montana power of attorney forms pdf templates

- North carolina department of revenue p form

- Form 500 authorization to disclose tax information ampamp designation

- Nebraska tax form 14n

- Change your business address business licensing service form

Find out other Irs Form 13844 Fill Out & Sign Online

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile