Form 13844 Rev 11 2024-2026

What is the Form 13844 Rev 11

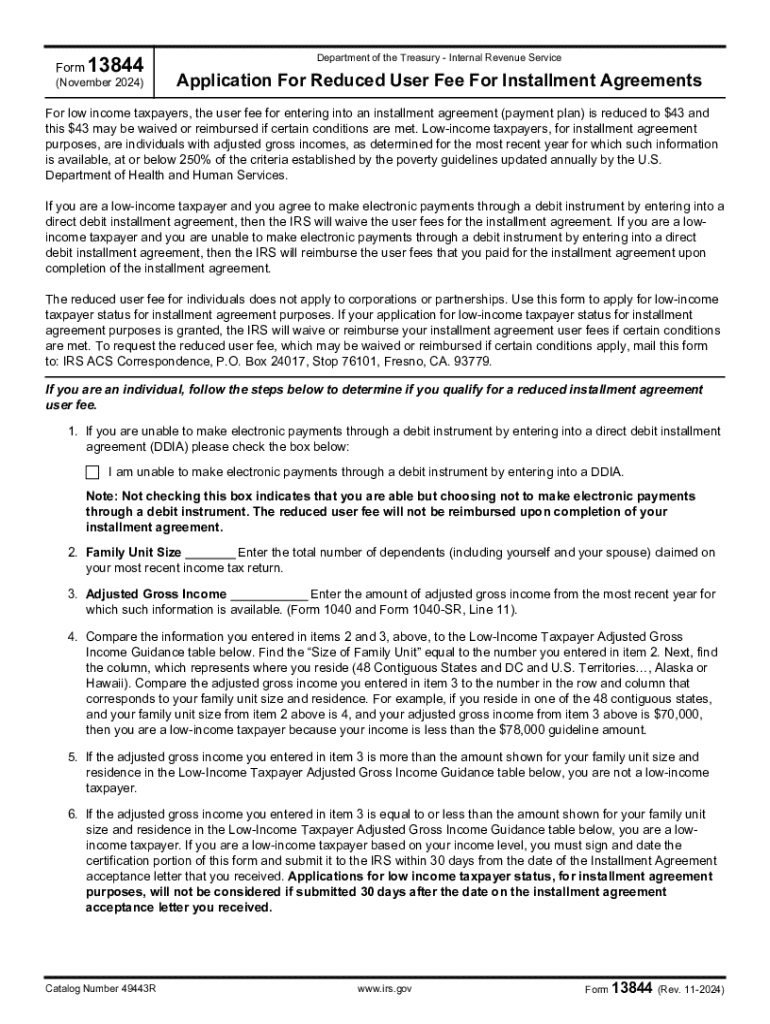

The Form 13844 Rev 11, also known as the Application for Reduced Fee for Installment Agreements, is a document used by taxpayers to request a reduction in the fee associated with setting up an installment agreement with the IRS. This form is particularly relevant for individuals experiencing financial hardship, allowing them to manage their tax obligations more effectively. The IRS provides this form to assist taxpayers in qualifying for a lower fee based on their income level and financial situation.

How to use the Form 13844 Rev 11

To use the Form 13844 Rev 11, taxpayers must first complete the form accurately, providing necessary details about their income and financial circumstances. This information helps the IRS determine eligibility for a reduced fee. Once completed, the form should be submitted alongside the application for the installment agreement. It is essential to ensure that all information is correct and that any required supporting documents are included to avoid delays in processing.

Steps to complete the Form 13844 Rev 11

Completing the Form 13844 Rev 11 involves several steps:

- Gather necessary financial documents, including proof of income and expenses.

- Fill out the form, ensuring all sections are completed, particularly those detailing your income and family size.

- Review the form for accuracy, checking that all information is current and complete.

- Attach any required documentation to support your claims, such as pay stubs or bank statements.

- Submit the form along with your installment agreement application to the IRS.

Eligibility Criteria

To qualify for a reduced fee using the Form 13844 Rev 11, taxpayers must meet specific eligibility criteria set by the IRS. Generally, these criteria include:

- Demonstrating financial hardship, typically defined by income levels below a certain threshold.

- Being in compliance with filing requirements for previous tax returns.

- Submitting the form in conjunction with an application for an installment agreement.

Meeting these criteria is essential for approval of the reduced fee request.

Required Documents

When submitting the Form 13844 Rev 11, it is important to include relevant supporting documents to substantiate your claim for a reduced fee. Required documents may include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of monthly expenses, like utility bills or rent statements.

- Any additional information that reflects your current financial situation.

Providing thorough documentation helps facilitate the review process by the IRS.

Form Submission Methods

The completed Form 13844 Rev 11 can be submitted to the IRS through various methods. Taxpayers may choose to:

- File the form online through the IRS website, if applicable.

- Mail the completed form to the appropriate IRS address provided in the form instructions.

- Visit a local IRS office to submit the form in person.

Choosing the right submission method can help ensure timely processing of your request.

Create this form in 5 minutes or less

Find and fill out the correct form 13844 rev 11

Create this form in 5 minutes!

How to create an eSignature for the form 13844 rev 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help in reducing fee income?

airSlate SignNow offers a streamlined eSignature solution that minimizes operational costs, ultimately leading to fee income reduced. By automating document workflows, businesses can save time and resources, allowing them to focus on revenue-generating activities.

-

What features of airSlate SignNow contribute to fee income reduction?

Key features such as customizable templates, bulk sending, and real-time tracking contribute to fee income reduced. These functionalities enhance efficiency and reduce the need for physical paperwork, which can be costly.

-

Is airSlate SignNow cost-effective for small businesses looking to reduce fee income?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses aiming to achieve fee income reduced. With flexible pricing plans, businesses can choose a package that fits their budget while still benefiting from powerful eSignature capabilities.

-

Can airSlate SignNow integrate with other tools to help reduce fee income?

Absolutely! airSlate SignNow integrates seamlessly with various business tools like CRM systems and cloud storage solutions, which can help in fee income reduced. These integrations streamline processes and eliminate redundant tasks, further enhancing cost efficiency.

-

What are the benefits of using airSlate SignNow for fee income reduction?

Using airSlate SignNow can lead to signNow fee income reduced by improving document turnaround times and reducing paper-related expenses. Additionally, the platform enhances compliance and security, which can prevent costly errors and delays.

-

How does airSlate SignNow ensure security while helping to reduce fee income?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your documents. This focus on security not only safeguards your data but also contributes to fee income reduced by minimizing the risk of costly bsignNowes.

-

What types of documents can I send with airSlate SignNow to help reduce fee income?

You can send a variety of documents, including contracts, agreements, and forms, using airSlate SignNow. By digitizing these processes, businesses can achieve fee income reduced through faster processing and reduced administrative costs.

Get more for Form 13844 Rev 11

Find out other Form 13844 Rev 11

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF