Irs Form13844 2014

What is the Irs Form13844

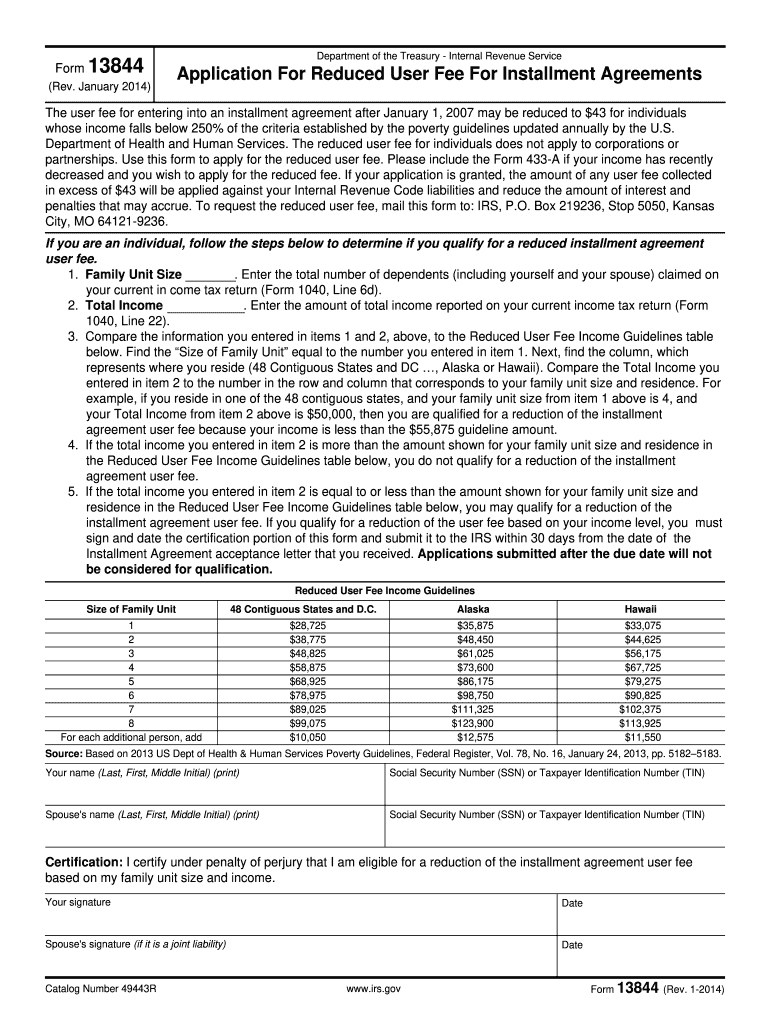

The Irs Form 13844, also known as the Application for the IRS Free File Program, is a document that allows eligible taxpayers to access free tax preparation and e-filing services. This form is primarily designed for individuals with an adjusted gross income below a specified threshold, enabling them to file their federal taxes without incurring any costs. By using this form, taxpayers can connect with participating software providers that offer free services tailored to their financial situations.

How to use the Irs Form13844

Using the Irs Form 13844 involves several straightforward steps. First, individuals must determine their eligibility based on income and other criteria. Once eligibility is confirmed, the form can be completed online or printed for submission. After filling out the necessary information, taxpayers can submit the form to gain access to the Free File Program. It is essential to follow the instructions carefully to ensure that all required details are provided accurately.

Steps to complete the Irs Form13844

Completing the Irs Form 13844 involves a series of steps:

- Visit the official IRS website to access the form.

- Review the eligibility criteria to confirm that you qualify for the Free File Program.

- Fill out the form with accurate personal and financial information.

- Submit the form online or print it for mailing, depending on your preference.

- Follow up with the IRS or the selected software provider to ensure your application is processed.

Legal use of the Irs Form13844

The Irs Form 13844 is legally binding when completed and submitted according to IRS guidelines. It is crucial that the information provided is truthful and accurate, as any discrepancies may lead to penalties or delays in processing. The form must be used solely for its intended purpose of accessing free tax preparation services, and misuse can result in legal consequences.

Eligibility Criteria

To qualify for the Irs Form 13844, taxpayers must meet specific eligibility criteria. Generally, this includes having an adjusted gross income below a certain limit, which is set annually by the IRS. Additionally, individuals must be U.S. citizens or residents and should not have complex tax situations, such as income from self-employment or rental properties. It is advisable to check the current year’s guidelines for any updates to these criteria.

Form Submission Methods

The Irs Form 13844 can be submitted through various methods, catering to different preferences. Taxpayers can complete the form online via the IRS website, which is the most efficient method. Alternatively, individuals may choose to print the form and submit it via mail. It is important to ensure that the submission method chosen aligns with the guidelines provided by the IRS to avoid any processing issues.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 13844 typically align with the general tax filing deadlines set by the IRS. Taxpayers should be aware of these dates to ensure timely submission. Generally, the deadline for filing federal income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Staying informed about these important dates is essential for a smooth filing experience.

Quick guide on how to complete irs form13844 2014

Complete Irs Form13844 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form13844 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to adjust and electronically sign Irs Form13844 without any hassle

- Obtain Irs Form13844 and click Get Form to commence.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Irs Form13844 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form13844 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form13844 2014

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is IRS Form 13844 and how does it relate to airSlate SignNow?

IRS Form 13844 is a tax form used by taxpayers to request assistance from the IRS for certain tax-related issues. airSlate SignNow allows you to easily eSign and manage this form online, ensuring a smooth and compliant filing process, which can save you time and reduce errors.

-

How can I use airSlate SignNow to complete IRS Form 13844?

With airSlate SignNow, you can upload IRS Form 13844, fill it out electronically, and eSign it from any device. This digital solution simplifies the completion of tax forms, allowing users to manage documentation efficiently and securely without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for IRS Form 13844?

Yes, airSlate SignNow offers various pricing plans to suit different needs and budgets. These plans provide access to features that facilitate eSigning and document management, making it a cost-effective solution for completing IRS Form 13844 and other documents.

-

What features does airSlate SignNow offer for handling IRS Form 13844?

airSlate SignNow provides an intuitive platform where you can easily fill, sign, and send IRS Form 13844. It includes features such as automatic reminders, document tracking, and robust security, ensuring that your tax documents are managed effectively.

-

Can I integrate airSlate SignNow with other tools for IRS Form 13844?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to incorporate IRS Form 13844 into your existing workflows. This capability streamlines the management of tax forms alongside other business processes, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for IRS Form 13844?

Using airSlate SignNow for IRS Form 13844 provides several benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The digital signing process is faster and more secure than traditional methods, enabling businesses and individuals to submit their forms with confidence.

-

Is airSlate SignNow secure for handling IRS Form 13844?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure access protocols, to ensure the safe handling of sensitive documents like IRS Form 13844. Users can trust that their information is protected throughout the signing and submission process.

Get more for Irs Form13844

- Letter tenant demand sample form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497306851 form

- Indiana unsafe form

- Indiana tenant landlord 497306853 form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises indiana form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles indiana form

- Letter from tenant to landlord about landlords failure to make repairs indiana form

- Tenant voluntarily form

Find out other Irs Form13844

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History