Form 1040 PR Fill in Capable

What is the Form 1040 PR Fill In Capable

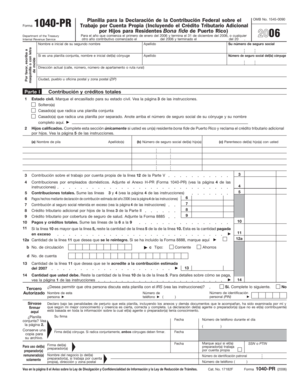

The Form 1040 PR Fill In Capable is a tax form used by residents of Puerto Rico to report their income and calculate their tax liability. This form is specifically designed for individuals who earn income and are subject to Puerto Rico's tax laws. It serves as a crucial document for ensuring compliance with local tax regulations and plays a significant role in the annual tax filing process.

How to use the Form 1040 PR Fill In Capable

Using the Form 1040 PR Fill In Capable involves several steps. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, accurately fill in each section of the form, ensuring that all income sources are reported. It is essential to follow the instructions provided with the form to avoid errors that could delay processing. Once completed, the form can be submitted electronically or via mail to the appropriate tax authority.

Steps to complete the Form 1040 PR Fill In Capable

Completing the Form 1040 PR Fill In Capable requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documentation.

- Begin filling out the form, starting with personal information such as your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Calculate your total income and determine your tax liability using the provided tax tables.

- Sign and date the form before submission.

Legal use of the Form 1040 PR Fill In Capable

The Form 1040 PR Fill In Capable is legally binding when completed and submitted in accordance with the law. It must be filled out accurately to reflect your income and tax obligations. Failure to provide truthful information can result in penalties, including fines or additional taxes owed. It is crucial to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 PR Fill In Capable typically align with the standard tax filing dates in the United States. Generally, the form must be submitted by April 15 of the following tax year. However, it is important to verify specific dates each year, as they may vary due to weekends or holidays. Staying informed about these deadlines helps avoid late fees and ensures timely processing of your tax return.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 PR Fill In Capable can be submitted through various methods. Taxpayers have the option to file the form electronically using approved tax software or online services. Alternatively, the completed form can be printed and mailed to the appropriate tax office. In some cases, individuals may also choose to submit the form in person at designated tax offices. Each method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete 2006 form 1040 pr fill in capable

Prepare [SKS] seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

How to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or mistakes requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040 PR Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the 2006 form 1040 pr fill in capable

How to create an eSignature for the 2006 Form 1040 Pr Fill In Capable online

How to generate an electronic signature for the 2006 Form 1040 Pr Fill In Capable in Google Chrome

How to make an electronic signature for putting it on the 2006 Form 1040 Pr Fill In Capable in Gmail

How to create an electronic signature for the 2006 Form 1040 Pr Fill In Capable from your mobile device

How to generate an eSignature for the 2006 Form 1040 Pr Fill In Capable on iOS

How to make an electronic signature for the 2006 Form 1040 Pr Fill In Capable on Android devices

People also ask

-

What is the Form 1040 PR Fill In Capable feature?

The Form 1040 PR Fill In Capable feature allows users to electronically fill out and submit their Puerto Rico income tax returns with ease. This tool simplifies the process, ensuring that all necessary fields are completed correctly and efficiently. With airSlate SignNow, you can confidently file your taxes without missing important information.

-

How much does the Form 1040 PR Fill In Capable feature cost?

Pricing for the Form 1040 PR Fill In Capable feature varies based on your selected subscription plan. airSlate SignNow offers competitive pricing options that cater to both individuals and businesses. You can choose a plan that fits your needs and budget while enjoying the benefits of streamlined document management.

-

Is the Form 1040 PR Fill In Capable feature easy to use?

Yes, the Form 1040 PR Fill In Capable feature is designed to be user-friendly and intuitive. Users can quickly navigate the platform and fill out their tax forms without needing technical expertise. With built-in guidance, airSlate SignNow ensures a smooth experience from start to finish.

-

Can I save my progress while filling out the Form 1040 PR Fill In Capable?

Absolutely! Using airSlate SignNow, you can save your progress while completing the Form 1040 PR Fill In Capable. This feature allows you to return to your document at any time, ensuring that you can complete your tax filings at your own pace without losing any information.

-

Does airSlate SignNow offer integration with other applications for the Form 1040 PR Fill In Capable?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the functionality of the Form 1040 PR Fill In Capable. You can connect with popular platforms like Google Drive, Dropbox, and others to streamline your document management process. This integration allows for easier file storage and access.

-

What advantages does the Form 1040 PR Fill In Capable offer for businesses?

The Form 1040 PR Fill In Capable feature benefits businesses by simplifying tax filing processes and minimizing errors. Enhanced accuracy and efficient time management mean less stress during tax season. Additionally, airSlate SignNow provides electronic signatures, making document approval quick and straightforward.

-

Can I access the Form 1040 PR Fill In Capable on mobile devices?

Yes, the Form 1040 PR Fill In Capable is accessible on mobile devices, allowing users to fill out their tax forms anytime, anywhere. The responsive design of airSlate SignNow ensures a seamless experience on smartphones and tablets. This mobility helps users manage their documents effectively while on the go.

Get more for Form 1040 PR Fill In Capable

- Il 1120 instructions tax illinois form

- Il 1120 tax illinois form

- Schedule ins income tax corporate form

- Schedule ubnld income tax corporate 10998385 form

- Schedule ub income tax corporate form

- Schedule m income tax business form

- Schedule nld income tax corporate form

- Schedule 1299 c income tax individual 10998403 form

Find out other Form 1040 PR Fill In Capable

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation