1040 Ez Form 1997

What is the 1040 EZ Form

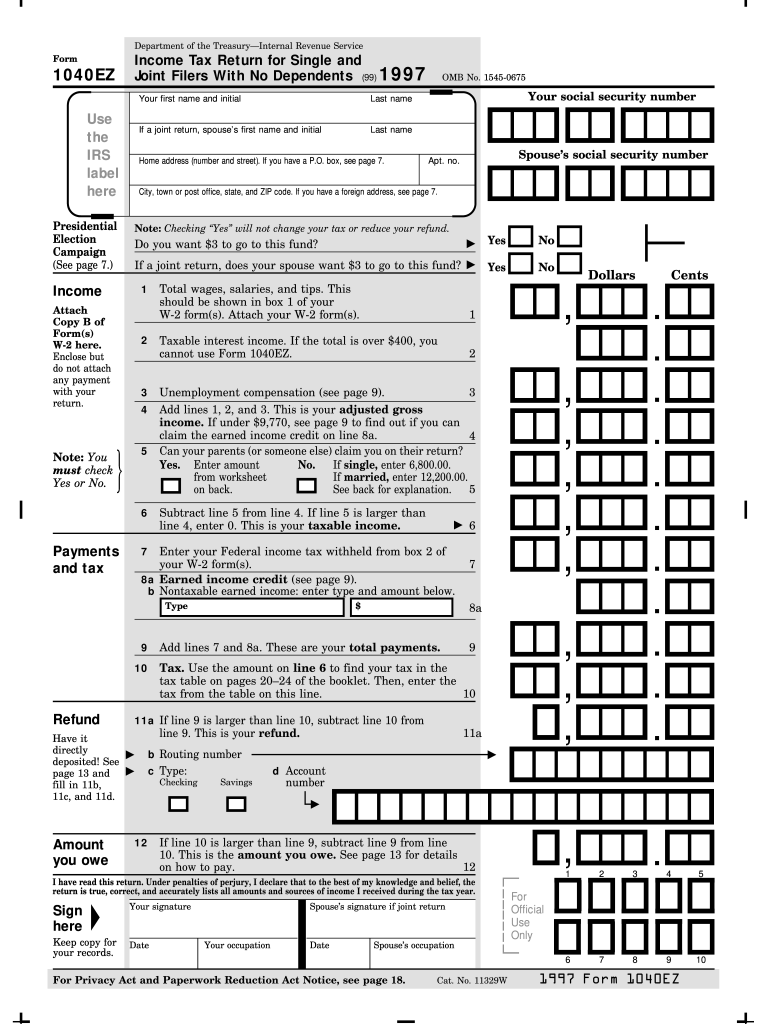

The 1040 EZ Form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward tax situations. This form is primarily used by individuals who are filing their federal income tax returns and meet specific eligibility criteria. The 1040 EZ is ideal for single or married taxpayers filing jointly with no dependents, and it is limited to those with taxable income below a certain threshold. This form streamlines the filing process, allowing for a quicker and more efficient submission of tax returns.

How to use the 1040 EZ Form

Using the 1040 EZ Form involves several straightforward steps. First, ensure you meet the eligibility criteria, which include having a taxable income below a specified limit and not claiming any dependents. Next, gather necessary information, such as your Social Security number, filing status, and income details. Fill out the form by entering your income, adjustments, and tax credits. After completing the form, you can e-file it or print it for mailing. Using a digital solution can simplify this process, ensuring accuracy and compliance with IRS regulations.

Steps to complete the 1040 EZ Form

Completing the 1040 EZ Form requires careful attention to detail. Follow these steps:

- Gather your financial documents, including W-2 forms and any other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, which may include wages, salaries, and tips.

- Calculate your adjusted gross income by subtracting any adjustments allowed.

- Determine your tax liability using the tax tables provided by the IRS.

- Sign and date the form before submitting it, either electronically or by mail.

Legal use of the 1040 EZ Form

The 1040 EZ Form is legally recognized as a valid document for filing federal income taxes in the United States. To ensure its legal standing, it must be completed accurately and in accordance with IRS guidelines. This includes providing truthful information and signing the form. When filed electronically, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures are legally binding. Using a reputable e-signature solution can enhance the security and legality of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 EZ Form align with the standard tax filing schedule. Typically, the deadline to file your federal income tax return is April 15 of each year. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file. It is crucial to stay informed about these dates to avoid penalties and ensure timely submission.

Required Documents

To complete the 1040 EZ Form, certain documents are necessary. These include:

- W-2 forms from employers, detailing your income and taxes withheld.

- Any 1099 forms for additional income, if applicable.

- Records of any adjustments to income, such as student loan interest.

- Your Social Security number and that of your spouse, if filing jointly.

Having these documents on hand will facilitate a smoother and more accurate filing process.

Quick guide on how to complete 1997 1040 ez form

Complete 1040 Ez Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle 1040 Ez Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign 1040 Ez Form with minimal effort

- Find 1040 Ez Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1040 Ez Form to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1997 1040 ez form

Create this form in 5 minutes!

How to create an eSignature for the 1997 1040 ez form

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the 1040 Ez Form?

The 1040 Ez Form is a simplified version of the standard 1040 tax form, designed for individuals with straightforward tax situations. It allows taxpayers to report their income, claim standard deductions, and determine if they owe taxes or will receive a refund. This form is especially beneficial for first-time filers or those with uncomplicated tax scenarios.

-

How can airSlate SignNow assist with the 1040 Ez Form?

AirSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the 1040 Ez Form. With its intuitive interface and seamless workflow, users can quickly fill out and eSign their tax documents, ensuring the timely submission of their 1040 Ez Form. This convenience simplifies the tax filing process, allowing individuals to focus on their financial matters.

-

Are there any costs associated with using airSlate SignNow for the 1040 Ez Form?

Yes, while airSlate SignNow offers several pricing tiers, there are cost-effective plans available that cater to varying needs, starting with a free trial. Users can choose a plan that best suits their volume of document sending and signing, including for the 1040 Ez Form. This flexibility ensures that individuals and businesses can access essential eSignature features without excessive costs.

-

What features does airSlate SignNow offer for the 1040 Ez Form?

AirSlate SignNow includes features such as templates, in-person signing, and advanced security measures, all tailored for documents like the 1040 Ez Form. Users can create reusable templates to streamline their tax filing process and enhance efficiency. Additionally, airSlate SignNow prioritizes security, ensuring that all sensitive information on the 1040 Ez Form is protected.

-

Can I use airSlate SignNow to integrate with tax software for my 1040 Ez Form?

Yes, airSlate SignNow integrates smoothly with popular tax software, allowing for an efficient workflow when preparing the 1040 Ez Form. By leveraging these integrations, users can import relevant data directly into their tax forms and seamlessly eSign them without stepping outside their chosen software. This integration enhances productivity and simplifies the filing process.

-

What benefits does using airSlate SignNow provide for electronically signing the 1040 Ez Form?

Using airSlate SignNow offers numerous benefits, including faster processing times, reduced paperwork, and enhanced convenience when signing the 1040 Ez Form. Users can sign documents from anywhere at any time, eliminating the need for physical signatures and in-person meetings. This flexibility not only saves time but also helps avoid costly delays in tax submissions.

-

How does airSlate SignNow ensure the security of my 1040 Ez Form?

AirSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your 1040 Ez Form and other sensitive documents. These protocols ensure that your personal and financial data is safeguarded against unauthorized access. With airSlate SignNow, you can confidently eSign and share your tax documents while maintaining privacy and security.

Get more for 1040 Ez Form

Find out other 1040 Ez Form

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online