Form 4972 2011

What is the Form 4972

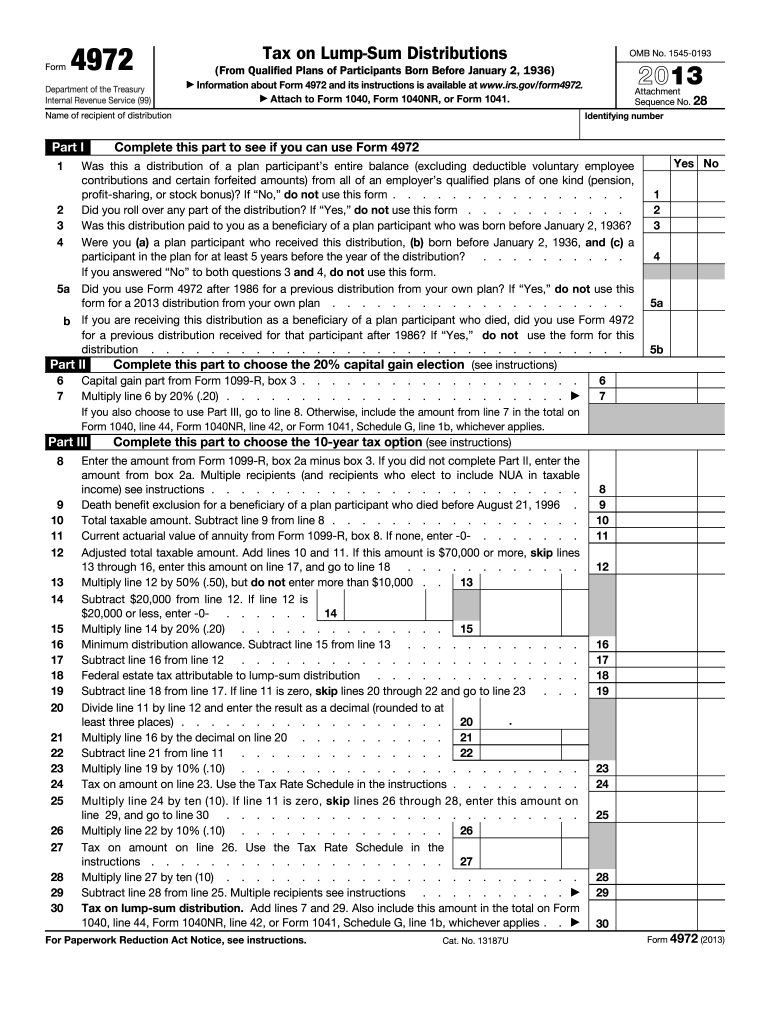

The Form 4972, also known as the "Tax on Lump-Sum Distributions," is a tax form used by individuals in the United States to report and calculate the tax owed on lump-sum distributions from qualified retirement plans. This form is particularly relevant for taxpayers who have received a one-time payment from their retirement accounts, such as pensions or 401(k) plans. The purpose of Form 4972 is to ensure that the appropriate tax rate is applied to these distributions, which may be subject to different tax treatments compared to regular income.

How to use the Form 4972

To use Form 4972, individuals must first determine if they are eligible to file it. This involves confirming that they received a lump-sum distribution from a qualified retirement plan. Once eligibility is established, taxpayers should complete the form by providing details about the distribution, including the total amount received and the tax withheld. After filling out the necessary information, the form should be submitted along with the individual's tax return to the IRS. Proper completion of Form 4972 is crucial to ensure accurate tax reporting and compliance.

Steps to complete the Form 4972

Completing Form 4972 involves several key steps:

- Gather necessary documents, including the distribution statement from the retirement plan.

- Determine eligibility to file the form based on the type of distribution received.

- Fill out the form by entering personal information, the total distribution amount, and any tax withheld.

- Calculate the tax owed using the appropriate tax rate for lump-sum distributions.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Form 4972

The legal use of Form 4972 is governed by IRS regulations regarding the taxation of retirement distributions. To ensure compliance, taxpayers must accurately report their lump-sum distributions and pay any taxes owed. Failure to properly file Form 4972 can result in penalties or additional taxes. It is essential to maintain records of the distribution and any related documentation in case of an audit or inquiry from the IRS.

Filing Deadlines / Important Dates

Form 4972 must be filed by the same deadline as your annual tax return, typically April 15th of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should be aware of any changes to the filing schedule and ensure that they submit their forms on time to avoid late fees or penalties.

Required Documents

To complete Form 4972, taxpayers will need specific documents, including:

- The distribution statement from the retirement plan, detailing the amount received and any taxes withheld.

- Previous tax returns, if applicable, to determine any carryover amounts or other relevant tax information.

- Identification information, such as Social Security numbers for both the taxpayer and any beneficiaries.

Penalties for Non-Compliance

Failing to file Form 4972 or inaccurately reporting the information can lead to significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, taxpayers may be subject to interest charges on any unpaid taxes related to the lump-sum distribution. It is crucial to ensure that Form 4972 is completed accurately and submitted on time to avoid these potential consequences.

Quick guide on how to complete 2011 form 4972

Prepare Form 4972 seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documentation, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form 4972 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 4972 with ease

- Acquire Form 4972 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the data and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or a sharing link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from your chosen device. Adjust and eSign Form 4972 and ensure outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 4972

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 4972

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 4972 and how is it used?

Form 4972 is a tax form that allows individuals to report a lump-sum distribution from an individual retirement account. It is mainly used to calculate taxes on early distributions taken from retirement plans. Using airSlate SignNow, you can easily fill out and eSign Form 4972, making tax season simpler and more efficient.

-

How can airSlate SignNow help with completing Form 4972?

airSlate SignNow offers an intuitive platform for digitally filling out and eSigning Form 4972. Our user-friendly interface streamlines the process, reducing errors and saving valuable time. You can easily share the completed form with tax professionals or relevant parties directly through our platform.

-

What are the pricing options for using airSlate SignNow to manage Form 4972?

airSlate SignNow offers a range of pricing plans tailored to different business sizes and needs, making it affordable to manage Form 4972 and other documents. You can select a plan that suits your requirements, whether you need basic features or advanced functionalities for document management and eSigning.

-

Is airSlate SignNow compliant with regulations related to Form 4972?

Yes, airSlate SignNow prioritizes compliance with legal regulations regarding document eSigning, including Form 4972. Our platform adheres to rigorous security standards, ensuring that all electronic signatures are valid and legally binding, which adds peace of mind to your tax preparation process.

-

Can I integrate airSlate SignNow with other software to handle Form 4972?

Absolutely! airSlate SignNow integrates seamlessly with various software applications that are commonly used in financial management. This means you can streamline the process of handling Form 4972 by connecting it to your existing tools, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for Form 4972 compared to traditional methods?

Using airSlate SignNow to handle Form 4972 offers signNow advantages over traditional methods. You save time on printing, signing, and mailing, plus the risk of errors is minimized with digital templates. Additionally, you can track the status of your Form 4972 in real-time, ensuring that everything is processed promptly.

-

Is there customer support available for using airSlate SignNow with Form 4972?

Yes, when you use airSlate SignNow to manage Form 4972, you have access to dedicated customer support. Our knowledgeable team is available to assist you with any questions or issues that may arise, ensuring a smooth experience as you complete your tax documentation.

Get more for Form 4972

Find out other Form 4972

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile