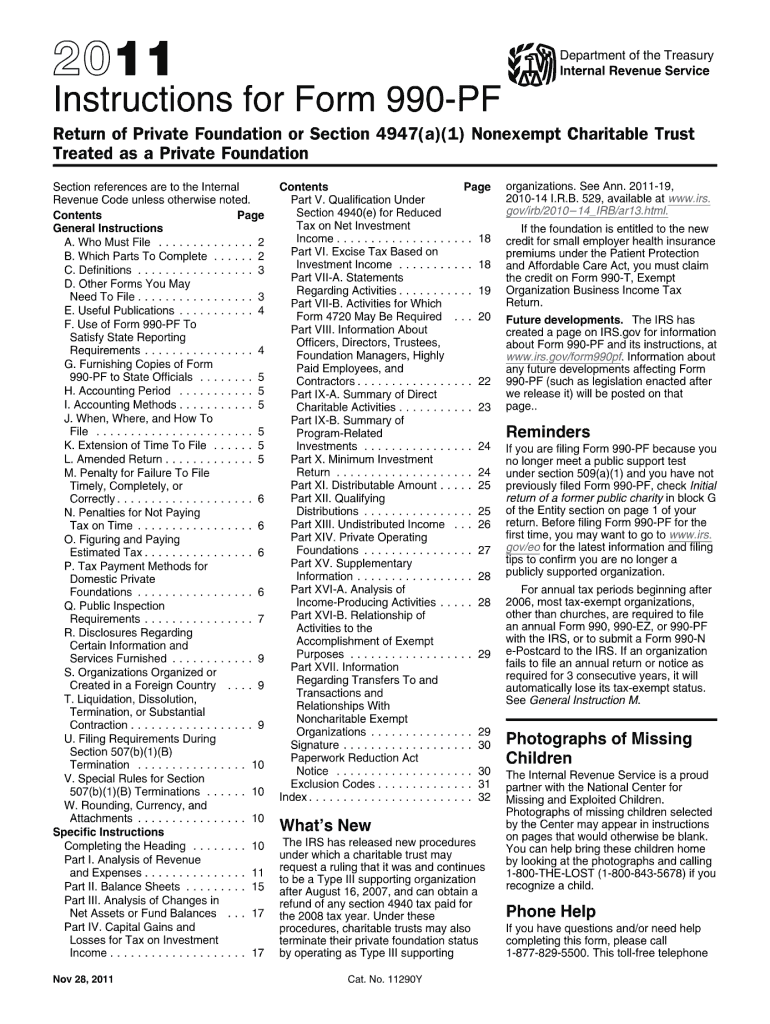

990 Pf Instruction Form 2011

What is the 990 Pf Instruction Form

The 990 Pf Instruction Form is a crucial document used by private foundations in the United States to report their financial activities to the Internal Revenue Service (IRS). This form provides detailed information about a foundation’s income, expenditures, and charitable distributions. The form is essential for ensuring compliance with federal tax regulations and maintaining the foundation's tax-exempt status. Understanding the purpose and requirements of the 990 Pf Instruction Form is vital for foundation administrators and board members.

How to use the 990 Pf Instruction Form

Using the 990 Pf Instruction Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, balance sheets, and details of charitable contributions made during the reporting period. Next, carefully fill out the form, providing accurate figures and necessary explanations where required. It is important to follow the IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form must be submitted to the IRS by the designated deadline, ensuring that all information is complete and accurate to maintain compliance.

Steps to complete the 990 Pf Instruction Form

Completing the 990 Pf Instruction Form requires a systematic approach:

- Step one: Collect all relevant financial documents, including previous tax returns and current financial statements.

- Step two: Review the instructions carefully to understand each section of the form.

- Step three: Fill in the required information, ensuring accuracy in all entries.

- Step four: Include any necessary schedules or attachments as indicated in the instructions.

- Step five: Review the completed form for any errors or omissions before submission.

- Step six: Submit the form electronically or by mail, depending on your preference and IRS guidelines.

Legal use of the 990 Pf Instruction Form

The legal use of the 990 Pf Instruction Form is governed by IRS regulations that dictate how private foundations must report their financial activities. Accurate completion of this form is necessary to maintain tax-exempt status and to comply with federal laws. Failure to file the form correctly or on time can result in penalties, including fines or loss of tax-exempt status. It is essential for foundation officials to understand their legal obligations and ensure that the form is used appropriately in accordance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Pf Instruction Form are crucial for compliance. Typically, the form must be submitted by the fifteenth day of the fifth month after the end of the foundation's fiscal year. For example, if a foundation's fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. Extensions may be available, but it is important to file for an extension before the original deadline. Staying aware of these important dates helps foundations avoid penalties and maintain compliance with IRS regulations.

Who Issues the Form

The 990 Pf Instruction Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides the form along with detailed instructions on how to complete it, ensuring that private foundations can accurately report their financial activities. Understanding the role of the IRS in the issuance and regulation of this form is essential for foundation administrators and board members.

Penalties for Non-Compliance

Non-compliance with the requirements of the 990 Pf Instruction Form can lead to significant penalties. Foundations that fail to file the form on time may incur fines, which can accumulate over time. Additionally, if a foundation consistently fails to comply with filing requirements, it risks losing its tax-exempt status. It is vital for foundation officials to understand these potential consequences and prioritize timely and accurate reporting to avoid legal and financial repercussions.

Quick guide on how to complete 990 pf instruction 2011 form

Prepare 990 Pf Instruction Form effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your paperwork quickly without delays. Manage 990 Pf Instruction Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign 990 Pf Instruction Form with minimal effort

- Locate 990 Pf Instruction Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information once more and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 990 Pf Instruction Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 pf instruction 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 990 pf instruction 2011 form

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the 990 Pf Instruction Form and why is it important?

The 990 Pf Instruction Form is a crucial document for organizations required to submit their financial information to the IRS. It provides essential guidelines on how to prepare and file Form 990-PF accurately, ensuring compliance with federal regulations. Understanding the 990 Pf Instruction Form helps non-profit organizations maintain transparency and accountability.

-

How can airSlate SignNow assist with the 990 Pf Instruction Form?

airSlate SignNow simplifies the process of filling out and signing the 990 Pf Instruction Form by providing a user-friendly interface for document management. With features like eSignature and document sharing, organizations can efficiently complete their forms and ensure secure submissions. This streamlines compliance and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for the 990 Pf Instruction Form?

Yes, airSlate SignNow offers a range of pricing plans tailored to suit various organizational needs. These plans ensure that you can efficiently manage documents like the 990 Pf Instruction Form without breaking your budget. Each plan includes features designed to enhance productivity while calling attention to compliance requirements.

-

What features does airSlate SignNow provide for the 990 Pf Instruction Form?

airSlate SignNow offers robust features including customizable templates, eSignatures, and secure document management specifically for the 990 Pf Instruction Form. These features are designed to enhance collaboration, improve accuracy, and ensure that your forms are filed on time. Additionally, the platform integrates easily with other tools for smooth workflow management.

-

Can airSlate SignNow help with electronic filing of the 990 Pf Instruction Form?

While airSlate SignNow facilitates the eSignature process, it does not file the 990 Pf Instruction Form electronically for you. However, it provides a seamless way to prepare, sign, and share the document digitally, ensuring that you are well-prepared for submission. Use it to enhance your filing process and ensure quick compliance.

-

What are the benefits of using airSlate SignNow for managing the 990 Pf Instruction Form?

Using airSlate SignNow for your 990 Pf Instruction Form management streamlines the document workflow, saves time, and minimizes the risk of errors. You can collaborate with team members in real-time, receive notifications, and access audit trails for transparency. This ultimately leads to a more efficient filing experience.

-

Is training available for using airSlate SignNow with the 990 Pf Instruction Form?

Yes, airSlate SignNow provides comprehensive training resources to assist users in mastering the platform, especially for documents like the 990 Pf Instruction Form. Access tutorials, webinars, and support documentation to ensure you are confident in navigating the system. Enhanced knowledge will help optimize your document workflow and compliance efforts.

Get more for 990 Pf Instruction Form

- Name affidavit of buyer hawaii form

- Name affidavit of seller hawaii form

- Non foreign affidavit under irc 1445 hawaii form

- Owners or sellers affidavit of no liens hawaii form

- Affidavit of occupancy and financial status hawaii form

- Complex will with credit shelter marital trust for large estates hawaii form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497304555 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497304556 form

Find out other 990 Pf Instruction Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors