Form 1041 Instructions 2013

What is the Form 1041 Instructions

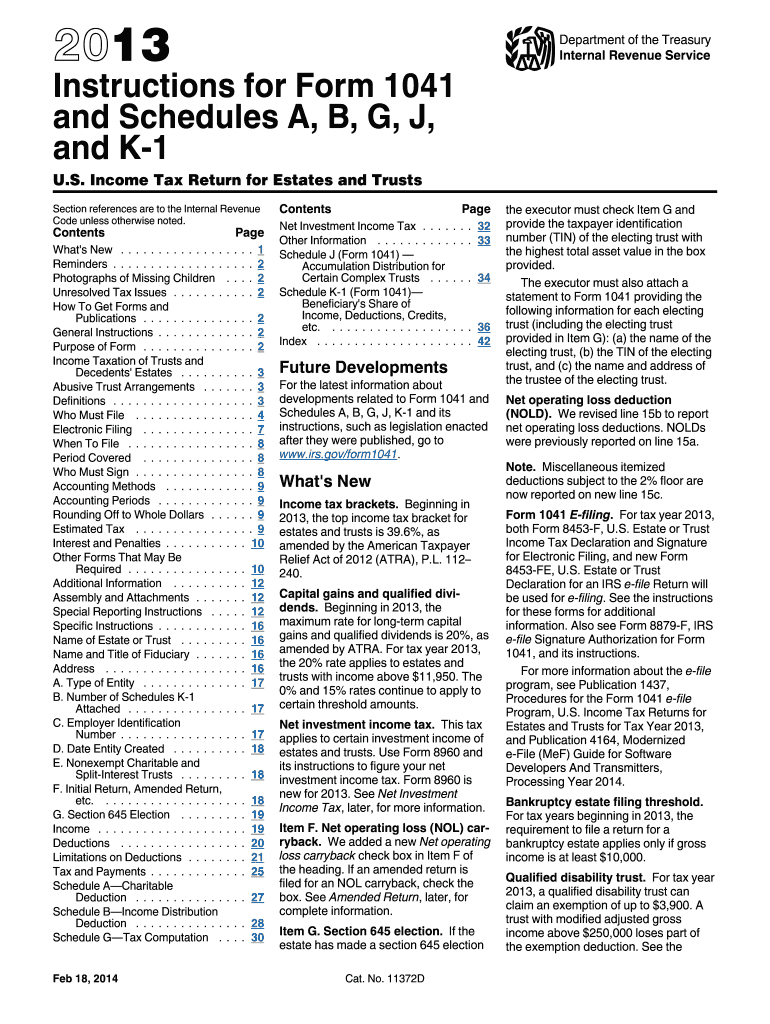

The Form 1041 Instructions provide detailed guidance for fiduciaries on how to complete the U.S. Income Tax Return for Estates and Trusts. This form is essential for reporting income, deductions, gains, and losses for estates or trusts that are required to file an income tax return. The instructions outline the eligibility criteria, required documentation, and specific line-by-line guidance to ensure accurate completion. Understanding these instructions is crucial for compliance with IRS regulations and to avoid potential penalties.

Steps to complete the Form 1041 Instructions

Completing the Form 1041 requires careful attention to detail. Here are the key steps:

- Gather necessary documents, including prior year tax returns, income statements, and expense records.

- Determine the filing status of the estate or trust, which affects tax rates and deductions.

- Complete the identification section, including the name, address, and taxpayer identification number of the estate or trust.

- Report income on the appropriate lines, ensuring all sources of income are included.

- Deduct allowable expenses, such as administrative costs, to calculate the taxable income.

- Review the instructions for any special considerations, such as distributions to beneficiaries.

- Sign and date the form before submitting it to the IRS.

Legal use of the Form 1041 Instructions

The legal use of the Form 1041 Instructions is critical for fiduciaries managing estates and trusts. These instructions ensure that the form is completed in compliance with IRS regulations, which helps avoid legal complications. Properly following these guidelines ensures that the fiduciary fulfills their legal obligations and protects the interests of the beneficiaries. Additionally, adherence to these instructions can safeguard against audits and penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 are crucial for compliance. Typically, the return is due on the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the Form 1041, several documents are necessary. These include:

- Prior year tax returns for the estate or trust.

- Income statements, such as K-1 forms from partnerships or S corporations.

- Records of expenses incurred during the tax year.

- Documentation of distributions made to beneficiaries.

- Any applicable schedules or forms related to deductions.

Having these documents ready will streamline the process of completing the form and ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Form 1041 can be submitted through various methods. Taxpayers can file electronically using IRS-approved software, which often simplifies the process and reduces errors. Alternatively, the form can be mailed to the appropriate IRS address based on the estate's or trust's location. In-person submission is generally not available for this form, but taxpayers can consult with tax professionals for assistance. Choosing the right submission method can enhance the efficiency of the filing process.

Quick guide on how to complete 2013 form 1041 instructions

Effortlessly prepare Form 1041 Instructions on any device

Digital document management has gained traction among both organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your files quickly and without delays. Handle Form 1041 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Form 1041 Instructions with ease

- Find Form 1041 Instructions and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize necessary sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow covers all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1041 Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1041 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1041 instructions

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What are the key features of airSlate SignNow for managing Form 1041 Instructions?

airSlate SignNow offers a user-friendly interface that simplifies the process of completing and signing Form 1041 Instructions. With features like document templates, cloud storage, and secure eSignatures, users can efficiently manage their tax forms. Additionally, the platform provides real-time tracking and reminders to ensure that you never miss a deadline.

-

How does airSlate SignNow help with the eSigning of Form 1041 Instructions?

With airSlate SignNow, eSigning Form 1041 Instructions is quick and secure. Users can easily upload their forms and invite others to sign electronically, eliminating the need for printing and scanning. This streamlines the process, saving time and reducing the risk of errors.

-

What is the pricing structure for using airSlate SignNow for Form 1041 Instructions?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it an affordable choice for managing Form 1041 Instructions. Plans typically include a range of features, from basic eSigning to advanced options with integrations and enhanced security. You can choose the plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software to manage Form 1041 Instructions?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, enhancing your workflow when handling Form 1041 Instructions. Whether you use accounting software, CRMs, or document management systems, these integrations allow you to streamline data transfer and improve efficiency.

-

What benefits does airSlate SignNow provide for businesses handling Form 1041 Instructions?

Using airSlate SignNow for Form 1041 Instructions provides signNow benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform enables teams to collaborate on forms in real-time, ensuring faster completion and fewer mistakes. Plus, the security measures in place protect sensitive information throughout the signing process.

-

Is airSlate SignNow compliant with tax regulations when it comes to Form 1041 Instructions?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, ensuring that your Form 1041 Instructions are processed in accordance with tax laws. The platform uses secure encryption and authentication methods to maintain compliance and protect user data.

-

How can I get support for using airSlate SignNow with Form 1041 Instructions?

airSlate SignNow provides excellent customer support to assist users with any questions regarding Form 1041 Instructions. You can access resources such as FAQs, tutorials, and live chat assistance to get help whenever you need it. This ensures that you can maximize the platform's features effectively.

Get more for Form 1041 Instructions

- Bmi form

- American legion baseball state winner form

- Nomination form borang penamaan allianzcommy

- Participant approval formssierra club outings

- Remote training agreement form

- European organisation for astronomical research in the southern hemisphere eso form

- Request for involuntary distribution form

- Kofc rsvp form

Find out other Form 1041 Instructions

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe