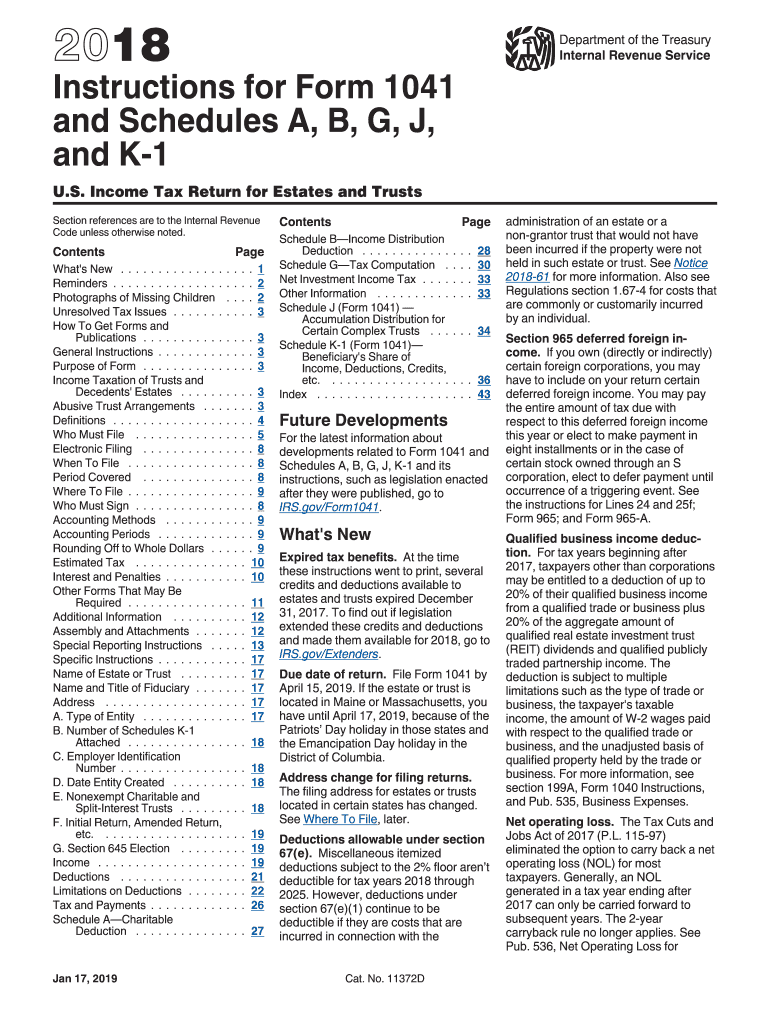

1041 Instructions for 2018

What is the 1041 Instructions For

The 1041 instructions provide guidance for fiduciaries in preparing and filing Form 1041, which is used to report income, deductions, gains, and losses of estates and trusts. This form is essential for ensuring that the income generated by the estate or trust is reported accurately to the IRS. The instructions outline the necessary information required, including details about beneficiaries, income sources, and allowable deductions. Understanding these instructions is crucial for compliance with federal tax regulations.

Steps to complete the 1041 Instructions For

Completing the 1041 instructions involves several key steps. First, gather all necessary financial information regarding the estate or trust, including income statements, expense records, and details about distributions to beneficiaries. Next, carefully fill out the form, ensuring that all required fields are completed accurately. Pay particular attention to the sections regarding income and deductions, as these can significantly impact the tax liability. After completing the form, review it thoroughly for any errors or omissions before submitting it to the IRS.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with Form 1041. Generally, the form must be filed by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year basis, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Timely filing is crucial to avoid penalties and interest on any taxes owed.

Required Documents

When preparing to file Form 1041, certain documents are essential. These include the estate or trust's financial statements, records of income received, and documentation of any deductions claimed. Additionally, information regarding distributions to beneficiaries must be collected, including Form K-1 for each beneficiary, which reports their share of the income. Having these documents organized and readily available will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Form 1041 can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software, which can streamline the process and reduce the likelihood of errors. Alternatively, the form can be mailed to the appropriate IRS address based on the estate's or trust's location. In-person submission is generally not an option for Form 1041, as the IRS does not accept walk-in filings for this form. It is important to follow the submission guidelines to ensure proper processing.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1041. These guidelines include detailed instructions on what constitutes taxable income, allowable deductions, and the treatment of distributions to beneficiaries. It is essential to consult the latest IRS publications and resources to stay informed about any changes to tax laws or filing requirements. Adhering to these guidelines will help ensure compliance and minimize the risk of audits or penalties.

Quick guide on how to complete 1041 instructions 2018 2019 form

Explore the easiest method to complete and sign your 1041 Instructions For

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to fill out and sign your 1041 Instructions For and related forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle paperwork swiftly and in compliance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools are all readily available in an intuitive interface.

Only a few steps are required to complete and sign your 1041 Instructions For:

- Upload the editable template to the editor using the Get Form button.

- Review what information is needed in your 1041 Instructions For.

- Navigate through the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal areas that are no longer relevant.

- Press Sign to create a legally binding electronic signature using any method you prefer.

- Insert the Date beside your signature and conclude your task with the Done button.

Store your completed 1041 Instructions For in the Documents folder in your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile file sharing options. There's no need to print your templates when you can submit them to the relevant public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1041 instructions 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the 1041 instructions 2018 2019 form

How to generate an eSignature for your 1041 Instructions 2018 2019 Form in the online mode

How to make an electronic signature for the 1041 Instructions 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the 1041 Instructions 2018 2019 Form in Gmail

How to create an electronic signature for the 1041 Instructions 2018 2019 Form straight from your smart phone

How to make an electronic signature for the 1041 Instructions 2018 2019 Form on iOS devices

How to create an electronic signature for the 1041 Instructions 2018 2019 Form on Android devices

People also ask

-

What are the 1041 Instructions For eSigning documents with airSlate SignNow?

The 1041 Instructions For eSigning documents with airSlate SignNow are designed to streamline the process of signing tax forms electronically. With our platform, you can easily upload your 1041 tax forms, add signature fields, and send them to clients or partners for quick signing, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for 1041 Instructions For eSigning?

Pricing for airSlate SignNow is competitively designed to accommodate various business sizes. While the exact cost can vary based on your specific needs and chosen plan, we offer flexible subscription options that make it affordable for businesses looking for efficient 1041 Instructions For eSigning solutions.

-

What features does airSlate SignNow offer for 1041 Instructions For tax documents?

AirSlate SignNow provides a range of robust features for 1041 Instructions For tax documents, including customizable templates, reusable signature fields, and real-time tracking of document status. These features enhance your workflow, ensuring that you can manage your tax documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for 1041 Instructions For tax submissions?

Yes, airSlate SignNow offers seamless integrations with many popular software applications, making it easy to handle 1041 Instructions For tax submissions. You can connect with platforms like Google Drive, Dropbox, and Zapier to streamline your document management process.

-

Is airSlate SignNow compliant with regulations for 1041 Instructions For eSigning?

Absolutely! AirSlate SignNow is fully compliant with eSignature laws such as the ESIGN Act and UETA, ensuring that your 1041 Instructions For eSigning process meets all legal requirements. This compliance guarantees the integrity and validity of your signed documents.

-

What are the benefits of using airSlate SignNow for 1041 Instructions For tax forms?

Using airSlate SignNow for 1041 Instructions For tax forms brings numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows for quick and easy eSigning, which can signNowly speed up the tax filing process and improve overall productivity.

-

Does airSlate SignNow provide support for 1041 Instructions For new users?

Yes, airSlate SignNow offers comprehensive support for new users navigating 1041 Instructions For eSigning. Our support team is available to assist with any questions or issues, and we provide a variety of resources, including tutorials and guides, to help you get started.

Get more for 1041 Instructions For

- Applicationredetermination for elderly and disabled programs form

- Ct patient screening form part a

- The age of jackson chapter 7 section 3 form

- Copy of contract of residency synergy sober living form

- Dcff2742 e child care authorization worksheetdoc dcf wisconsin form

- Pmc msa requirements and application northern california form

- Songwriter agreement template form

- Songwriter split agreement template form

Find out other 1041 Instructions For

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure