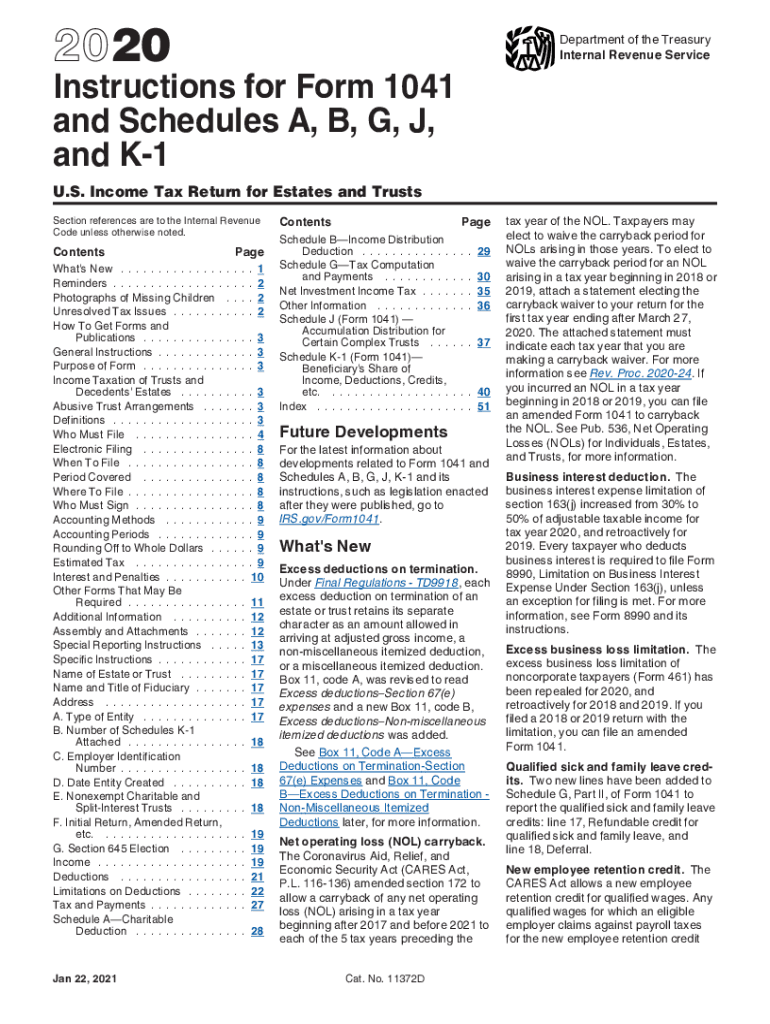

Instructions for Form 1041 and Schedules A, B, G, J, and K 1 Instructions for Form 1041 and Schedules A, B, G, J, and K 1, U S I 2020

Understanding Form 1041 and Its Instructions

The IRS Form 1041 is used for reporting income, deductions, gains, and losses of estates and trusts. The instructions for Form 1041 guide taxpayers through the process of completing the form accurately. This includes details on how to report income received by the estate or trust, as well as deductions that may be claimed. Understanding these instructions is crucial for ensuring compliance with federal tax laws.

Steps to Complete Form 1041 Instructions

Completing the instructions for Form 1041 involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Complete the necessary sections of Form 1041, ensuring that all income and deductions are accurately reported.

- Review the instructions for any specific schedules that may need to be filed along with Form 1041, such as Schedules A, B, G, J, and K-1.

- Ensure that all information is complete and accurate before submission.

Key Elements of Form 1041 Instructions

The instructions for Form 1041 highlight several critical elements that must be addressed:

- Filing Status: Identify whether the estate or trust is a simple or complex entity.

- Income Reporting: Understand how to report various types of income, including dividends, interest, and capital gains.

- Deductions: Learn about allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Tax Computation: Follow guidelines for calculating the tax owed based on the net income of the estate or trust.

Legal Use of Form 1041 Instructions

Using the Form 1041 instructions correctly is essential for legal compliance. The IRS requires that all information reported on the form be truthful and accurate. Misrepresentation or errors can lead to penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the completion of the form.

Obtaining Form 1041 Instructions

The instructions for Form 1041 can be obtained directly from the IRS website or through tax preparation software. It is important to ensure that you are using the most current version of the instructions to comply with any recent changes in tax law. Additionally, printed copies may be available at local IRS offices or through tax professionals.

Filing Deadlines for Form 1041

Timely filing of Form 1041 is crucial to avoid penalties. The due date for Form 1041 is typically the fifteenth day of the fourth month following the close of the estate's or trust's tax year. For estates, this means that if the estate's tax year ends on December 31, the form is due by April 15 of the following year. Extensions may be available, but they must be filed properly to avoid late fees.

Quick guide on how to complete 2020 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

Prepare Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers a remarkable eco-friendly alternative to conventional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest method to modify and eSign Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I without hassle

- Find Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional written signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I while ensuring outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What are the IRS forms 1041 instructions?

IRS forms 1041 instructions provide guidance on how to properly fill out the form used for income tax return for estates and trusts. These instructions detail the necessary information required, such as income reporting and deductions applicable for the tax year. Familiarizing yourself with these instructions can greatly ease the filing process.

-

How can airSlate SignNow help with filing IRS forms 1041?

AirSlate SignNow simplifies the process of collecting the necessary signatures on IRS forms 1041. By leveraging our easy-to-use eSignature features, you can quickly send and receive signed documents without the hassle of printing and scanning. This streamlines your workflow and ensures compliance with the IRS requirements.

-

Are there any fees associated with using airSlate SignNow for IRS forms 1041?

While airSlate SignNow offers a variety of pricing plans, it is generally considered a cost-effective solution for handling IRS forms 1041. Users can choose from different subscription levels based on their business needs. The investment can lead to signNow time savings and efficiency when managing your tax documents.

-

What features does airSlate SignNow offer for IRS forms 1041?

AirSlate SignNow provides essential features such as customizable templates, secure eSigning, and automated reminders to help you manage IRS forms 1041 effectively. Users can also track document status and receive notifications when forms are signed, ensuring a smooth and efficient process. These features help maintain compliance and enhance productivity.

-

Can I integrate airSlate SignNow with other software platforms for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, enhancing your ability to manage IRS forms 1041. This integration allows for easy access to documents and can streamline the overall filing process. By utilizing these connections, you can enhance your productivity and accuracy when dealing with tax documents.

-

Is there customer support available for questions about IRS forms 1041?

Absolutely! airSlate SignNow provides customer support to help you with any questions regarding IRS forms 1041 instructions and the document management process. You can access support through multiple channels, which ensures that you have the assistance needed to navigate your tasks effectively.

-

What are the benefits of using airSlate SignNow for IRS forms 1041?

Using airSlate SignNow for IRS forms 1041 can signNowly reduce the time and effort spent on document management. The platform's ease of use and automation features help streamline workflows and minimize errors, thus promoting compliance with tax regulations. Ultimately, this leads to a more efficient tax filing experience.

Get more for Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I

Find out other Instructions For Form 1041 And Schedules A, B, G, J, And K 1 Instructions For Form 1041 And Schedules A, B, G, J, And K 1, U S I

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter