Irs Form 1041irs Forms 2011

What is the IRS Form 1041?

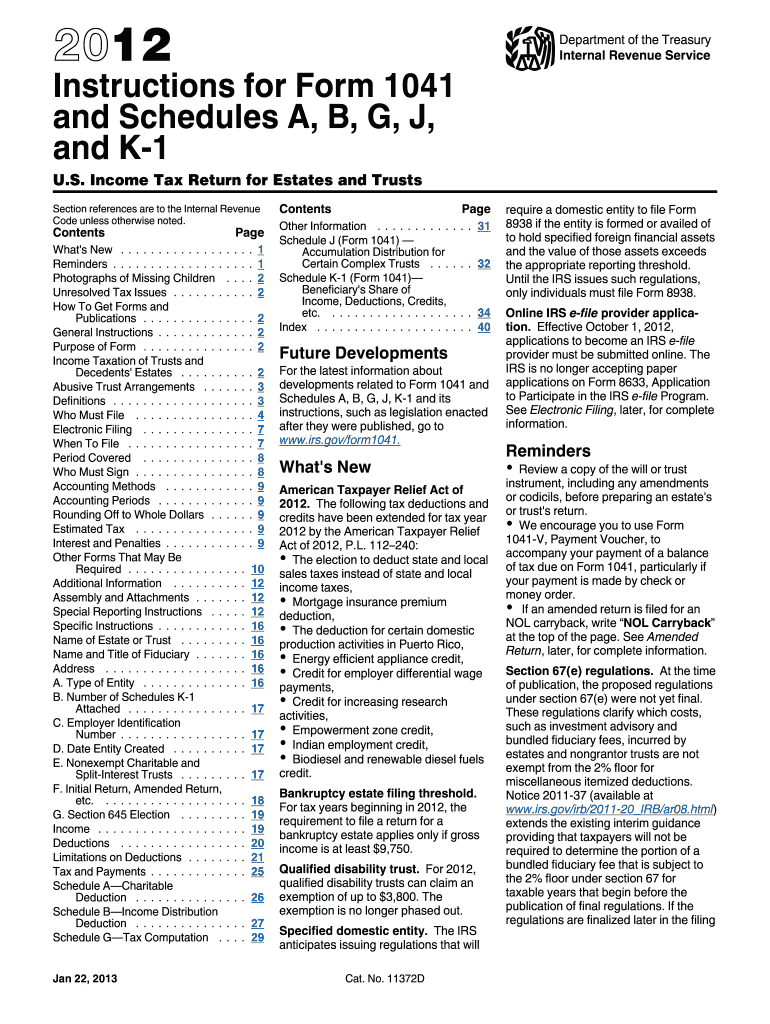

The IRS Form 1041 is a tax return used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries who manage the financial affairs of estates or trusts. It enables them to report the income generated by the estate or trust and to determine the tax liability. The form must be filed annually, and it is crucial for ensuring compliance with federal tax regulations.

How to Use the IRS Form 1041

Using the IRS Form 1041 involves several steps to ensure accurate reporting of income and expenses. First, gather all relevant financial documents, including income statements, receipts for deductions, and any other pertinent information related to the estate or trust. Next, fill out the form by providing detailed information about the estate or trust, including its name, address, and taxpayer identification number. Be sure to report all income accurately and claim any allowable deductions to minimize tax liability. Finally, review the completed form for accuracy before submission.

Steps to Complete the IRS Form 1041

Completing the IRS Form 1041 requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather necessary documentation, including financial statements and tax records.

- Complete the identification section, including the name and address of the estate or trust.

- Report all income earned by the estate or trust, such as interest, dividends, and rental income.

- List allowable deductions, which may include administrative expenses and distributions to beneficiaries.

- Calculate the total income and deductions to determine the taxable income.

- Sign and date the form, ensuring that it is filed by the deadline.

Legal Use of the IRS Form 1041

The IRS Form 1041 is legally binding when completed and submitted according to IRS guidelines. It must be filed by the fiduciary responsible for managing the estate or trust. The information reported must be accurate and truthful, as inaccuracies can lead to penalties or legal repercussions. Compliance with tax laws is essential to avoid issues with the IRS, including audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1041 are critical for compliance. The form is typically due on the fifteenth day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Extensions may be available, but they must be requested before the original deadline.

Form Submission Methods

The IRS Form 1041 can be submitted using various methods, including:

- Online filing through approved tax software that supports e-filing.

- Mailing a paper copy to the appropriate IRS address based on the estate's or trust's location.

- In-person submission at designated IRS offices, although this option may be limited.

Quick guide on how to complete 2011 irs form 1041irs forms

Effortlessly Prepare Irs Form 1041irs Forms on Any Device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Irs Form 1041irs Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Irs Form 1041irs Forms with Ease

- Find Irs Form 1041irs Forms and then click Access Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and then click the Finish button to save your modifications.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Irs Form 1041irs Forms to ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 irs form 1041irs forms

Create this form in 5 minutes!

How to create an eSignature for the 2011 irs form 1041irs forms

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the purpose of Irs Form 1041irs Forms?

Irs Form 1041irs Forms are used for income tax returns for estates and trusts. They help ensure compliance with federal tax regulations, allowing you to report income earned by the estate or trust. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help me manage Irs Form 1041irs Forms?

airSlate SignNow provides an efficient platform to send, sign, and manage Irs Form 1041irs Forms digitally. With its user-friendly interface, you can easily prepare and eSign your documents, enhancing the overall efficiency of the filing process. Our solution also saves time and reduces errors associated with paper filing.

-

What features does airSlate SignNow offer for processing Irs Form 1041irs Forms?

Key features include document templates, automated workflows, and secure cloud storage that streamline the management of Irs Form 1041irs Forms. You can also track document status and get real-time notifications to stay updated. These features allow for a smoother and more efficient filing experience.

-

Is airSlate SignNow cost-effective for handling Irs Form 1041irs Forms?

Yes, airSlate SignNow offers a variety of pricing plans designed to meet diverse business needs, making it a cost-effective option for handling Irs Form 1041irs Forms. With features that enhance productivity and accuracy, the investment pays off quickly. You can choose a plan that best fits your organization's size and requirements.

-

Can I integrate airSlate SignNow with other software for Irs Form 1041irs Forms?

Absolutely! airSlate SignNow can be integrated with various accounting and tax software, facilitating the easy exchange of data for Irs Form 1041irs Forms. This integration helps automate workflows and reduces manual entry, further streamlining your tax preparation process.

-

What are the benefits of eSigning Irs Form 1041irs Forms with airSlate SignNow?

eSigning Irs Form 1041irs Forms with airSlate SignNow offers signNow benefits, including enhanced security and faster processing times. Electronic signatures are legally binding, allowing you to maintain compliance while expediting the approval process. Plus, you can sign documents from anywhere, reducing the need for in-person meetings.

-

How does airSlate SignNow ensure the security of my Irs Form 1041irs Forms?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption and authentication protocols to protect your Irs Form 1041irs Forms. Additionally, our platform complies with major data protection regulations, ensuring your sensitive information is safe and secure throughout the signing process.

Get more for Irs Form 1041irs Forms

- Minutes for organizational meeting iowa iowa form

- Sample transmittal letter to secretary of states office to file articles of incorporation iowa iowa form

- Js 44 civil cover sheet federal district court iowa form

- Lead based paint disclosure for sales transaction iowa form

- Lead based paint disclosure for rental transaction iowa form

- Notice of lease for recording iowa form

- Sample cover letter for filing of llc articles or certificate with secretary of state iowa form

- Supplemental residential lease forms package iowa

Find out other Irs Form 1041irs Forms

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney