Form 4952 2017

What is the Form 4952

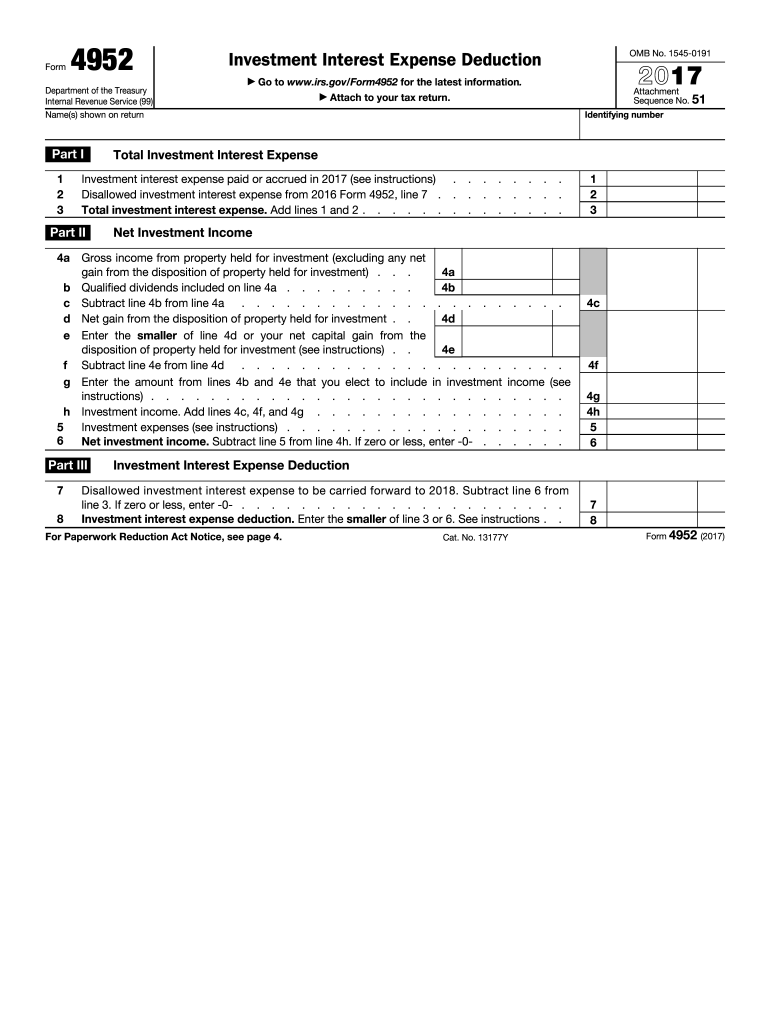

The Form 4952 is a tax form used by individuals to calculate the amount of investment interest expense that can be deducted on their federal tax return. This form is particularly relevant for taxpayers who have incurred interest expenses related to investments, such as margin loans or other borrowing used to purchase investment property. By completing this form, taxpayers can determine the deductible amount of their investment interest expense, which can help reduce their overall taxable income.

How to use the Form 4952

To effectively use the Form 4952, taxpayers must first gather all relevant information regarding their investment interest expenses. This includes details about the loans taken out for investments and the income generated from those investments. The form requires specific calculations to determine the allowable deduction, which involves comparing the investment interest expense to the net investment income. After completing the calculations, taxpayers will report the deductible amount on their tax return, typically on Schedule A.

Steps to complete the Form 4952

Completing the Form 4952 involves several key steps:

- Gather Information: Collect all necessary documentation regarding investment interest expenses and net investment income.

- Fill Out the Form: Enter the investment interest expense and net investment income in the appropriate sections of the form.

- Calculate the Deduction: Use the provided calculations to determine the allowable deduction based on the figures entered.

- Transfer the Deduction: Report the calculated deduction on your tax return, typically on Schedule A.

Legal use of the Form 4952

The legal use of Form 4952 requires taxpayers to follow IRS guidelines regarding the deduction of investment interest expenses. It is essential to ensure that all information provided on the form is accurate and complete. Taxpayers must only claim deductions for expenses that are legitimately incurred in relation to their investments. Failure to comply with IRS regulations can lead to penalties or audits, so it is crucial to maintain proper records and documentation supporting the claims made on the form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 4952. Typically, the form is due on the same date as the individual's federal income tax return. For most taxpayers, this is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website for any updates or changes to these deadlines.

Form Submission Methods (Online / Mail / In-Person)

Form 4952 can be submitted through various methods, depending on the taxpayer's preference and circumstances. The form can be filed electronically using tax preparation software that supports IRS e-filing. Alternatively, taxpayers may choose to print the completed form and mail it to the IRS along with their tax return. In-person submission is generally not an option for this form, as it is primarily handled through electronic or postal channels.

Quick guide on how to complete form 4952 2017

Uncover the easiest method to complete and endorse your Form 4952

Are you still spending time preparing your official documents on paper instead of doing so online? airSlate SignNow offers a superior approach to complete and endorse your Form 4952 and related forms for public services. Our intelligent eSignature solution provides you with everything necessary to handle paperwork swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools all readily accessible through a user-friendly interface.

Only a few steps are needed to fill out and endorse your Form 4952:

- Upload the fillable template to the editor using the Get Form button.

- Review the information you must provide in your Form 4952.

- Move between the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your data.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Redact fields that are no longer relevant.

- Select Sign to generate a legally enforceable eSignature using your chosen method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed Form 4952 in the Documents section of your profile, download it, or export it to your chosen cloud storage. Our solution also allows flexible file sharing. There's no need to print your forms when submitting them to the appropriate public office - do it using email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 4952 2017

Create this form in 5 minutes!

How to create an eSignature for the form 4952 2017

How to generate an eSignature for the Form 4952 2017 online

How to create an eSignature for the Form 4952 2017 in Google Chrome

How to make an eSignature for signing the Form 4952 2017 in Gmail

How to generate an eSignature for the Form 4952 2017 right from your smart phone

How to create an electronic signature for the Form 4952 2017 on iOS devices

How to make an eSignature for the Form 4952 2017 on Android devices

People also ask

-

What is Form 4952 and how can airSlate SignNow help with it?

Form 4952 is used for calculating the amount of investment interest expense that can be deducted. airSlate SignNow can streamline the process by allowing you to easily send, eSign, and manage your Form 4952 documents securely, ensuring compliance and accuracy.

-

How much does it cost to use airSlate SignNow for Form 4952?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including features specifically designed for handling Form 4952. You can choose from several tiers, ensuring that you get the right tools for eSigning documents at an affordable rate.

-

What features does airSlate SignNow provide for managing Form 4952?

airSlate SignNow offers a variety of features to assist with Form 4952, including customizable templates, secure eSigning, and document tracking. These features ensure your forms are completed efficiently and in compliance with IRS regulations.

-

Can airSlate SignNow integrate with other software for managing Form 4952?

Yes, airSlate SignNow supports a range of integrations with popular applications, allowing you to streamline your workflow while managing Form 4952. Whether it's accounting software or document management systems, you can enhance your productivity effortlessly.

-

Is it easy to eSign Form 4952 using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes eSigning Form 4952 a simple task. With just a few clicks, you can sign your documents digitally and send them securely, saving you time and hassle.

-

What are the benefits of using airSlate SignNow for Form 4952?

The benefits of using airSlate SignNow for Form 4952 include increased efficiency, enhanced security, and improved compliance with tax regulations. This platform simplifies the eSignature process, ensuring that your forms are processed quickly and accurately.

-

How secure is airSlate SignNow when handling sensitive documents like Form 4952?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. Your Form 4952 and other sensitive documents are protected throughout the eSigning process, giving you peace of mind.

Get more for Form 4952

- Victim statement template form

- Subdivision development application form burwood council burwood nsw gov

- Msu digital login form

- Getting a bee certficate from nyda form

- In the matter of irene m dol form

- Trs publications form

- State department deto agreement template form

- State prenuptial agreement template form

Find out other Form 4952

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later