Irs Form 4952 PDF Download 2016

What is the IRS Form 4952 PDF Download

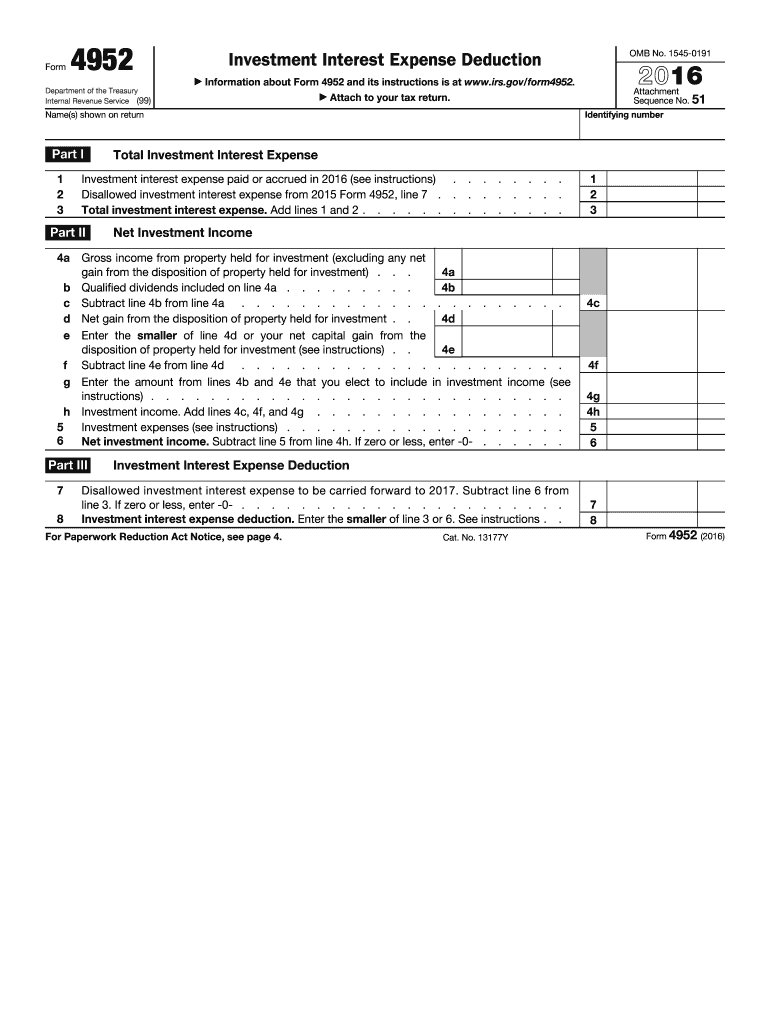

The IRS Form 4952 is used to calculate the amount of investment interest expense that can be deducted on your tax return. This form is essential for taxpayers who have incurred interest expenses related to investments, such as margin interest on stock purchases or interest on loans used to acquire investment property. The form helps ensure that taxpayers accurately report their allowable deductions, which can ultimately affect their overall tax liability.

How to Obtain the IRS Form 4952 PDF Download

To obtain the IRS Form 4952 PDF, you can visit the official IRS website, where the form is readily available for download. The form can be found in the forms and publications section, allowing you to access the most current version. It is essential to ensure that you are using the latest form to comply with tax regulations. Additionally, many tax preparation software programs may include this form, providing a convenient option for those who prefer digital filing.

Steps to Complete the IRS Form 4952 PDF Download

Completing the IRS Form 4952 involves several steps:

- Gather necessary information: Collect all relevant financial documents, including interest expense statements and investment income records.

- Fill out the form: Start with your personal information, followed by the details of your investment interest expenses and income.

- Calculate allowable deductions: Use the provided worksheets to determine the amount of investment interest expense that can be deducted.

- Review the form: Ensure all information is accurate and complete before submission.

- Submit the form: Include Form 4952 with your tax return when filing.

Legal Use of the IRS Form 4952 PDF Download

The IRS Form 4952 must be used in accordance with IRS guidelines to ensure its legal validity. Taxpayers should only use the form for the intended purpose of calculating investment interest expense deductions. It is important to provide accurate information and to keep records that support the figures reported on the form. Misuse or incorrect information may lead to penalties or audits by the IRS.

Key Elements of the IRS Form 4952 PDF Download

Key elements of the IRS Form 4952 include:

- Part I: This section outlines the investment interest expense and the amount that can be deducted.

- Part II: This section provides a summary of investment income, which is essential for calculating the allowable deduction.

- Worksheets: The form includes worksheets to assist taxpayers in determining their investment interest expense limits and carryovers from previous years.

Form Submission Methods

Taxpayers can submit the IRS Form 4952 through various methods, including:

- Online: If e-filing your tax return, you can submit Form 4952 electronically through approved tax software.

- Mail: You can print the completed form and include it with your paper tax return, sending it to the appropriate IRS address based on your location.

- In-Person: Some taxpayers may choose to deliver their tax returns and forms directly to their local IRS office.

Quick guide on how to complete irs form 4952 pdf download 2016

Discover the simplest method to complete and sign your Irs Form 4952 Pdf Download

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to complete and sign your Irs Form 4952 Pdf Download and associated forms for public services. Our intelligent electronic signature solution offers you all the tools needed to handle paperwork swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools readily available within an easy-to-use interface.

Only a few steps are needed to finalize the completion and signing of your Irs Form 4952 Pdf Download:

- Upload the fillable template to the editor using the Get Form button.

- Review the information required for your Irs Form 4952 Pdf Download.

- Move through the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your information.

- Modify the content using Text boxes or Images found in the top toolbar.

- Emphasize what is important or Mask sections that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any preferred method.

- Add the Date alongside your signature and complete your task with the Done button.

Store your completed Irs Form 4952 Pdf Download in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our service also provides adaptable form sharing options. There's no need to print your forms when submitting them to the relevant public office - do it via email, fax, or by requesting USPS delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 4952 pdf download 2016

FAQs

-

What service can I use to have a website visitor fill out a form, put the data in the form into a prewritten PDF, then charge the visitor to download the PDF with the data provided filled in?

You can use signNow to set up PDF templates, which can be filled out with an online form. signNow doesn’t support charging people to download the PDF, but you could use Stripe for this (would require some programming.)

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

Create this form in 5 minutes!

How to create an eSignature for the irs form 4952 pdf download 2016

How to generate an electronic signature for your Irs Form 4952 Pdf Download 2016 online

How to generate an eSignature for the Irs Form 4952 Pdf Download 2016 in Google Chrome

How to make an eSignature for signing the Irs Form 4952 Pdf Download 2016 in Gmail

How to make an electronic signature for the Irs Form 4952 Pdf Download 2016 straight from your mobile device

How to make an eSignature for the Irs Form 4952 Pdf Download 2016 on iOS

How to generate an electronic signature for the Irs Form 4952 Pdf Download 2016 on Android OS

People also ask

-

What is the Irs Form 4952 Pdf Download and why is it important?

The Irs Form 4952 Pdf Download is a crucial document for taxpayers who need to report investment interest expenses. It helps in calculating the allowable deduction for these expenses, ensuring compliance with IRS regulations. Having easy access to this form can streamline your tax filing process and potentially maximize your deductions.

-

How can I obtain the Irs Form 4952 Pdf Download from airSlate SignNow?

You can easily obtain the Irs Form 4952 Pdf Download by visiting our landing page and accessing the document section. Simply click on the download link to get the PDF directly to your device. This ensures you have the latest version of the form for your tax documentation needs.

-

Is airSlate SignNow suitable for businesses needing to eSign the Irs Form 4952?

Absolutely! airSlate SignNow is designed for businesses that require efficient document signing solutions. With our platform, you can easily eSign the Irs Form 4952 Pdf Download, ensuring a secure and legally binding process while saving time and eliminating paper waste.

-

What features does airSlate SignNow offer for managing tax documents like the Irs Form 4952?

Our platform provides features such as document templates, eSignature capabilities, and secure cloud storage. This means you can prepare, sign, and store the Irs Form 4952 Pdf Download all in one place. Moreover, our user-friendly interface makes navigating through your tax documents easier than ever.

-

Can I integrate airSlate SignNow with other accounting software for managing the Irs Form 4952?

Yes, airSlate SignNow offers integrations with popular accounting software platforms, enhancing your ability to manage the Irs Form 4952 Pdf Download. This seamless integration allows for better workflow efficiency and helps keep your financial documents organized without switching between multiple tools.

-

What are the pricing options for using airSlate SignNow to manage my tax forms like the Irs Form 4952?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it a cost-effective solution for managing tax forms like the Irs Form 4952 Pdf Download. You can choose from monthly or annual plans, ensuring you have access to our features without breaking the bank. Check our website for detailed pricing information.

-

How does using airSlate SignNow benefit my business when dealing with the Irs Form 4952?

Utilizing airSlate SignNow for your Irs Form 4952 Pdf Download not only speeds up the signing process but also enhances security and compliance. Our platform ensures that all signed documents are securely stored and easily accessible for later review or audit. This signNowly reduces the hassle of traditional paperwork.

Get more for Irs Form 4952 Pdf Download

Find out other Irs Form 4952 Pdf Download

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding