Investment Interest Expense Deduction Internal Revenue 2020

What is the Investment Interest Expense Deduction?

The Investment Interest Expense Deduction allows taxpayers to deduct interest paid on loans used to purchase investments. This deduction is particularly relevant for individuals who borrow money to invest in stocks, bonds, or other investment properties. By claiming this deduction, taxpayers can reduce their taxable income, which may ultimately lower their overall tax liability. It's important to note that the deduction is limited to the amount of net investment income, meaning that any excess interest cannot be deducted in the current tax year but may be carried forward to future years.

Steps to Complete the Investment Interest Expense Deduction

Completing the Investment Interest Expense Deduction involves several key steps:

- Gather Documentation: Collect all relevant documents, including Form 4952, interest statements, and records of your investment income.

- Calculate Net Investment Income: Determine your total investment income, which includes interest, dividends, and capital gains.

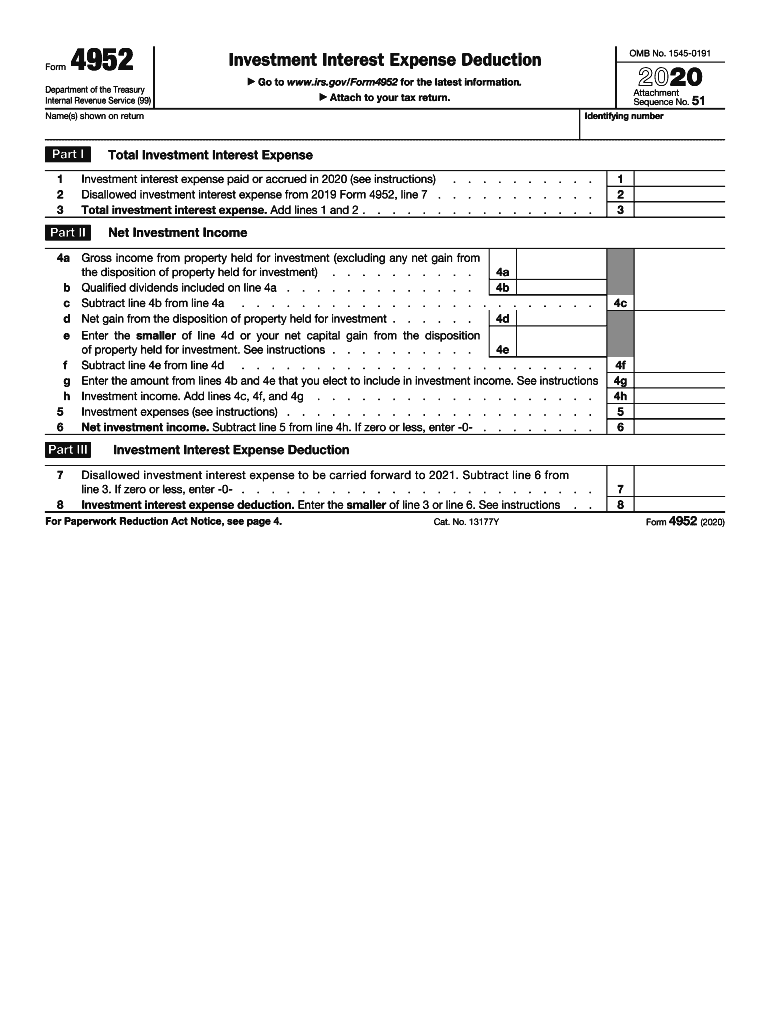

- Complete Form 4952: Fill out the form, ensuring you accurately report your investment interest expenses and net investment income.

- Transfer Information: Transfer the deduction amount from Form 4952 to your tax return, typically on Schedule A if you are itemizing deductions.

Eligibility Criteria for the Investment Interest Expense Deduction

To qualify for the Investment Interest Expense Deduction, taxpayers must meet specific criteria:

- Investment Interest Expenses: The deduction is only available for interest paid on loans used to purchase investments.

- Net Investment Income: Taxpayers can only deduct interest expenses up to the amount of their net investment income.

- Filing Status: The deduction is available to individual taxpayers, including those filing jointly or separately.

IRS Guidelines for the Investment Interest Expense Deduction

The Internal Revenue Service (IRS) provides specific guidelines regarding the Investment Interest Expense Deduction. Taxpayers must adhere to these guidelines to ensure compliance and maximize their deduction:

- Documentation: Maintain accurate records of all interest payments and investment income.

- Form Completion: Use Form 4952 to report the deduction accurately, including all required calculations.

- Limitations: Be aware of limitations on the deduction, particularly regarding net investment income and carryover provisions for excess interest expenses.

Examples of Using the Investment Interest Expense Deduction

Understanding how the Investment Interest Expense Deduction works can be clarified through examples:

- Example One: A taxpayer borrows $10,000 at a five percent interest rate to invest in stocks. If their net investment income is $1,000, they can deduct $1,000 of interest expenses on their tax return.

- Example Two: If a taxpayer incurs $2,000 in interest expenses but only has $1,500 in net investment income, they can only deduct $1,500 this year and may carry over the remaining $500 to future years.

Required Documents for the Investment Interest Expense Deduction

To successfully claim the Investment Interest Expense Deduction, taxpayers should prepare the following documents:

- Form 4952: This form must be completed to claim the deduction.

- Interest Statements: Documentation from lenders showing the amount of interest paid on investment loans.

- Investment Income Records: Statements or documents that detail all sources of investment income, including dividends and interest earned.

Form Submission Methods for the Investment Interest Expense Deduction

Taxpayers have several options for submitting their Investment Interest Expense Deduction:

- Online Filing: Many taxpayers choose to file their taxes electronically using tax software, which can streamline the process and reduce errors.

- Mail Submission: Taxpayers can also print their completed forms and mail them to the IRS, ensuring they follow the correct mailing address based on their location.

- In-Person Filing: Some individuals may prefer to file in person at local IRS offices, although this option may require an appointment.

Quick guide on how to complete investment interest expense deduction internal revenue

Complete Investment Interest Expense Deduction Internal Revenue effortlessly on any gadget

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Investment Interest Expense Deduction Internal Revenue on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and eSign Investment Interest Expense Deduction Internal Revenue easily

- Obtain Investment Interest Expense Deduction Internal Revenue and click on Get Form to initiate.

- Utilize the resources we provide to complete your form.

- Highlight essential sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Investment Interest Expense Deduction Internal Revenue to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct investment interest expense deduction internal revenue

Create this form in 5 minutes!

How to create an eSignature for the investment interest expense deduction internal revenue

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What are the form 4952 instructions for using airSlate SignNow?

The form 4952 instructions for using airSlate SignNow involve creating and managing electronic signatures with ease. First, upload your document that requires signing, and then place signature fields for your recipients. You can customize the signing order and add any necessary notes or attachments, making the process seamless and efficient.

-

How can I integrate form 4952 instructions into my workflow?

Integrating form 4952 instructions into your workflow is simple with airSlate SignNow. You can use our API to connect with your existing systems and automate the document signing process. This integration supports various platforms to ensure a smooth transition and increased productivity.

-

What pricing options are available for following form 4952 instructions?

airSlate SignNow offers flexible pricing plans to suit different needs when following form 4952 instructions. Our plans include features like unlimited signing and template creation, allowing you to choose the best option according to your usage. Check our website for detailed pricing information and special offers.

-

Are there any benefits to using airSlate SignNow for form 4952 instructions?

Using airSlate SignNow for form 4952 instructions provides numerous benefits, including enhanced security and compliance. The platform ensures that your documents are securely signed and stored, helping you meet regulatory requirements. Additionally, it's user-friendly, making it accessible for all team members.

-

What features does airSlate SignNow provide for handling form 4952 instructions?

airSlate SignNow offers a variety of features for handling form 4952 instructions, including customizable signing workflows and real-time tracking of document status. You can also save templates for frequently used forms, which streamlines the signing process. Our platform supports multi-party signing to accommodate different transaction types.

-

Can airSlate SignNow help with multiple signers for form 4952 instructions?

Yes, airSlate SignNow can efficiently manage multiple signers for form 4952 instructions. The platform allows you to define the signing order, ensuring that each signer receives the document at the right time. This feature is essential for collaborative projects that require input from various stakeholders.

-

How does eSigning with airSlate SignNow work for form 4952 instructions?

eSigning with airSlate SignNow for form 4952 instructions is straightforward. Simply upload your document, set up the necessary fields, and send it out for signing. Recipients receive an email notification, and they can sign the document electronically from any device, enhancing convenience and speed.

Get more for Investment Interest Expense Deduction Internal Revenue

- Residential or rental lease extension agreement wyoming form

- Commercial rental lease application questionnaire wyoming form

- Apartment lease rental application questionnaire wyoming form

- Residential rental lease application wyoming form

- Salary verification form for potential lease wyoming

- Landlord agreement to allow tenant alterations to premises wyoming form

- Notice of default on residential lease wyoming form

- Landlord tenant lease co signer agreement wyoming form

Find out other Investment Interest Expense Deduction Internal Revenue

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple