Form 4952 Investment Interest Expense Deduction 2022

What is the Form 4952 Investment Interest Expense Deduction

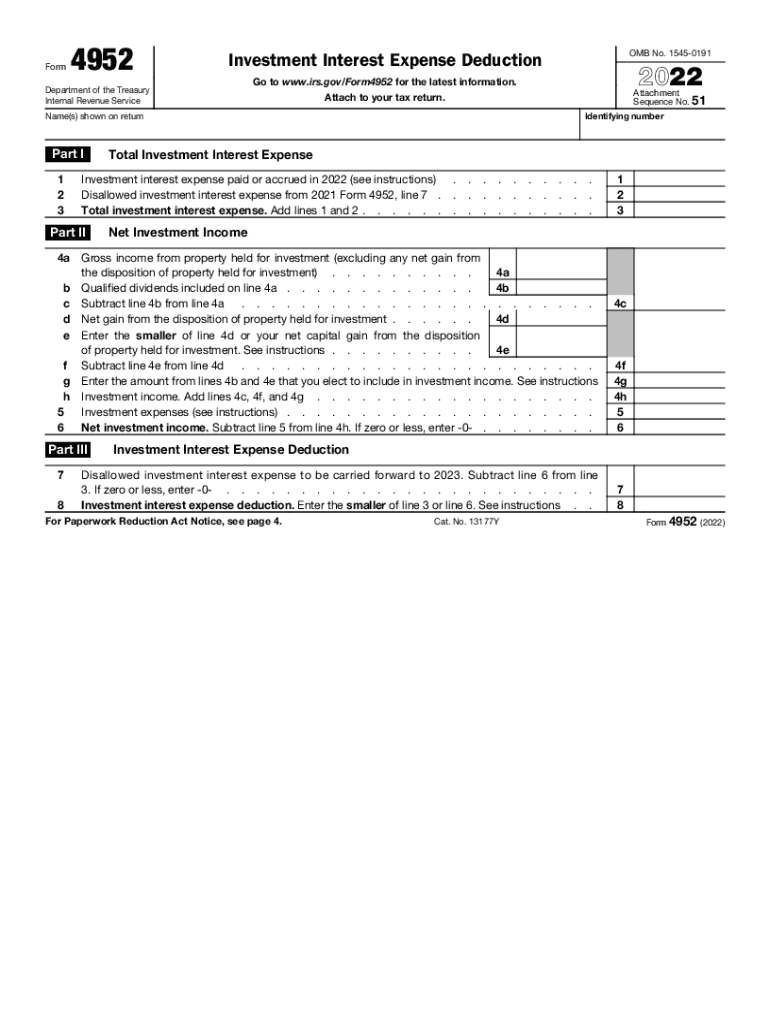

The Form 4952 is used to calculate the investment interest expense deduction, which allows taxpayers to deduct interest paid on money borrowed to purchase investments. This deduction can only be claimed to the extent of net investment income, meaning that any investment interest expenses exceeding this amount cannot be deducted in the current tax year but can be carried forward to future years. Understanding the nuances of this form is essential for taxpayers looking to optimize their tax returns while adhering to IRS regulations.

How to use the Form 4952 Investment Interest Expense Deduction

Using the Form 4952 involves several steps. First, gather all necessary documentation related to your investment income and expenses. Next, complete the form by reporting your net investment income, which includes dividends, interest, and capital gains. After calculating your allowable investment interest expense deduction, transfer the result to your tax return. It is important to ensure that all figures are accurate to avoid issues with the IRS.

Steps to complete the Form 4952 Investment Interest Expense Deduction

Completing the Form 4952 requires careful attention to detail. Follow these steps:

- Begin by entering your name and Social Security number at the top of the form.

- Report your investment income on Line 1, which includes all relevant income sources.

- Calculate your total investment interest expense on Line 2, including interest paid on loans used to purchase investments.

- Determine your allowable deduction by comparing your investment interest expense to your net investment income.

- Complete any additional sections as required and ensure all calculations are accurate.

Eligibility Criteria

To be eligible for the investment interest expense deduction, taxpayers must have incurred interest expenses on loans used specifically for investment purposes. Additionally, the deduction is limited to the amount of net investment income. If your expenses exceed your income, you can carry forward the excess to future tax years. It is crucial to maintain thorough records of all investment-related transactions to support your claims.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 4952. These guidelines outline what qualifies as investment interest expense and detail how to report it accurately. Taxpayers should consult IRS publications and instructions for Form 4952 to ensure compliance with current tax laws. Following these guidelines helps minimize the risk of audits and penalties.

Required Documents

When preparing to complete the Form 4952, certain documents are necessary to support your calculations. These include:

- Statements from brokerage accounts detailing investment income and expenses.

- Loan agreements or statements showing interest paid on borrowed funds used for investments.

- Any relevant tax documents that report net investment income.

Having these documents readily available can streamline the process of completing the form and ensure accuracy in your tax filing.

Quick guide on how to complete 2022 form 4952 investment interest expense deduction

Complete Form 4952 Investment Interest Expense Deduction seamlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Form 4952 Investment Interest Expense Deduction on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Form 4952 Investment Interest Expense Deduction effortlessly

- Locate Form 4952 Investment Interest Expense Deduction and click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4952 Investment Interest Expense Deduction and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 4952 investment interest expense deduction

Create this form in 5 minutes!

People also ask

-

What is form 4952 and why is it important?

Form 4952 is an IRS form used to calculate the investment interest expense deduction. It is important for taxpayers who have incurred interest expenses related to investment income, allowing them to potentially reduce their taxable income and save on taxes.

-

How can airSlate SignNow help with form 4952?

airSlate SignNow offers a streamlined process for filling out and eSigning form 4952. With user-friendly templates and data input features, you can efficiently complete your tax documentation while ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for form 4952?

Yes, airSlate SignNow provides affordable pricing plans that cater to various business needs. Our plans facilitate easy digital document management, including form 4952, without breaking the bank.

-

What features does airSlate SignNow include for document handling?

airSlate SignNow includes features like eSigning, document templates, real-time collaboration, and cloud storage. These features allow you to efficiently complete form 4952 and other documents, enhancing productivity and efficiency.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow can be integrated with various tax management and accounting software. This integration allows for seamless data transfer and simplifies the process of managing form 4952 alongside your other financial documents.

-

What are the benefits of using airSlate SignNow for form 4952?

Using airSlate SignNow for form 4952 streamlines the eSigning process, saves time, and enhances accuracy. Our platform also increases security for sensitive financial documents, ensuring that your tax information is protected.

-

Is airSlate SignNow user-friendly for beginners working on form 4952?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for beginners to navigate. Whether you're completing form 4952 or managing other documents, our intuitive interface allows anyone to get started quickly.

Get more for Form 4952 Investment Interest Expense Deduction

- Quitclaim deed by two individuals to corporation new jersey form

- Warranty deed from two individuals to corporation new jersey form

- New jersey lien 497319173 form

- Discharge lien form

- New jersey lien 497319175 form

- New jersey right form

- Quitclaim deed from individual to corporation new jersey form

- Warranty deed from individual to corporation new jersey form

Find out other Form 4952 Investment Interest Expense Deduction

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form