ARE118 Employee Expense Form Form 2106 Department of the 2021

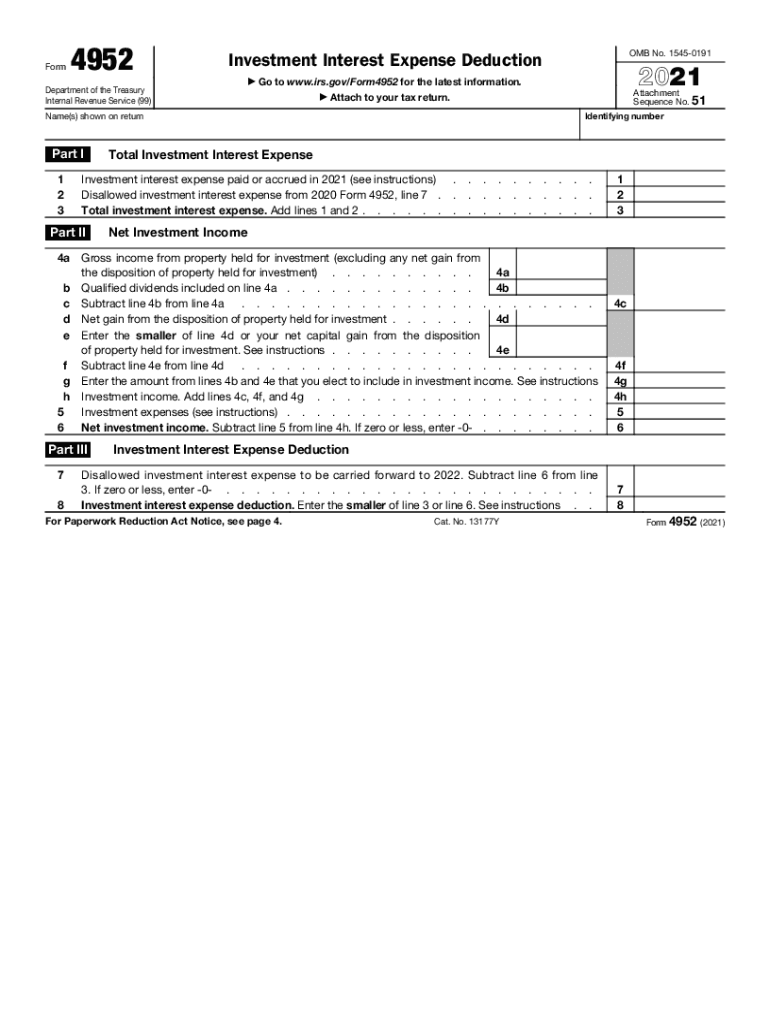

What is IRS Form 4952?

IRS Form 4952 is used to calculate the amount of investment interest expense that can be deducted on your tax return. This form is essential for taxpayers who have incurred interest expenses related to their investments. The form helps determine the allowable deduction based on the taxpayer's net investment income. Understanding this form is crucial for ensuring compliance with tax regulations and maximizing potential deductions.

Key Elements of IRS Form 4952

The key elements of IRS Form 4952 include sections for reporting investment interest expenses, net investment income, and any carryover amounts from previous years. Taxpayers must accurately fill out these sections to determine their deductible investment interest. Additionally, the form requires information on the types of investments that generated income, which can affect the overall calculation of allowable deductions.

Steps to Complete IRS Form 4952

Completing IRS Form 4952 involves several steps:

- Gather all relevant documentation related to your investment interest expenses.

- Calculate your total investment interest expenses for the tax year.

- Determine your net investment income, which includes income from dividends, interest, and capital gains.

- Fill out the form by entering your calculated figures in the appropriate sections.

- Review the form for accuracy before submission.

Filing Deadlines for IRS Form 4952

IRS Form 4952 must be filed along with your annual tax return, typically due on April fifteenth. If you require additional time, you may file for an extension, which allows you to submit your tax return by October fifteenth. It is important to adhere to these deadlines to avoid penalties and ensure your investment interest deductions are processed correctly.

Legal Use of IRS Form 4952

IRS Form 4952 is legally binding when completed accurately and submitted on time. It is crucial for taxpayers to understand the legal implications of the information provided on this form. Misreporting or failing to file can result in penalties, interest charges, or audits by the IRS. Therefore, ensuring compliance with IRS regulations is essential for all taxpayers utilizing this form.

Examples of Using IRS Form 4952

Taxpayers may use IRS Form 4952 in various scenarios, such as:

- Claiming deductions for interest paid on loans taken out to purchase stocks or bonds.

- Reporting investment interest expenses related to margin accounts.

- Utilizing carryover amounts from previous years to offset current investment interest expenses.

Quick guide on how to complete are118 employee expense form form 2106 department of the

Prepare ARE118 Employee Expense Form Form 2106 Department Of The effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage ARE118 Employee Expense Form Form 2106 Department Of The on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

The easiest way to modify and eSign ARE118 Employee Expense Form Form 2106 Department Of The without effort

- Find ARE118 Employee Expense Form Form 2106 Department Of The and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you select. Modify and eSign ARE118 Employee Expense Form Form 2106 Department Of The and ensure effective communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct are118 employee expense form form 2106 department of the

Create this form in 5 minutes!

How to create an eSignature for the are118 employee expense form form 2106 department of the

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What is the form 4952 used for?

The form 4952 is primarily used to calculate the investment interest expense deduction. This form helps taxpayers determine how much of their investment interest can be deducted against their taxable income, ensuring they make the most of their financial investments.

-

How can airSlate SignNow help with form 4952?

airSlate SignNow simplifies the process of filling out and submitting form 4952. Our platform allows users to upload, sign, and send documents securely, making it easier to manage financial forms like the 4952 efficiently.

-

Is there a pricing plan for using airSlate SignNow for form 4952?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Whether you're a small business or a larger enterprise, our cost-effective solutions allow you to handle paperwork, including form 4952, seamlessly at an affordable rate.

-

What features does airSlate SignNow offer for handling form 4952?

airSlate SignNow provides a range of features designed to streamline document management, including customizable templates, eSignature capabilities, and secure cloud storage. These features make completing and sharing form 4952 straightforward and efficient.

-

Can I collaborate with my team on form 4952 using airSlate SignNow?

Absolutely! airSlate SignNow allows team collaboration on documents, including form 4952. You can invite team members to review, comment, or sign the form, ensuring everyone is on the same page and approvals are quick.

-

Are there any integrations available with airSlate SignNow for form 4952?

Yes, airSlate SignNow integrates with popular productivity tools and services, enhancing your workflow when handling form 4952. This allows you to manage your documents alongside other apps you may be using, creating a streamlined process.

-

What benefits does airSlate SignNow provide for submitting form 4952?

Using airSlate SignNow to submit form 4952 offers numerous benefits, including increased efficiency and security. The platform ensures that your sensitive information is protected while also enabling quick access and easy tracking of your submission.

Get more for ARE118 Employee Expense Form Form 2106 Department Of The

- Florida contractor form

- Concrete mason contractor package florida form

- Demolition contractor package florida form

- Security contractor package florida form

- Insulation contractor package florida form

- Paving contractor package florida form

- Site work contractor package florida form

- Siding contractor package florida form

Find out other ARE118 Employee Expense Form Form 2106 Department Of The

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile