for the Calendar Year , or Other Tax Year 2012

What is the For The Calendar Year, Or Other Tax Year

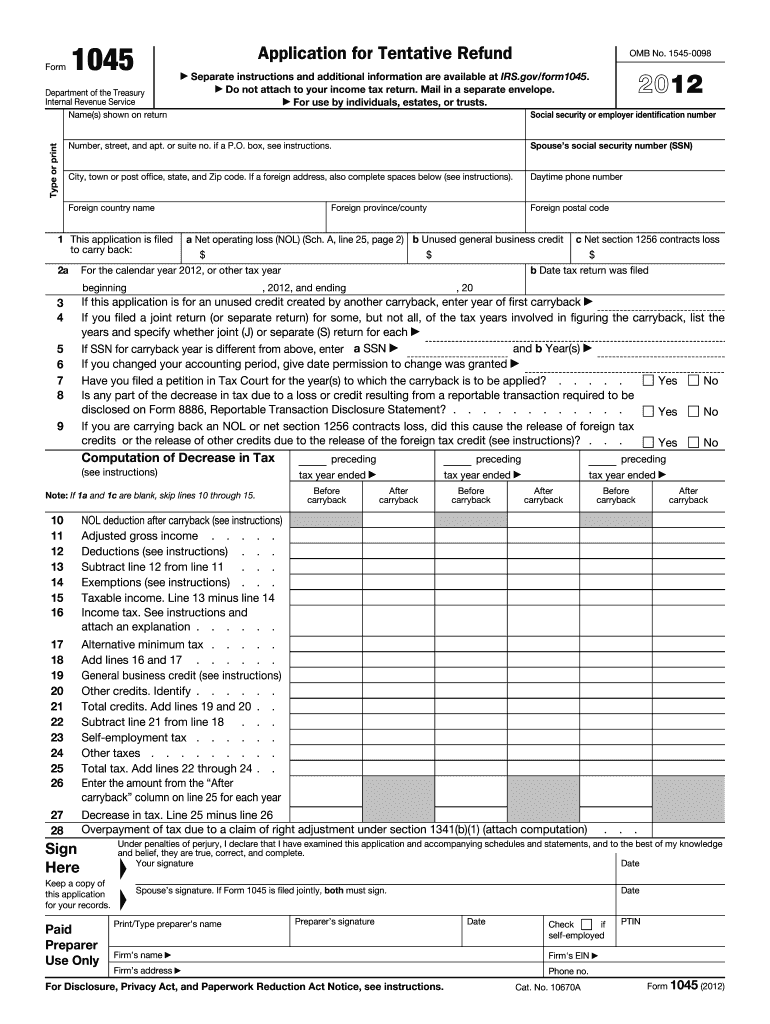

The form for the calendar year, or other tax year, is a crucial document used primarily for tax reporting purposes. It allows individuals and businesses to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and is typically required annually, aligning with the taxpayer's chosen reporting period. The calendar year refers to the standard January to December timeframe, while other tax years may vary based on the specific needs or circumstances of the taxpayer.

Steps to Complete the For The Calendar Year, Or Other Tax Year

Completing the form for the calendar year, or other tax year, involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form carefully, ensuring that all income sources are reported and deductions are claimed correctly. It's important to double-check all entries for accuracy to avoid potential penalties. Finally, sign and date the form before submitting it to the IRS by the designated deadline.

Legal Use of the For The Calendar Year, Or Other Tax Year

The legal use of the form for the calendar year, or other tax year, is governed by IRS regulations. This form must be completed accurately to fulfill legal obligations for tax reporting. Failure to provide accurate information can result in penalties, including fines or audits. Additionally, the form must be submitted by the specified deadlines to avoid late fees and interest on unpaid taxes. Understanding the legal implications of this form is essential for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the form for the calendar year, or other tax year, are critical for taxpayers to observe. Typically, individual tax returns are due by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their tax year. It is essential to stay informed about these important dates to avoid penalties and ensure timely submission of the form.

Required Documents

To complete the form for the calendar year, or other tax year, several documents are typically required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Gathering these documents in advance can streamline the completion process and help ensure accuracy.

IRS Guidelines

The IRS provides specific guidelines for completing the form for the calendar year, or other tax year. These guidelines outline the necessary information to include, how to report various types of income, and the deductions that may be claimed. It is important to refer to the latest IRS publications and instructions related to the form to ensure compliance with current tax laws and regulations. Following these guidelines can help prevent errors and potential audits.

Quick guide on how to complete for the calendar year 2012 or other tax year

Effortlessly Prepare For The Calendar Year , Or Other Tax Year on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without any hold-ups. Manage For The Calendar Year , Or Other Tax Year on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign For The Calendar Year , Or Other Tax Year smoothly

- Find For The Calendar Year , Or Other Tax Year and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Finished button to save your modifications.

- Select your preferred method for sending your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign For The Calendar Year , Or Other Tax Year while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for the calendar year 2012 or other tax year

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year 2012 or other tax year

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the significance of choosing 'For The Calendar Year, Or Other Tax Year' in airSlate SignNow?

Choosing 'For The Calendar Year, Or Other Tax Year' in airSlate SignNow ensures that all documents are tailored to meet specific tax year requirements. This customization is essential for maintaining compliance and accuracy in financial reporting. It helps businesses manage their documentation efficiently throughout the year, thereby minimizing errors during tax submissions.

-

How does airSlate SignNow's pricing structure work for 'For The Calendar Year, Or Other Tax Year'?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including those focusing on 'For The Calendar Year, Or Other Tax Year.' Depending on the plan you choose, you can access features that streamline document management and e-signatures while remaining budget-friendly. This transparency in pricing allows you to find a solution that suits your specific financial timeline.

-

What features does airSlate SignNow provide for businesses concerned with 'For The Calendar Year, Or Other Tax Year'?

airSlate SignNow includes features like templates, automated workflows, and real-time collaboration specifically for documents associated with 'For The Calendar Year, Or Other Tax Year.' These tools simplify the e-signing process, enhance efficiency, and help maintain compliance with tax regulations. This comprehensive suite of features ensures seamless document handling throughout the year.

-

How can airSlate SignNow benefit my business during 'For The Calendar Year, Or Other Tax Year'?

By utilizing airSlate SignNow, businesses can signNowly streamline their document processes during 'For The Calendar Year, Or Other Tax Year.' The platform offers user-friendly e-signatures and automated workflows that reduce paperwork and increase productivity. This means less time spent on administrative tasks and more focus on core business activities.

-

Are there any integrations available for airSlate SignNow that support 'For The Calendar Year, Or Other Tax Year' documentation?

Yes, airSlate SignNow integrates with various tools and platforms that enhance your ability to manage documents for 'For The Calendar Year, Or Other Tax Year.' This includes CRM systems, project management tools, and finance software, allowing seamless data exchange and improved efficiency. Such integrations help create a cohesive workflow for handling time-sensitive documents.

-

How secure is airSlate SignNow when handling 'For The Calendar Year, Or Other Tax Year' documents?

airSlate SignNow prioritizes security and compliance, ensuring that all documents related to 'For The Calendar Year, Or Other Tax Year' are protected with top-tier encryption and security measures. Your sensitive information is safeguarded against unauthorized access, giving you peace of mind while sending and signing important documents. This focus on security makes airSlate SignNow a reliable choice for businesses.

-

Can I customize my workflow in airSlate SignNow for 'For The Calendar Year, Or Other Tax Year' needs?

Absolutely! airSlate SignNow allows for extensive customization of workflows to cater specifically to your 'For The Calendar Year, Or Other Tax Year' requirements. You can tailor the approval processes, set reminders, and automate repetitive tasks to align with your business needs. This level of customization boosts efficiency and ensures that your documentation is always timely.

Get more for For The Calendar Year , Or Other Tax Year

Find out other For The Calendar Year , Or Other Tax Year

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile