About Form 1045, Application for Tentative RefundInternal Revenue 2022

About Form 1045, Application for Tentative Refund

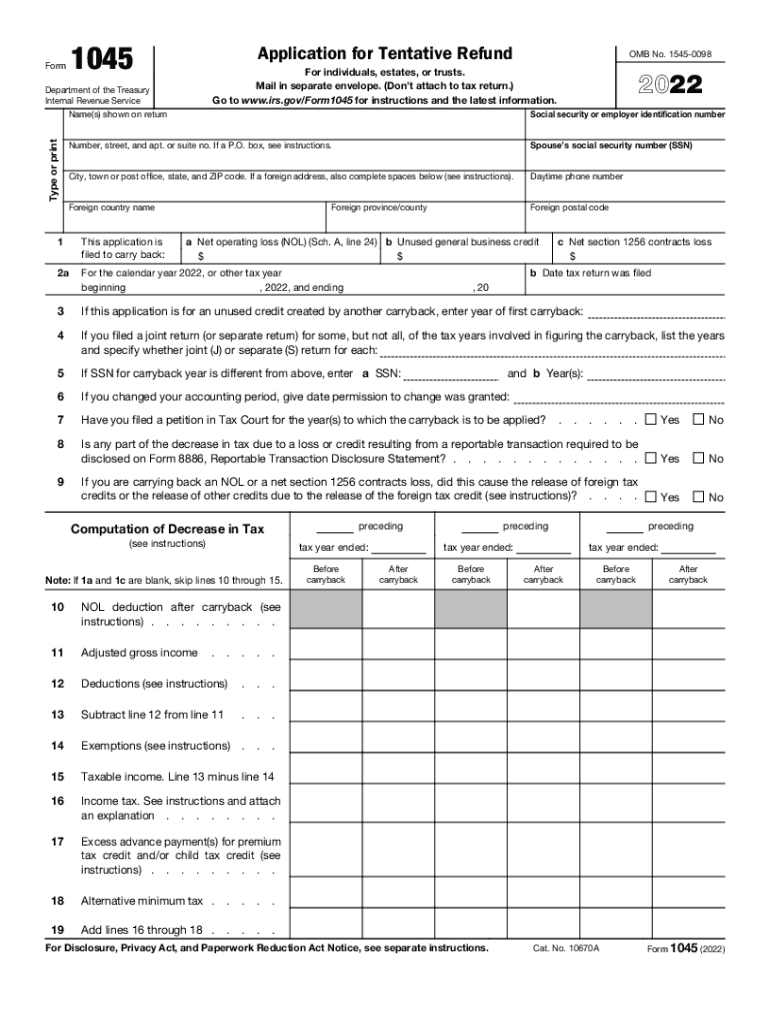

The Form 1045 is a crucial document used by taxpayers to apply for a tentative refund of overpaid taxes due to a net operating loss (NOL) carryback. This form allows individuals and businesses to quickly recover taxes paid in previous years, streamlining the process of obtaining refunds. The IRS provides this form to facilitate the application process, ensuring that taxpayers can effectively manage their financial obligations.

Steps to Complete Form 1045

Completing Form 1045 requires careful attention to detail. Here are the essential steps:

- Gather Required Information: Collect your tax returns for the years affected by the NOL, as well as any supporting documentation.

- Fill Out the Form: Provide accurate information regarding your NOL, including the amount and the tax years involved.

- Calculate Your Refund: Use the form's instructions to determine the correct refund amount based on your NOL.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes that could delay processing.

- Submit the Form: Send your completed Form 1045 to the appropriate IRS address, either by mail or electronically if eligible.

Filing Deadlines / Important Dates

Understanding the deadlines associated with Form 1045 is vital for taxpayers seeking a timely refund. Generally, the form must be filed within twelve months of the end of the tax year in which the NOL occurred. For example, if you experienced an NOL in 2020, you would need to submit your Form 1045 by the end of 2021. Staying aware of these deadlines helps ensure that you do not miss the opportunity for a refund.

Eligibility Criteria

To file Form 1045, taxpayers must meet specific eligibility criteria. Primarily, you must have incurred a net operating loss in a prior tax year that you wish to carry back. Additionally, the loss must be applied to the appropriate tax years as specified by IRS guidelines. Individuals, corporations, and certain estates can all qualify, provided they adhere to the IRS regulations regarding NOLs.

Legal Use of Form 1045

Form 1045 is legally recognized as a valid means for taxpayers to claim refunds based on net operating losses. To ensure compliance, it is essential to follow IRS guidelines closely. The form must be completed accurately, as any discrepancies may lead to delays or rejections of the refund request. Utilizing reliable eSignature solutions, like signNow, can help maintain the integrity of the submission process and ensure that all signatures are legally binding.

Form Submission Methods

Taxpayers have several options for submitting Form 1045. The form can be mailed directly to the IRS, ensuring that all required documentation accompanies the application. Additionally, eligible taxpayers may have the option to file electronically, which can expedite the processing time. Understanding the submission methods available can help streamline the refund process and improve overall efficiency.

Quick guide on how to complete about form 1045 application for tentative refundinternal revenue

Easily Prepare About Form 1045, Application For Tentative RefundInternal Revenue on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage About Form 1045, Application For Tentative RefundInternal Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and eSign About Form 1045, Application For Tentative RefundInternal Revenue Effortlessly

- Obtain About Form 1045, Application For Tentative RefundInternal Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Alter and eSign About Form 1045, Application For Tentative RefundInternal Revenue and ensure seamless communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1045 application for tentative refundinternal revenue

Create this form in 5 minutes!

People also ask

-

What is the 1045 2020 document, and how can airSlate SignNow help with it?

The 1045 2020 document is vital for tax-related purposes for businesses. airSlate SignNow simplifies the process of signing and sending your 1045 2020 documents electronically, ensuring compliance and quick turnaround times without the hassles of paper.

-

Is airSlate SignNow a cost-effective solution for handling 1045 2020 documents?

Yes, airSlate SignNow offers a cost-effective way to manage your 1045 2020 documents. With flexible pricing plans tailored to businesses of all sizes, you can streamline your document workflows without breaking the bank.

-

What features does airSlate SignNow offer for eSigning the 1045 2020 document?

airSlate SignNow provides robust features for eSigning the 1045 2020 document, including customizable templates, secure digital signatures, and real-time notifications. These features ensure your documents are processed efficiently and accurately.

-

Can I integrate airSlate SignNow with other software for managing 1045 2020 documents?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage your 1045 2020 documents alongside your existing tools. This integration enhances productivity and ensures a smoother workflow.

-

How does airSlate SignNow facilitate compliance for the 1045 2020 document?

airSlate SignNow ensures compliance for the 1045 2020 document by adhering to industry standards for electronic signatures. This includes maintaining security and authenticity, so you can confidently submit your documents for processing.

-

What are the benefits of using airSlate SignNow for my 1045 2020 documentation?

Using airSlate SignNow for your 1045 2020 documentation offers numerous benefits, including time savings, reduced paper usage, and enhanced security. These advantages contribute to a more efficient and eco-friendly document management process.

-

Is there customer support available for users dealing with 1045 2020 documents?

Yes, airSlate SignNow provides extensive customer support, ensuring that you receive assistance with your 1045 2020 documents whenever needed. Our support team is knowledgeable and ready to help with any questions or issues that may arise.

Get more for About Form 1045, Application For Tentative RefundInternal Revenue

- Contractors notice to owner about disclosure of labor and materials mechanic liens corporation or llc illinois form

- Illinois deed 497306083 form

- Illinois succession form

- Illinois 60 day notice form

- Quitclaim deed by two individuals to husband and wife illinois form

- Warranty deed from two individuals to husband and wife illinois form

- Illinois husband wife 497306089 form

- Illinois 60 day notice 497306090 form

Find out other About Form 1045, Application For Tentative RefundInternal Revenue

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney