Form 1045 2017

What is the Form 1045

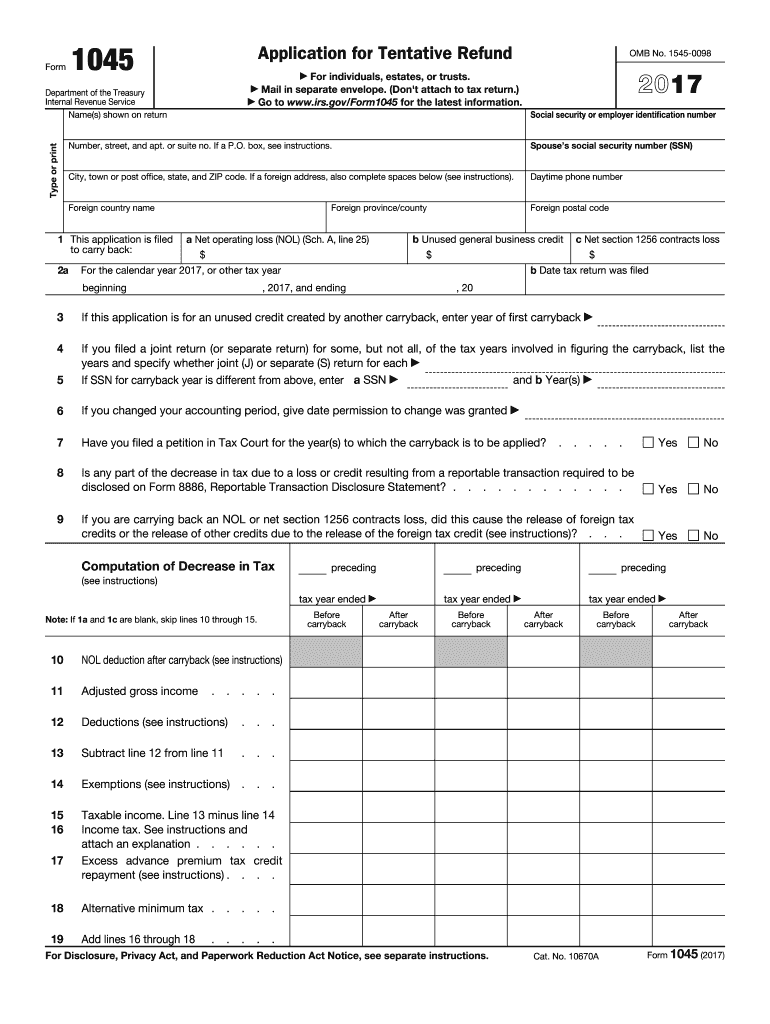

The Form 1045 is a tax form used by individuals in the United States to apply for a quick refund of overpaid taxes. This form is particularly relevant for those who have experienced a loss during the tax year and wish to carry back that loss to offset income from previous years. By filing Form 1045, taxpayers can expedite their refund process, allowing them to reclaim funds more efficiently than through the standard tax return process.

How to use the Form 1045

To use Form 1045 effectively, taxpayers must first determine their eligibility based on their financial situation, particularly if they have incurred a net operating loss (NOL). Once eligibility is confirmed, the form should be completed with accurate information regarding the taxpayer's income, deductions, and the amount of loss being carried back. After filling out the form, it must be submitted to the appropriate IRS office, ensuring that all required documentation is included to support the claim.

Steps to complete the Form 1045

Completing Form 1045 involves several key steps:

- Gather necessary financial documents, including prior tax returns and records of the loss.

- Fill out the form, providing detailed information about income, deductions, and the loss.

- Calculate the amount of refund requested based on the carried-back loss.

- Review the form for accuracy and completeness to avoid delays.

- Submit the completed form to the IRS, either by mail or electronically, depending on the submission method chosen.

Legal use of the Form 1045

The legal use of Form 1045 is governed by IRS regulations, which stipulate that the form must be used for legitimate tax claims. Taxpayers should ensure that all information provided is accurate and truthful to avoid penalties. The form must be filed within the specified timeframe to be considered valid, and it is essential to comply with all IRS guidelines regarding the documentation and submission process.

Filing Deadlines / Important Dates

Filing deadlines for Form 1045 are critical to ensure that taxpayers receive their refunds promptly. Typically, the form must be filed within twelve months of the end of the tax year in which the loss occurred. Taxpayers should be aware of specific dates related to their tax situation, including the end of the tax year and any extensions that may apply. Keeping track of these dates can help avoid missed opportunities for claiming refunds.

Required Documents

When filing Form 1045, certain documents are required to substantiate the claim. These include:

- Prior year tax returns to establish the income against which the loss will be applied.

- Documentation of the net operating loss, such as financial statements or records of business income and expenses.

- Any additional forms or schedules that support the calculations made on Form 1045.

Form Submission Methods (Online / Mail / In-Person)

Form 1045 can be submitted through various methods, depending on the taxpayer's preference and the IRS guidelines. Options include:

- Mailing the completed form to the designated IRS address, which varies based on the taxpayer's location.

- Submitting the form electronically through IRS-approved software, which may enhance processing speed.

- In-person submission at local IRS offices, although this option may be limited and subject to availability.

Quick guide on how to complete form 1045 2017

Handle Form 1045 effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Administer Form 1045 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest approach to modify and eSign Form 1045 with ease

- Locate Form 1045 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or sharing a link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or inaccuracies that necessitate reprinting. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Modify and eSign Form 1045 while ensuring clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1045 2017

Create this form in 5 minutes!

How to create an eSignature for the form 1045 2017

How to generate an eSignature for your Form 1045 2017 online

How to create an electronic signature for your Form 1045 2017 in Chrome

How to generate an eSignature for signing the Form 1045 2017 in Gmail

How to create an electronic signature for the Form 1045 2017 straight from your mobile device

How to generate an eSignature for the Form 1045 2017 on iOS devices

How to make an electronic signature for the Form 1045 2017 on Android devices

People also ask

-

What is Form 1045 and how can airSlate SignNow help with it?

Form 1045 is a tax form used by individuals to apply for a quick refund of overpayments. With airSlate SignNow, you can easily eSign and send your Form 1045 electronically, streamlining the submission process and ensuring that your documents are securely received by the IRS.

-

Is airSlate SignNow suitable for filing Form 1045?

Yes, airSlate SignNow is an excellent solution for filing Form 1045. Our platform provides a user-friendly interface that allows you to fill out, sign, and send your tax forms quickly and securely, ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing Form 1045?

airSlate SignNow offers a variety of features specifically designed for managing Form 1045, including customizable templates, secure cloud storage, and real-time tracking. These features help you to efficiently organize your tax documents and ensure that your filings are accurate and timely.

-

How does airSlate SignNow ensure the security of my Form 1045?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure servers to protect your Form 1045 and any sensitive information contained within it, ensuring that your documents are safe from unauthorized access.

-

Can I integrate airSlate SignNow with other applications for Form 1045 management?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and more. This allows you to manage your Form 1045 alongside your other essential tools, enhancing your workflow and productivity.

-

What are the pricing options for using airSlate SignNow for Form 1045?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to all our features, including those needed for managing Form 1045, at a cost-effective rate.

-

How does eSigning my Form 1045 with airSlate SignNow work?

eSigning your Form 1045 with airSlate SignNow is simple and efficient. After preparing your form, you can send it for signature via email; the recipient will receive a link to sign electronically, ensuring a quick turnaround without the need for printing or mailing.

Get more for Form 1045

Find out other Form 1045

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure