Form 1045 Application for Tentative Refund 2024-2026

What is the Form 1045 Application for Tentative Refund

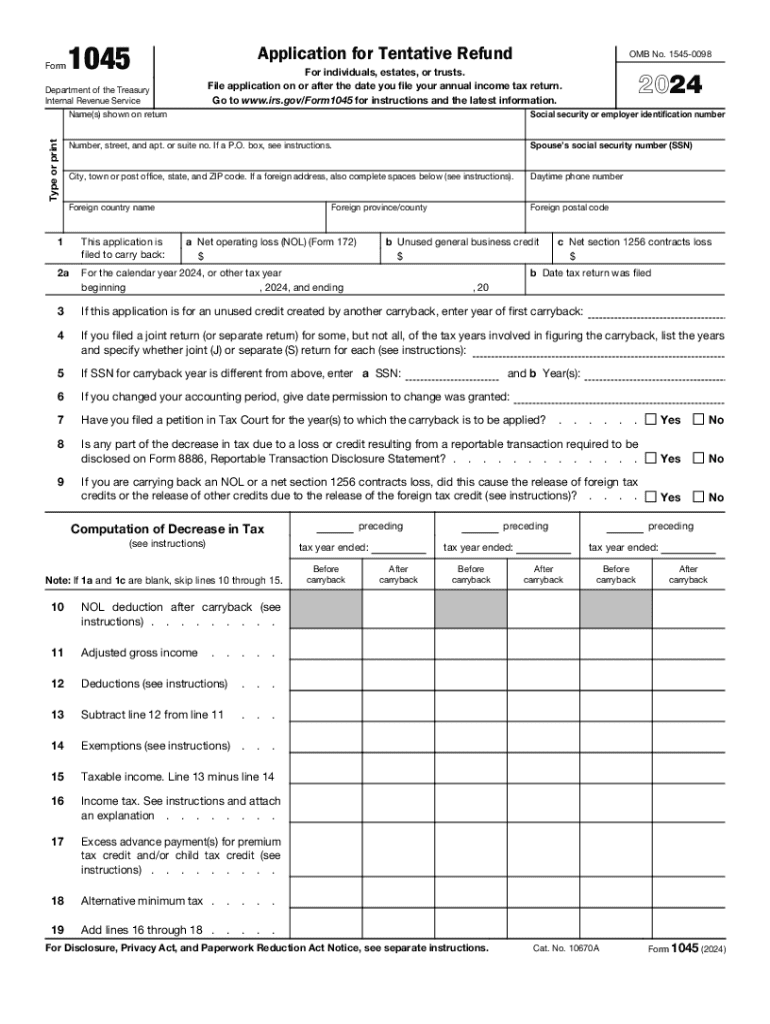

The Form 1045 is an application used by taxpayers to request a tentative refund from the IRS due to a net operating loss (NOL) carryback. This form allows individuals and businesses to quickly receive a refund based on losses incurred in previous tax years, which can significantly improve cash flow. By filing Form 1045, taxpayers can expedite the process of obtaining a refund rather than waiting for their amended return to be processed. The form is specifically designed for those who have experienced a net operating loss and wish to apply it to prior tax years to recover overpaid taxes.

How to Use the Form 1045 Application for Tentative Refund

Using the Form 1045 involves several key steps. First, determine your eligibility by confirming that you have a net operating loss that can be carried back. Next, gather the necessary documentation, including prior year tax returns and any relevant schedules. Complete the form accurately, ensuring that all required fields are filled out, including the calculation of the NOL and the amount of refund requested. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the submission options available for your situation.

Steps to Complete the Form 1045 Application for Tentative Refund

Completing Form 1045 requires careful attention to detail. Here are the essential steps:

- Obtain the latest version of Form 1045 from the IRS website or other official sources.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Calculate your net operating loss using the NOL worksheet provided in the form's instructions.

- Indicate the tax year(s) for which you are applying the carryback and the amount of refund you are requesting.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate IRS address or through electronic filing, if applicable.

Eligibility Criteria for Form 1045 Application for Tentative Refund

To be eligible to file Form 1045, taxpayers must have incurred a net operating loss in the current tax year that they wish to carry back to previous tax years. This form is available for individuals, corporations, and certain pass-through entities. The NOL must be calculated according to IRS guidelines, and taxpayers should ensure that they have not already filed an amended return for the years in question. Additionally, the application must be submitted within one year of the due date of the return for the year in which the NOL occurred.

Required Documents for Form 1045 Application for Tentative Refund

When filing Form 1045, it is important to include supporting documentation to substantiate your claim. Required documents typically include:

- Copies of tax returns for the years affected by the NOL.

- Any relevant schedules or forms that detail income, deductions, and credits.

- The completed NOL worksheet, which helps calculate the amount of the loss.

- Any additional documentation that supports the calculation of the NOL, such as business income statements.

Filing Deadlines for Form 1045 Application for Tentative Refund

The deadline for filing Form 1045 is generally within one year from the due date of the return for the tax year in which the net operating loss occurred. This means that if the loss occurred in the 2022 tax year, the form must be filed by the due date of the 2022 return, typically April 15, 2023, unless an extension has been granted. It is crucial to adhere to this timeline to ensure eligibility for a tentative refund.

Create this form in 5 minutes or less

Find and fill out the correct form 1045 application for tentative refund

Create this form in 5 minutes!

How to create an eSignature for the form 1045 application for tentative refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1045 and how can airSlate SignNow help with it?

Form 1045 is a tax form used to apply for a quick refund of overpaid taxes. airSlate SignNow simplifies the process of completing and submitting form 1045 by allowing users to eSign documents securely and efficiently, ensuring that your tax refund request is processed without delays.

-

Is there a cost associated with using airSlate SignNow for form 1045?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides access to features that streamline the completion and eSigning of form 1045, making it a cost-effective solution for managing your tax documents.

-

What features does airSlate SignNow offer for managing form 1045?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for form 1045. These tools help ensure that your tax documents are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other applications for form 1045?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 1045 alongside your other business processes. This integration enhances productivity by enabling you to access and eSign documents directly from your preferred platforms.

-

How does airSlate SignNow ensure the security of my form 1045?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your form 1045 and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for form 1045?

Using airSlate SignNow for form 1045 offers numerous benefits, including faster processing times, reduced paperwork, and enhanced accuracy. The platform's user-friendly interface makes it easy for anyone to complete and eSign their tax documents without hassle.

-

Is airSlate SignNow suitable for individuals filing form 1045?

Yes, airSlate SignNow is suitable for both individuals and businesses filing form 1045. Its intuitive design and comprehensive features make it accessible for anyone looking to manage their tax documents efficiently.

Get more for Form 1045 Application For Tentative Refund

Find out other Form 1045 Application For Tentative Refund

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple