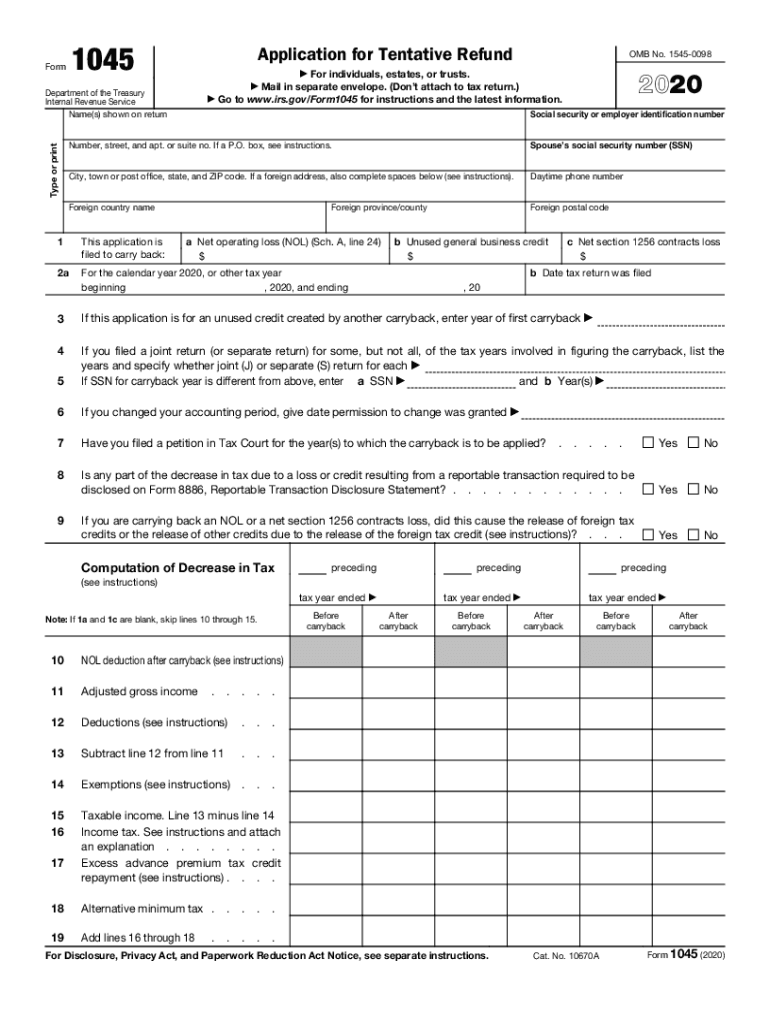

Form 1045 Application for Tentative Refund 2020

What is the Form 1045 Application For Tentative Refund

The Form 1045 Application For Tentative Refund is a document used by taxpayers to request a quick refund of overpaid taxes. This form is particularly beneficial for individuals who have experienced a loss in the current tax year and wish to apply that loss to prior tax years. By doing so, they can receive a refund more promptly than waiting for the standard processing of an amended return. The application is submitted to the Internal Revenue Service (IRS) and must include specific information regarding the taxpayer's income, deductions, and the amount of overpayment.

Steps to complete the Form 1045 Application For Tentative Refund

Completing the Form 1045 involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary financial documents, including prior year tax returns and any relevant schedules. Next, fill out the form by providing personal information, including your name, Social Security number, and the tax year for which you are requesting a refund. Indicate the amount of the overpayment and the specific loss you are applying. Finally, review the form for accuracy, sign it, and submit it to the IRS.

Filing Deadlines / Important Dates

Timely submission of the Form 1045 is crucial for receiving your refund. The IRS requires that the form be filed within one year of the end of the tax year in which the loss occurred. For example, if you are applying for a refund related to the 2014 tax year, the form must be submitted by December 31, 2015. It is important to keep track of these deadlines to ensure that your application is processed without delays.

Eligibility Criteria

To qualify for the Form 1045 Application For Tentative Refund, taxpayers must meet specific eligibility criteria. Generally, you must have incurred a net operating loss (NOL) in the current tax year that can be carried back to offset income in prior years. Additionally, you must have filed a tax return for the years you wish to amend. It is essential to review IRS guidelines to confirm that your situation aligns with the requirements for filing this form.

Legal use of the Form 1045 Application For Tentative Refund

The legal use of the Form 1045 is governed by IRS regulations, which stipulate that the form must be completed accurately and submitted in accordance with established deadlines. Failure to comply with these regulations can result in delays or denial of your refund request. It is advisable to maintain records of all submitted documents and correspondence with the IRS to ensure compliance and facilitate any necessary follow-ups.

How to obtain the Form 1045 Application For Tentative Refund

The Form 1045 can be obtained directly from the IRS website or by contacting the IRS to request a physical copy. Additionally, tax preparation software often includes the form, allowing taxpayers to fill it out electronically. It is important to ensure that you are using the correct version of the form for the applicable tax year, as requirements may change from year to year.

Quick guide on how to complete 2020 form 1045 application for tentative refund

Complete Form 1045 Application For Tentative Refund effortlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It offers a superior eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct version and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 1045 Application For Tentative Refund on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and electronically sign Form 1045 Application For Tentative Refund without hassle

- Obtain Form 1045 Application For Tentative Refund and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Form 1045 Application For Tentative Refund and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1045 application for tentative refund

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1045 application for tentative refund

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 1045 for 2014 and why is it important?

Form 1045 for 2014 is used by taxpayers to apply for a quick refund of any overpayment of taxes. It allows individuals to apply for a refund based on the carryback of net operating losses to prior tax years. Understanding how to fill out Form 1045 for 2014 can help you efficiently claim your tax refunds.

-

How can airSlate SignNow help me with Form 1045 for 2014?

airSlate SignNow simplifies the process of filling out and signing Form 1045 for 2014 by providing an easy-to-use digital platform. With our solution, you can quickly prepare the form, add necessary signatures, and submit it without the hassle of printing or mailing documents. This saves you time and streamlines your tax refund process.

-

Is there a cost associated with using airSlate SignNow for Form 1045 for 2014?

Yes, airSlate SignNow offers various pricing plans tailored to fit your business needs. You can choose a plan that helps you manage Form 1045 for 2014 efficiently while minimizing costs. Our solutions are designed to be cost-effective, providing excellent value for your document management.

-

What features are available for electronic signatures on Form 1045 for 2014?

With airSlate SignNow, you can enjoy a range of features for electronic signatures on Form 1045 for 2014, including customizable workflows and secure signing options. Our platform ensures that all signatures are legally binding and compliant with regulations. This makes it easy to manage your paperwork effectively and safely.

-

Can I integrate airSlate SignNow with other software for processing Form 1045 for 2014?

Absolutely! airSlate SignNow allows for integrations with popular software applications, enhancing your ability to process Form 1045 for 2014. Whether you're using accounting software or CRM solutions, our platform can seamlessly integrate to streamline your document workflow.

-

Is it possible to track the status of my Form 1045 for 2014 submission through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 1045 for 2014 submission in real-time. You will receive notifications regarding the signing process, ensuring you are kept up-to-date every step of the way. This feature enhances transparency and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for Form 1045 for 2014 over traditional methods?

Using airSlate SignNow for Form 1045 for 2014 offers several benefits, including faster processing times and reduced paperwork. Our digital solution minimizes the risk of errors and delivers efficiency by allowing multiple stakeholders to review and sign documents simultaneously. This modern approach enhances productivity and accuracy.

Get more for Form 1045 Application For Tentative Refund

- Sheetrock drywall contractor package wyoming form

- Flooring contractor package wyoming form

- Trim carpentry contractor package wyoming form

- Fencing contractor package wyoming form

- Hvac contractor package wyoming form

- Landscaping contractor package wyoming form

- Commercial contractor package wyoming form

- Excavation contractor package wyoming form

Find out other Form 1045 Application For Tentative Refund

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy