Form 1045 2016

What is the Form 1045

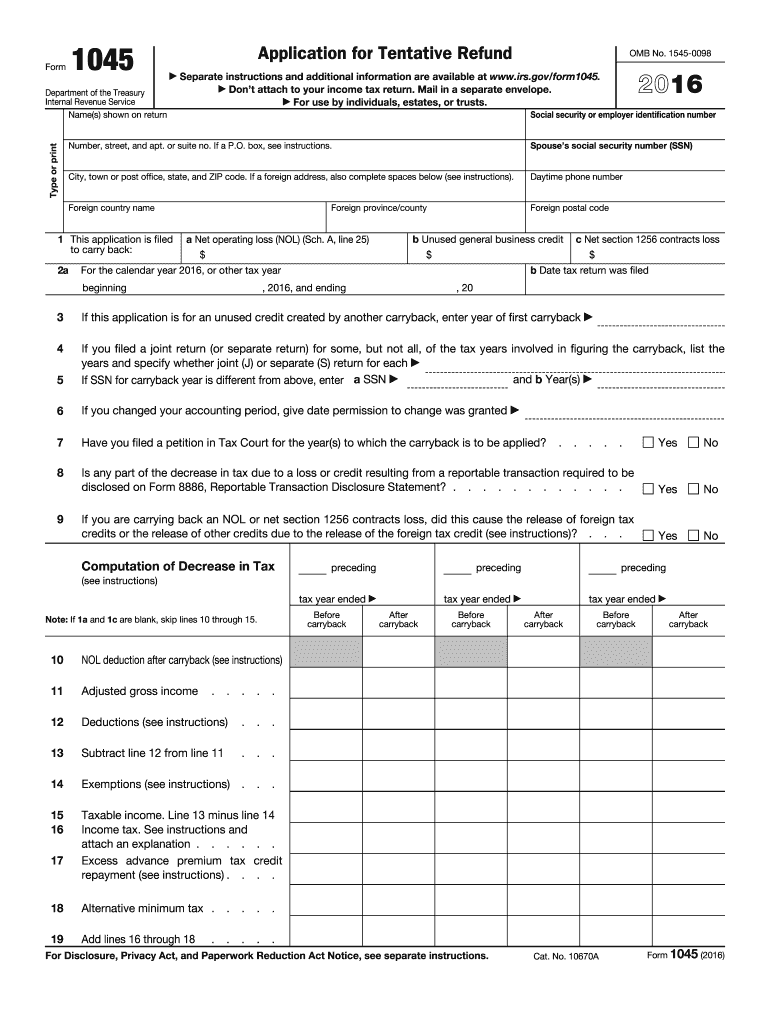

The Form 1045 is a tax document used by individuals and businesses in the United States to apply for a quick refund of overpaid taxes. This form is specifically designed for those who have experienced a net operating loss (NOL) and wish to carry back that loss to prior tax years. By using Form 1045, taxpayers can expedite their refund process, allowing them to receive funds more quickly than through standard tax return procedures.

How to use the Form 1045

Using Form 1045 involves several straightforward steps. First, ensure that you qualify for a refund based on a net operating loss. Next, gather all necessary documentation that supports your claim, such as prior tax returns and evidence of the NOL. Complete the form accurately, ensuring all sections are filled out correctly. Once completed, submit the form to the appropriate IRS address, depending on your location and whether you are filing electronically or by mail.

Steps to complete the Form 1045

Completing Form 1045 requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are claiming the NOL.

- Calculate your net operating loss and fill in the relevant sections of the form.

- Attach any supporting documentation, such as prior tax returns and schedules that demonstrate the NOL.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 1045

The legal use of Form 1045 is governed by IRS regulations. It is essential to ensure that the information provided is accurate and truthful, as submitting false information can lead to penalties. The form must be filed within the designated timeframe, typically within one year of the NOL occurrence, to be eligible for a refund. Compliance with all IRS guidelines is crucial to ensure that the form is processed without issues.

Filing Deadlines / Important Dates

Filing deadlines for Form 1045 are critical for taxpayers looking to claim a refund. Generally, the form must be filed within one year of the end of the tax year in which the NOL occurred. It is advisable to keep track of specific dates, as missing the deadline could result in the loss of the opportunity to receive a refund. Always check the IRS website for the most current deadlines and any changes to filing requirements.

Required Documents

When preparing to file Form 1045, certain documents are necessary to support your claim. These may include:

- Prior year tax returns to establish the NOL.

- Schedules and forms that detail income and deductions relevant to the NOL.

- Any correspondence from the IRS regarding previous tax filings.

Having these documents ready will facilitate a smoother filing process and help ensure that your claim is processed efficiently.

Quick guide on how to complete 2016 form 1045

Effortlessly prepare Form 1045 on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1045 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and electronically sign Form 1045 without effort

- Locate Form 1045 and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your modifications.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Form 1045 to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1045

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1045

How to make an eSignature for the 2016 Form 1045 online

How to make an eSignature for the 2016 Form 1045 in Chrome

How to make an electronic signature for putting it on the 2016 Form 1045 in Gmail

How to generate an eSignature for the 2016 Form 1045 from your mobile device

How to generate an eSignature for the 2016 Form 1045 on iOS

How to make an eSignature for the 2016 Form 1045 on Android OS

People also ask

-

What is Form 1045 and why is it important for businesses?

Form 1045 is a tax form used by individuals to apply for a quick tax refund. For businesses utilizing airSlate SignNow, understanding this form is crucial as it allows for streamlined e-signature processes, making filing taxes more efficient.

-

How does airSlate SignNow facilitate the completion of Form 1045?

airSlate SignNow simplifies the process of completing Form 1045 by allowing users to fill out and eSign the document electronically. This ensures faster processing times and reduces the chances of errors that can occur with paper submissions.

-

What are the pricing plans for using airSlate SignNow with Form 1045?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of various businesses. Whether you're a solo entrepreneur or a large corporation, you can find a plan that allows easy management and eSigning of Form 1045 at an affordable rate.

-

Can airSlate SignNow integrate with other software for managing Form 1045?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing your workflow when managing Form 1045. This allows for better documentation management and automated processes for filing and eSigning tax forms.

-

What features does airSlate SignNow provide for handling Form 1045?

airSlate SignNow includes features such as templates for Form 1045, advanced security measures, and mobile access. These features make it easier for businesses to prepare and sign their tax documents efficiently and securely.

-

How does eSigning Form 1045 benefit businesses?

eSigning Form 1045 can signNowly streamline the filing process, allowing for quick approvals and reducing turnaround times. This efficiency helps businesses maintain compliance while saving time and resources.

-

Is airSlate SignNow compliant with laws regarding Form 1045?

Yes, airSlate SignNow complies with regulatory standards for electronic signatures, ensuring that eSigned Form 1045 documents are legally binding. This compliance provides businesses with confidence in their eSigning processes.

Get more for Form 1045

Find out other Form 1045

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement