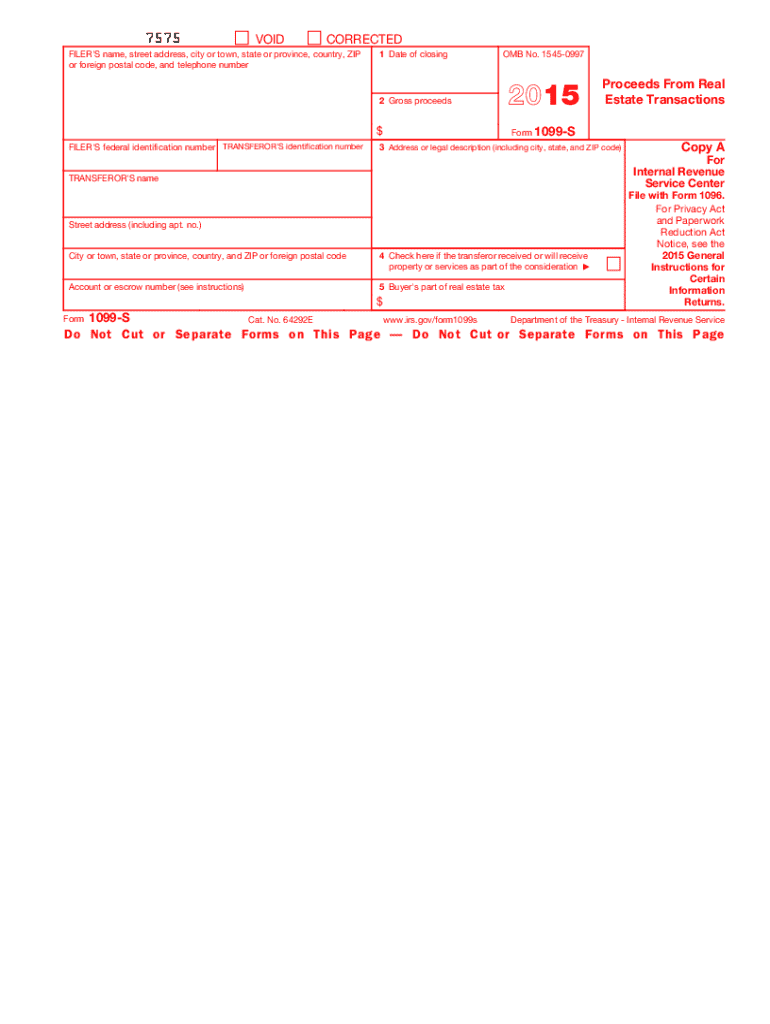

1099s Form 2015

What is the 1099s Form

The 1099s Form is a tax document used in the United States to report income received by individuals or entities that are not classified as employees. This form is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employee service providers. The 1099s Form plays a crucial role in ensuring that all income is accurately reported to the Internal Revenue Service (IRS) for tax purposes.

How to use the 1099s Form

To use the 1099s Form, businesses must first determine if they have made qualifying payments to non-employees during the tax year. If payments exceed a specific threshold, typically six hundred dollars, the business is required to issue a 1099s Form to the recipient. The form must include details such as the total amount paid, the recipient's taxpayer identification number, and the business's information. Recipients of the form will use it to report their income when filing their tax returns.

Steps to complete the 1099s Form

Completing the 1099s Form involves several key steps:

- Gather necessary information about the recipient, including their name, address, and taxpayer identification number (TIN).

- Collect details of the payments made, ensuring that the total amount is accurately recorded.

- Fill out the form with the required information, ensuring that all entries are correct and complete.

- Submit the completed form to the IRS, either electronically or via mail, by the designated deadline.

- Provide a copy of the form to the recipient for their records.

Legal use of the 1099s Form

The legal use of the 1099s Form is essential for compliance with IRS regulations. Businesses must ensure that they accurately report all qualifying payments to avoid penalties. The form serves as a record of income for the recipient and must be issued in a timely manner. Failure to issue a 1099s Form when required can lead to fines and other legal consequences for the business.

Filing Deadlines / Important Dates

Filing deadlines for the 1099s Form are critical for compliance. Typically, businesses must submit the form to the IRS by January thirty-first of the year following the tax year in which payments were made. Additionally, copies must be provided to recipients by the same date. It is essential for businesses to adhere to these deadlines to avoid penalties and ensure that all income is reported accurately.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1099s Form. These guidelines include instructions on who should receive the form, the information required, and the methods of submission. Businesses must familiarize themselves with these guidelines to ensure compliance and avoid potential issues during tax season. Adhering to IRS rules helps maintain accurate records and supports proper income reporting.

Quick guide on how to complete 1099s 2015 form

Manage 1099s Form easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your papers swiftly without delays. Manage 1099s Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign 1099s Form effortlessly

- Locate 1099s Form and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Adjust and eSign 1099s Form and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099s 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1099s 2015 form

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is a 1099s Form and why is it important?

The 1099s Form is a tax document used to report income received other than wages, salaries, or tips. It's crucial for ensuring accurate tax filings, as it helps the IRS track income from freelance work or other non-employment sources. Properly managing your 1099s Form is essential for compliance and avoiding potential tax penalties.

-

How can airSlate SignNow help with the 1099s Form process?

airSlate SignNow streamlines the process of sending and obtaining signatures on your 1099s Form. Our platform allows you to easily create, share, and eSign these tax documents securely and efficiently. By simplifying this process, you can save time and reduce errors in your tax documentation.

-

Is airSlate SignNow cost-effective for managing 1099s Form?

Yes, airSlate SignNow provides a cost-effective solution for managing your 1099s Form. With various pricing plans catering to different business sizes, our platform ensures you access powerful features without breaking the bank. You can manage multiple documents and signatures seamlessly while keeping costs low.

-

What features does airSlate SignNow offer for eSigning 1099s Form?

Our platform offers a range of features designed for eSigning 1099s Form, including customizable templates, real-time tracking, and secure storage. Users can easily access their documents from any device and utilize features like automated reminders to ensure timely signing. These tools make handling your 1099s Form hassle-free.

-

Can I integrate airSlate SignNow with my accounting software for 1099s Form?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for smooth management of your 1099s Form. This integration helps ensure accurate data transfer and minimizes manual entry errors, making your tax preparation process more efficient.

-

How secure is the information I submit on the 1099s Form using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technology to protect your documents, including the sensitive information on your 1099s Form. Regular security audits and compliance with industry standards ensure that your data remains safe and confidential.

-

What types of organizations can benefit from using airSlate SignNow for 1099s Form?

Any organization that handles independent contractors or freelancers can benefit from using airSlate SignNow for 1099s Form. Our platform is ideal for businesses of all sizes, from startups to large corporations, looking to streamline their document management and eSigning processes. By implementing our solution, companies can improve efficiency and reduce paperwork.

Get more for 1099s Form

Find out other 1099s Form

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile