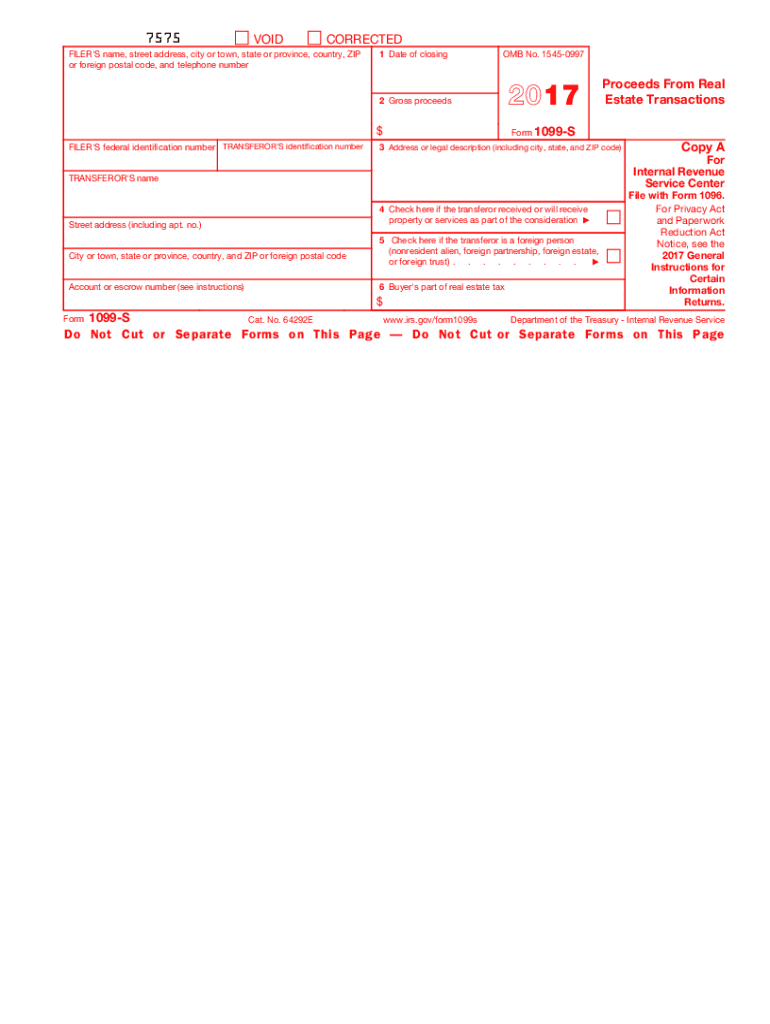

Form 1099 2017

What is the Form 1099

The Form 1099 is a series of documents used in the United States to report various types of income other than wages, salaries, and tips. It is primarily utilized by businesses and individuals to report payments made to non-employees, such as freelancers, contractors, and vendors. The Internal Revenue Service (IRS) requires these forms to ensure that all income is accurately reported and taxed appropriately. There are several variants of the Form 1099, each designated for different types of income, including but not limited to interest income, dividends, and miscellaneous income.

Steps to complete the Form 1099

Completing the Form 1099 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, determine the appropriate type of Form 1099 to use based on the nature of the payment. Fill out the form by entering the required information, such as the amount paid and any withholding tax. Once completed, review the form for any errors before submitting it to the IRS and providing a copy to the recipient. Using a digital solution can streamline this process, making it easier to fill out and sign the form securely.

Legal use of the Form 1099

The legal use of the Form 1099 is governed by IRS guidelines, which stipulate that it must be issued for payments made in the course of a trade or business. This includes payments to independent contractors, rents, and other specified payments. It is essential to issue the form accurately and on time to avoid potential penalties. Additionally, the recipient must report the income listed on the Form 1099 when filing their tax returns. Ensuring compliance with these legal requirements helps maintain transparency and accountability in financial transactions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 vary depending on the specific type of form and the method of submission. Generally, the deadline for providing the form to recipients is January 31 of the year following the tax year in which the payments were made. If filing electronically, the deadline extends to March 31. It is crucial to adhere to these deadlines to avoid late filing penalties, which can accumulate quickly if not addressed promptly.

Who Issues the Form 1099

The Form 1099 is typically issued by businesses or individuals who have made payments to non-employees during the tax year. This includes companies hiring independent contractors, landlords receiving rent payments, and financial institutions reporting interest payments. It is the responsibility of the payer to ensure that the Form 1099 is accurately completed and submitted to the IRS, as well as provided to the recipient. Understanding who is required to issue these forms is vital for maintaining compliance with tax regulations.

Examples of using the Form 1099

There are various scenarios in which the Form 1099 is utilized. For instance, a freelance graphic designer who earns over $600 from a client in a tax year will receive a Form 1099-MISC from that client. Similarly, a landlord who receives rental income must issue a Form 1099 for payments made to a property management company. These examples illustrate the diverse applications of the Form 1099 in reporting income across different industries and professions.

Quick guide on how to complete 2017 form 1099

Easily Prepare Form 1099 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly, without delays. Handle Form 1099 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Effortlessly Edit and eSign Form 1099

- Obtain Form 1099 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or black out sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 1099 and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1099

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1099

How to generate an electronic signature for your 2017 Form 1099 online

How to make an eSignature for the 2017 Form 1099 in Google Chrome

How to create an electronic signature for putting it on the 2017 Form 1099 in Gmail

How to make an eSignature for the 2017 Form 1099 right from your smart phone

How to generate an eSignature for the 2017 Form 1099 on iOS devices

How to generate an eSignature for the 2017 Form 1099 on Android

People also ask

-

What is Form 1099 and why do I need it?

Form 1099 is an IRS tax form used to report various types of income other than wages, salaries, and tips. Businesses often need to file Form 1099 to document payments made to independent contractors, freelancers, or other entities. By using airSlate SignNow, you can easily create, sign, and send Form 1099 electronically, ensuring compliance and efficiency in your tax reporting.

-

How does airSlate SignNow simplify the process of sending Form 1099?

With airSlate SignNow, you can quickly prepare and send Form 1099 to multiple recipients with just a few clicks. Our platform allows you to fill out the form electronically, add necessary signatures, and track the status of each document in real-time. This streamlines the process and reduces the risk of errors associated with paper-based forms.

-

What features does airSlate SignNow offer for managing Form 1099?

airSlate SignNow provides robust features for managing Form 1099, including customizable templates, bulk sending options, and integration with accounting software. Additionally, our platform ensures that all documents are securely stored and accessible, allowing for easy retrieval when needed. These features make it easier for businesses to handle their tax documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 1099?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Each plan includes features specifically designed for managing documents like Form 1099. You can choose a plan that fits your budget and needs, ensuring you have an affordable solution for eSigning and sending important tax documents.

-

Can I integrate airSlate SignNow with my accounting software for Form 1099?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your Form 1099 directly from your existing systems. This integration simplifies your workflow by automatically syncing data, making it easier to keep track of your tax documents and payments.

-

How secure is airSlate SignNow when handling Form 1099?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and secure cloud storage to protect your Form 1099 and other sensitive documents. Our platform also complies with regulatory standards, ensuring that your tax documents are handled with the utmost security and confidentiality.

-

Can I track the status of my Form 1099 once sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form 1099 after you send it. You will receive real-time notifications regarding who has viewed or signed the document, providing you with peace of mind and ensuring that deadlines are met. This feature is particularly useful during the busy tax season.

Get more for Form 1099

- Instructions form 433d

- Form 706 rev october 2006 fill in capable united states estate and generation skipping transfer tax return

- 1120 form for 2006

- Irs tax form 5129

- Irs form 5471 2006

- Form 8264 rev march 2004 fill in capable application for registration of a tax shelter

- Form 8717 rev june 2006 fill in capable user fee for employee plan determination opinion and advisory letter request

- Printable official form 107

Find out other Form 1099

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself