Form 1099 S Proceeds from Real Estate Transactions 2021-2026

What is the Form 1099 S Proceeds From Real Estate Transactions

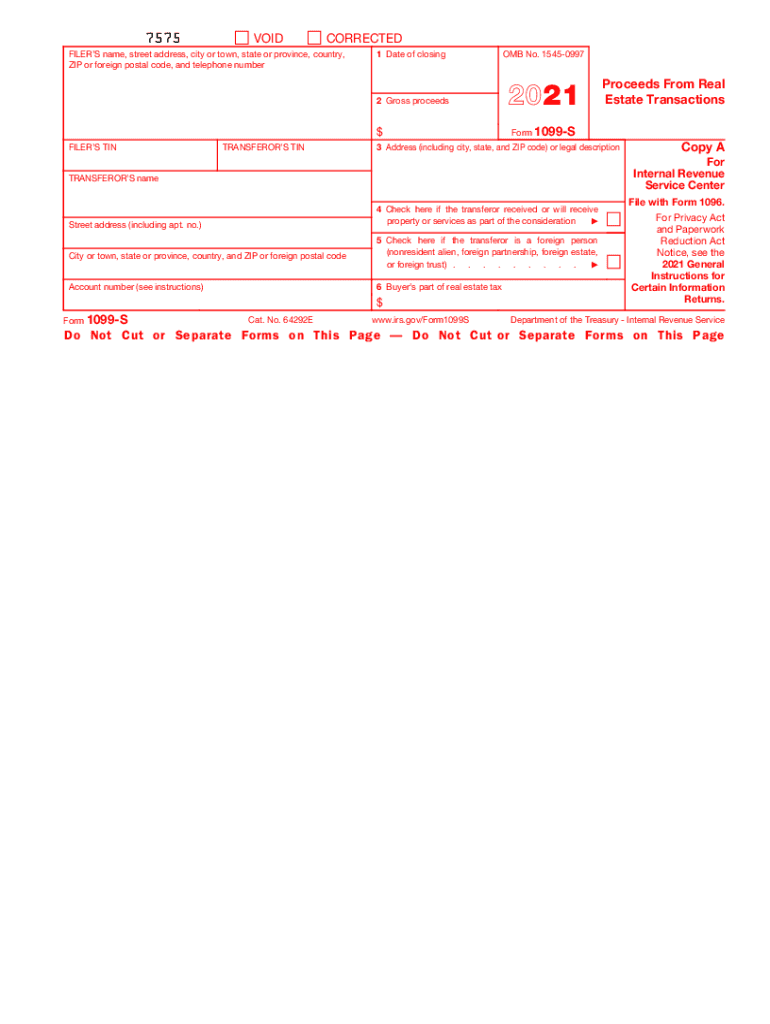

The Form 1099 S is a tax document used to report proceeds from real estate transactions. It is primarily issued when a property is sold, and it captures essential details about the transaction, including the seller's information, the buyer's information, and the gross proceeds from the sale. This form is crucial for both the seller and the IRS, as it helps ensure accurate reporting of income derived from real estate sales. The information reported on the 1099 S is used to calculate capital gains and other tax implications related to the sale of the property.

Steps to complete the Form 1099 S Proceeds From Real Estate Transactions

Completing the Form 1099 S involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the seller's and buyer's names, addresses, and taxpayer identification numbers (TINs). Next, enter the gross proceeds from the sale in the appropriate box on the form. It is also important to check the box indicating whether the transaction was a sale or exchange of real estate. After filling out the form, review all entries for accuracy before submitting it to the IRS and providing a copy to the seller.

Legal use of the Form 1099 S Proceeds From Real Estate Transactions

The legal use of the Form 1099 S is essential for compliance with IRS regulations. This form must be filed whenever a real estate transaction occurs that meets certain criteria, such as sales exceeding a specific amount. Failure to file the form correctly can result in penalties for both the seller and the buyer. It is important to ensure that all information is accurate and that the form is submitted by the deadline to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 S are crucial to avoid penalties. Typically, the form must be filed with the IRS by the end of February if submitted on paper or by the end of March if filed electronically. Additionally, a copy of the form must be provided to the seller by January 31. Staying aware of these deadlines helps ensure compliance and avoids potential fines.

Who Issues the Form

The Form 1099 S is typically issued by the settlement agent or the person responsible for closing the real estate transaction. This may include title companies, real estate brokers, or attorneys involved in the sale. It is their responsibility to gather the necessary information and ensure the form is completed and submitted to the IRS accurately and on time.

Penalties for Non-Compliance

Non-compliance with Form 1099 S filing requirements can lead to significant penalties. The IRS imposes fines for failing to file the form, providing incorrect information, or not providing a copy to the seller. Penalties can vary based on the severity of the non-compliance, ranging from a few hundred dollars to several thousand, depending on how late the form is filed and the number of forms involved.

Quick guide on how to complete 2021 form 1099 s proceeds from real estate transactions

Effortlessly create Form 1099 S Proceeds From Real Estate Transactions on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage Form 1099 S Proceeds From Real Estate Transactions across any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest method to alter and eSign Form 1099 S Proceeds From Real Estate Transactions effortlessly

- Locate Form 1099 S Proceeds From Real Estate Transactions and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 1099 S Proceeds From Real Estate Transactions and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1099 s proceeds from real estate transactions

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1099 s proceeds from real estate transactions

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What are 1099 s 2012 forms, and why are they important?

The 1099 s 2012 forms are tax documents used to report various types of income other than wages, salaries, and tips. They are important because they help the IRS track how much money you earned and ensure that appropriate taxes are paid. For businesses, effectively managing 1099 s 2012 forms can streamline tax season and avoid potential penalties.

-

How does airSlate SignNow assist with 1099 s 2012 documentation?

airSlate SignNow simplifies the process of sending and eSigning 1099 s 2012 documentation by providing a user-friendly platform. You can quickly upload your forms, send them for signatures, and store them securely. This seamless process helps ensure accuracy and compliance for your business.

-

What features does airSlate SignNow offer for managing 1099 s 2012?

With airSlate SignNow, you can easily create, send, and track 1099 s 2012 forms. The platform includes robust features like templates, automated reminders for signers, and integration with various accounting software. These features ensure that you can manage your 1099 s 2012 efficiently and error-free.

-

Is airSlate SignNow cost-effective for managing 1099 s 2012 forms?

Yes, airSlate SignNow offers affordable pricing plans tailored for businesses that need to manage 1099 s 2012 forms efficiently. The cost-effective solution helps reduce overhead expenses related to paperwork and physical storage. By using our platform, businesses can save time and money during tax season.

-

Can I integrate airSlate SignNow with accounting software for 1099 s 2012?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your 1099 s 2012 forms effortlessly. This integration streamlines your workflow, providing a cohesive system for tracking income and expenses, ultimately enhancing your tax preparation process.

-

What is the benefit of eSigning 1099 s 2012 forms with airSlate SignNow?

eSigning 1099 s 2012 forms with airSlate SignNow ensures quicker turnaround times and enhances document security. Signing electronically means faster processing and delivery, reducing the chances of lost documents. Moreover, eSigning offers a legally compliant solution that simplifies record-keeping.

-

How does airSlate SignNow ensure the security of my 1099 s 2012 data?

airSlate SignNow prioritizes the security of your 1099 s 2012 data by using state-of-the-art encryption protocols. All documents are securely stored, and access is restricted to authorized users only. This commitment to security helps protect sensitive information and maintain your confidence in our platform.

Get more for Form 1099 S Proceeds From Real Estate Transactions

- Financial statements only in connection with prenuptial premarital agreement hawaii form

- Revocation of premarital or prenuptial agreement hawaii form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children hawaii form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497304270 form

- Hawaii incorporate form

- Hawaii pre incorporation agreement shareholders agreement and confidentiality agreement hawaii form

- Hawaii bylaws form

- Hi corporations form

Find out other Form 1099 S Proceeds From Real Estate Transactions

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure