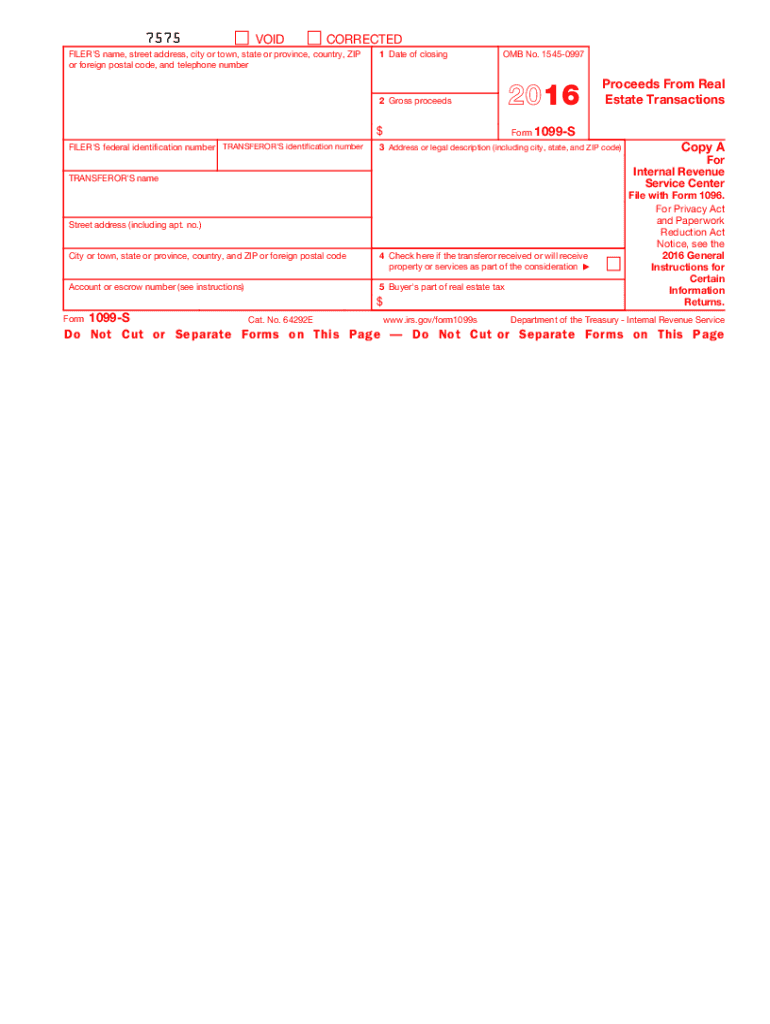

1099s Form 2016

What is the 1099s Form

The 1099s Form is a tax document used in the United States to report income received from sources other than an employer. This form is typically issued to independent contractors, freelancers, and other non-employee workers who have earned $600 or more in a calendar year. It serves as a record for both the taxpayer and the Internal Revenue Service (IRS) to ensure that all income is reported accurately for tax purposes.

How to use the 1099s Form

To use the 1099s Form, recipients must first ensure they receive the form from the payer. Once received, the recipient should review the information for accuracy, including their name, address, and Social Security number or Employer Identification Number (EIN). If the details are correct, the recipient must report the income listed on the form when filing their annual tax return. It is essential to keep a copy of the 1099s Form for personal records as well.

Steps to complete the 1099s Form

Completing the 1099s Form involves several steps:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number.

- Fill in the total amount paid to the recipient during the tax year.

- Include any federal income tax withheld, if applicable.

- Provide your business information as the payer, including your name, address, and taxpayer identification number.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The deadline for filing the 1099s Form varies depending on the method of submission. For forms submitted by mail, the deadline is typically January thirty-first of the year following the tax year. If filing electronically, the deadline may extend to March second. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the 1099s Form on time or inaccuracies in reporting can result in penalties imposed by the IRS. The penalties vary based on how late the form is filed and the size of the business. For example, if a form is filed late, the penalty can range from fifty dollars to three hundred dollars per form, depending on how late it is submitted. Consistent non-compliance may also lead to more severe consequences.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the 1099s Form. These guidelines include instructions on who must file, what information is required, and how to report various types of income. It is essential to consult the most recent IRS publications or the official IRS website for detailed instructions to ensure compliance with current tax laws.

Quick guide on how to complete 1099s 2016 form

Complete 1099s Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your files promptly without delays. Manage 1099s Form on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

How to edit and eSign 1099s Form with ease

- Find 1099s Form and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and hit the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 1099s Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099s 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1099s 2016 form

How to create an eSignature for your 1099s 2016 Form in the online mode

How to generate an eSignature for your 1099s 2016 Form in Google Chrome

How to create an electronic signature for putting it on the 1099s 2016 Form in Gmail

How to make an electronic signature for the 1099s 2016 Form from your smartphone

How to create an eSignature for the 1099s 2016 Form on iOS devices

How to create an eSignature for the 1099s 2016 Form on Android

People also ask

-

What is a 1099s Form and why is it important?

The 1099s Form is a tax document used to report income received by individuals or businesses that are not employees. It is crucial for tax reporting purposes, ensuring that all income is accurately accounted for during tax season. Using airSlate SignNow, you can easily create, send, and eSign your 1099s Forms, streamlining your tax documentation process.

-

How can airSlate SignNow help me manage 1099s Forms?

airSlate SignNow provides a user-friendly platform for managing 1099s Forms, allowing you to create and send these documents efficiently. With our electronic signature feature, you can obtain signatures from recipients quickly, ensuring timely submissions to the IRS. This helps in reducing paperwork and improving your overall workflow.

-

Are there any fees associated with sending 1099s Forms using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. While there are costs associated with sending 1099s Forms, our plans are designed to be cost-effective, ensuring you get great value for your investment. You can choose a plan that fits your budget and usage requirements.

-

Can I integrate airSlate SignNow with my accounting software for 1099s Forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your 1099s Forms alongside your financial data. This integration helps streamline your workflow, allowing you to automatically populate and send 1099s Forms without manual entry.

-

Is it easy to eSign a 1099s Form with airSlate SignNow?

Yes, eSigning a 1099s Form with airSlate SignNow is incredibly simple. You can quickly upload your form, add the necessary fields for signatures, and send it out for signing. Recipients can eSign from any device, making the process fast and efficient.

-

What security measures does airSlate SignNow have for 1099s Forms?

airSlate SignNow takes the security of your documents seriously. We use advanced encryption protocols to protect your 1099s Forms during transmission and storage, ensuring that sensitive information remains confidential. Our platform complies with industry standards to provide a secure eSigning experience.

-

Can I track the status of my 1099s Forms sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your sent 1099s Forms in real-time. You will receive notifications when your document is viewed and signed, so you can stay informed about its progress. This feature enhances accountability and helps ensure timely submissions.

Get more for 1099s Form

- Online printable mse form

- Transportation electronic award management system grantee recipient user access request form

- Borrower financial information flagstar

- Proper ty owners registra tion form all new york title

- What is the function of the borrowers certification and authorization form

- Endorser addendum form

- Dmv application form pdf san jose sanjose

- Xd10 form

Find out other 1099s Form

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF