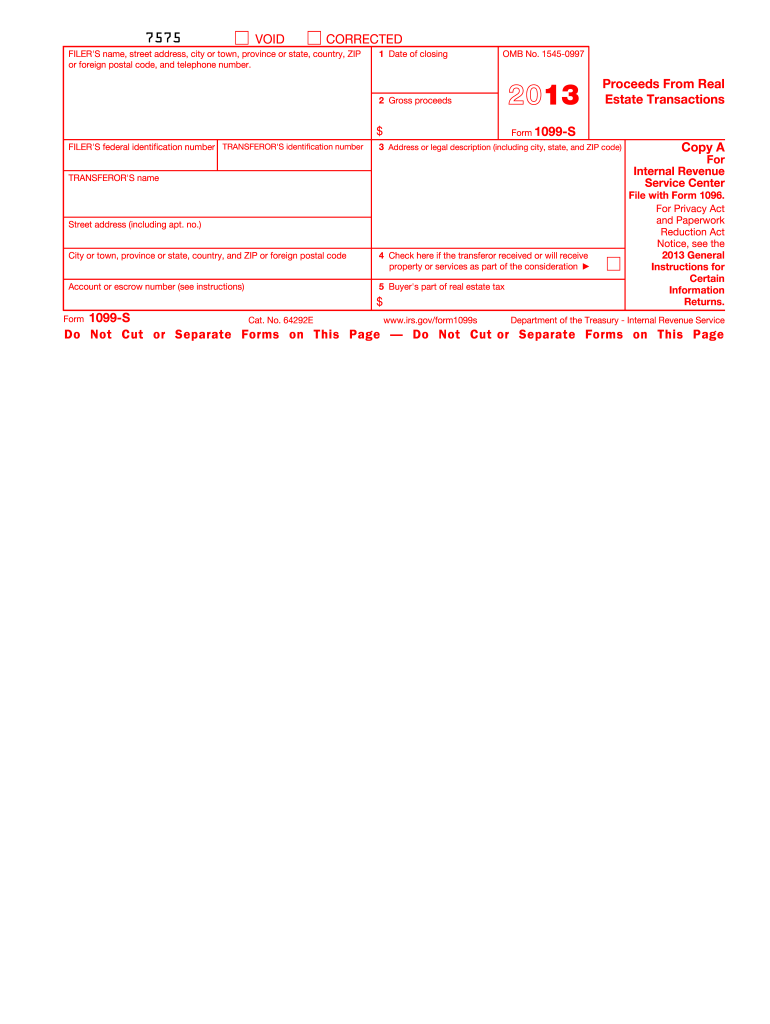

Form 1099 2013

What is the Form 1099

The Form 1099 is a series of documents used in the United States to report various types of income other than wages, salaries, and tips. It is essential for tax reporting purposes, ensuring that individuals and businesses accurately report their earnings to the Internal Revenue Service (IRS). There are several variants of the Form 1099, including the 1099-MISC for miscellaneous income and the 1099-NEC specifically for non-employee compensation. Each variant serves a distinct purpose, and understanding which form to use is crucial for compliance with tax regulations.

Steps to complete the Form 1099

Completing the Form 1099 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, determine the type of income being reported and select the appropriate variant of the Form 1099. Fill in the required fields accurately, including the total amount paid to the recipient during the tax year. Finally, review the completed form for any errors before submitting it to the IRS and providing a copy to the recipient. It is important to keep a copy for your records as well.

Legal use of the Form 1099

The legal use of the Form 1099 is governed by IRS regulations. It is crucial to issue a Form 1099 to any individual or entity that has received at least $600 in reportable payments during the tax year. This includes payments for services, rents, prizes, and other income. Failure to issue the form when required can result in penalties. Additionally, recipients must report the income listed on the Form 1099 on their tax returns, making accurate reporting essential for both parties involved.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 vary depending on the specific variant being submitted. Generally, the forms must be sent to recipients by January 31 of the following year. If filing electronically, the deadline may extend to March 31. It is important to adhere to these deadlines to avoid penalties. Additionally, the IRS requires that all Forms 1099 be filed by specific dates, which can vary based on the method of submission, whether by paper or electronically.

Who Issues the Form 1099

The Form 1099 is typically issued by businesses or individuals who make payments to independent contractors, freelancers, or other entities. This includes companies that hire subcontractors, landlords collecting rent, and organizations awarding prizes or awards. It is the responsibility of the payer to accurately complete and distribute the Form 1099 to the appropriate recipients and the IRS. Understanding who is required to issue the form is essential for compliance with tax obligations.

Examples of using the Form 1099

There are various scenarios in which the Form 1099 is utilized. For instance, a freelance graphic designer who earns more than $600 from a single client would receive a 1099-NEC from that client to report their income. Similarly, a landlord receiving rental payments may issue a 1099-MISC to report the total rent received from a tenant. These examples illustrate the diverse applications of the Form 1099 in different income situations, emphasizing its importance in the tax reporting process.

Quick guide on how to complete 2013 form 1099

Complete Form 1099 effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage Form 1099 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and eSign Form 1099 seamlessly

- Obtain Form 1099 and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or obscured files, tedious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form 1099 and guarantee outstanding communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1099

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1099

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is a Form 1099, and why is it important?

Form 1099 is a tax form used to report income earned by non-employees, making it essential for independent contractors and freelancers. Accurately completing and sending the Form 1099 is crucial to ensure compliance with IRS regulations and to avoid penalties. By using airSlate SignNow, you can easily prepare and send this form securely and efficiently.

-

How can airSlate SignNow help with Form 1099 management?

AirSlate SignNow enables you to streamline the process of preparing and eSigning Form 1099. Our platform allows you to upload your tax documents, collect necessary signatures, and maintain an organized record of your submissions. This not only saves time but also enhances accuracy and compliance.

-

Is airSlate SignNow a cost-effective solution for managing Form 1099?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 1099 and other documents. With flexible pricing plans, businesses can choose a package that suits their needs without overspending. Our service maximizes your investment by simplifying document workflows.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1099?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software to simplify your Form 1099 preparation process. This integration allows for easy import of data, saving you time and minimizing errors. Syncing your data ensures a smooth workflow between your accounting tools and our eSignature platform.

-

What features does airSlate SignNow offer for eSigning Form 1099?

AirSlate SignNow provides numerous features for eSigning Form 1099, such as customizable templates, real-time tracking, and secure cloud storage. With user-friendly tools, you can create and manage documents effortlessly. These features ensure that your Form 1099 eSigning process is fast, efficient, and secure.

-

Can airSlate SignNow ensure the security of my Form 1099 data?

Yes, security is a top priority for airSlate SignNow. We employ advanced encryption and secure servers to protect your Form 1099 and personal information. Additionally, our platform is compliant with industry standards, ensuring that your data remains confidential during the eSigning process.

-

Are there any limits on the number of Form 1099 documents I can send with airSlate SignNow?

AirSlate SignNow offers flexible plans that cater to different business sizes, with varying limits on the number of documents you can send. Our higher-tier plans provide unlimited document sends, ensuring you can manage all your Form 1099 requirements without constraints. Check our pricing page for plan details!

Get more for Form 1099

Find out other Form 1099

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF