Crf002 2012-2026

What is the CRF 002?

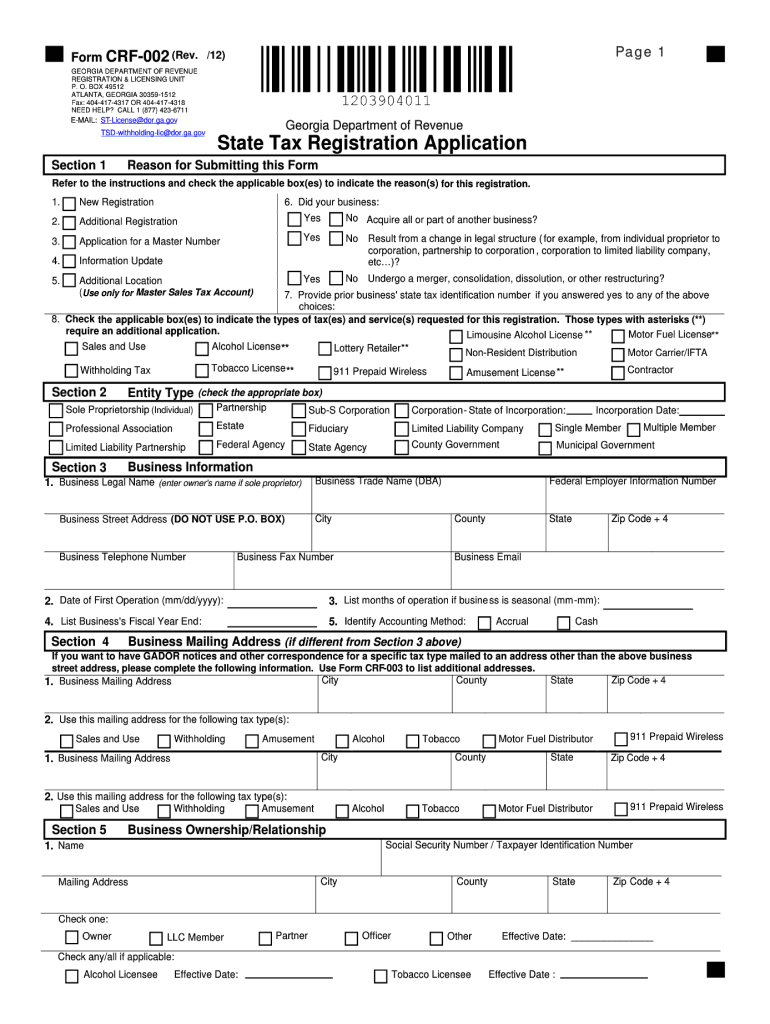

The CRF 002 is a specific form used primarily in Georgia for tax reporting purposes. It serves as a crucial document for individuals and businesses to report their income and calculate their tax liabilities accurately. The form is designed to meet the requirements set forth by the Internal Revenue Service (IRS) and the Georgia Department of Revenue. Understanding the CRF 002 is essential for ensuring compliance with state tax laws and for effectively managing your tax obligations.

How to Obtain the CRF 002

To obtain the CRF 002, individuals can visit the official Georgia Department of Revenue website, where the form is available for download. The form can be accessed in a fillable PDF format, allowing users to complete it electronically. Additionally, physical copies may be available at local tax offices or libraries. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Steps to Complete the CRF 002

Completing the CRF 002 involves several key steps:

- Download the CRF 002 form from the Georgia Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income sources and any deductions you plan to claim.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign the form electronically using a compliant eSignature solution, such as airSlate SignNow.

- Submit the completed form either electronically or by mail, following the instructions provided.

Legal Use of the CRF 002

The CRF 002 is legally recognized as a valid document for tax reporting in Georgia. It must be completed accurately and submitted by the designated deadlines to avoid penalties. The form is designed to comply with IRS regulations, allowing for electronic signatures, which enhances its legal standing. It is crucial for taxpayers to understand the legal implications of the information provided on the form, as inaccuracies can lead to audits or fines.

Key Elements of the CRF 002

Key elements of the CRF 002 include:

- Personal identification information, such as name and address.

- Income reporting sections that require details of earnings from various sources.

- Deductions and credits that may apply to reduce taxable income.

- Signature section for verification and legal acknowledgment.

Each section must be completed with accurate information to ensure proper processing by the tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the CRF 002 are typically aligned with the federal tax filing dates. For most taxpayers, the deadline is April 15 of each year. However, it is important to check for any specific state extensions or changes that may apply. Keeping track of these dates is essential to avoid late fees and ensure timely compliance with tax obligations.

Digital vs. Paper Version

The digital version of the CRF 002 offers several advantages over the paper version. Completing the form online allows for easier data entry, automatic calculations, and the ability to save and edit the document as needed. Additionally, electronic submission can expedite processing times and reduce the risk of lost documents. However, some taxpayers may prefer the paper version for its tangible nature and the ability to review it in a physical format.

Quick guide on how to complete sumbit form crf 002 to georgia 2012 2019

Your assistance manual on how to prepare your Crf002

If you’re interested in learning how to create and submit your Crf002, here are some brief guidelines to simplify the tax processing.

First, you only need to set up your airSlate SignNow profile to revolutionize how you handle documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, generate, and complete your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to edit details as necessary. Enhance your tax management with advanced PDF editing, electronic signing, and intuitive sharing.

Follow the instructions below to accomplish your Crf002 in just a few minutes:

- Create your account and begin working on PDFs almost immediately.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Crf002 in our editor.

- Complete the necessary fillable fields with your information (text content, numbers, checks).

- Employ the Sign Tool to append your legally-recognized eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Be aware that submitting via paper can increase return mistakes and delay refunds. Naturally, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

What things are required to fill out the NDA form for 2019?

Hello,To fill the application form candidates must have the following details/documents.Email id and Mobile numberBank card details for online paymentPhotograph (3 KB - 40 KB)Signature ( 1 KB - 40 KB)Community CertificateEducational qualification detailsTo know the details about NDA Application form - Click hereThank you..!!

-

What are the steps to fill out the JEE Mains 2019 application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application formJEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the sumbit form crf 002 to georgia 2012 2019

How to generate an eSignature for the Sumbit Form Crf 002 To Georgia 2012 2019 in the online mode

How to make an eSignature for your Sumbit Form Crf 002 To Georgia 2012 2019 in Google Chrome

How to make an eSignature for signing the Sumbit Form Crf 002 To Georgia 2012 2019 in Gmail

How to make an electronic signature for the Sumbit Form Crf 002 To Georgia 2012 2019 right from your smart phone

How to generate an electronic signature for the Sumbit Form Crf 002 To Georgia 2012 2019 on iOS devices

How to make an electronic signature for the Sumbit Form Crf 002 To Georgia 2012 2019 on Android OS

People also ask

-

What is Crf002 and how does it relate to airSlate SignNow?

Crf002 refers to a specific compliance or regulatory framework that airSlate SignNow adheres to, ensuring secure electronic signatures and document management. Utilizing Crf002 standards, businesses can maintain compliance while streamlining their signing processes.

-

How much does airSlate SignNow with Crf002 compliance cost?

Pricing for airSlate SignNow varies based on the features and the number of users, but it is designed to be cost-effective. Businesses looking for Crf002 compliant solutions can choose from various plans that cater to their specific needs without breaking the bank.

-

What features does airSlate SignNow offer for Crf002 compliance?

airSlate SignNow offers a range of features that support Crf002 compliance, including secure document storage, audit trails, and customizable templates. These features not only enhance security but also improve the overall efficiency of document management.

-

Can I integrate airSlate SignNow with other tools while ensuring Crf002 compliance?

Yes, airSlate SignNow offers seamless integrations with various business tools and applications while maintaining Crf002 compliance. This flexibility allows businesses to streamline their workflows without compromising security or regulatory standards.

-

What are the benefits of using airSlate SignNow for Crf002 compliant signing?

Using airSlate SignNow for Crf002 compliant signing provides numerous benefits, such as enhanced security, improved efficiency, and reduced turnaround times for document signing. This solution empowers businesses to manage their documents confidently and in compliance with necessary regulations.

-

Is airSlate SignNow suitable for all business sizes under Crf002 regulations?

Absolutely! airSlate SignNow is suitable for businesses of all sizes looking to comply with Crf002 regulations. Whether you're a small startup or a large enterprise, this solution can scale to meet your needs while ensuring compliance.

-

How do I get started with airSlate SignNow for Crf002 compliance?

Getting started with airSlate SignNow for Crf002 compliance is simple. You can sign up for a free trial on the website, explore the features, and see how it meets your compliance needs before committing to a plan.

Get more for Crf002

- Partnership form 1065calendar year due date

- California school immunization record california department of sunol k12 ca form

- Request that your employer withhold an additional amount from your pay which may help avoid having too little tax form

- If there are more than 10 locations please attach a separate listing form

- Massachusetts m 4 employees withholding exemption certificate form

- Form ma 1099 hc individual mandate massachusetts massgov

- Massachusetts department of revenue form st 7r motor

- Form 228a federal income tax withholding certificate form 228a federal income tax withholding certificate

Find out other Crf002

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free