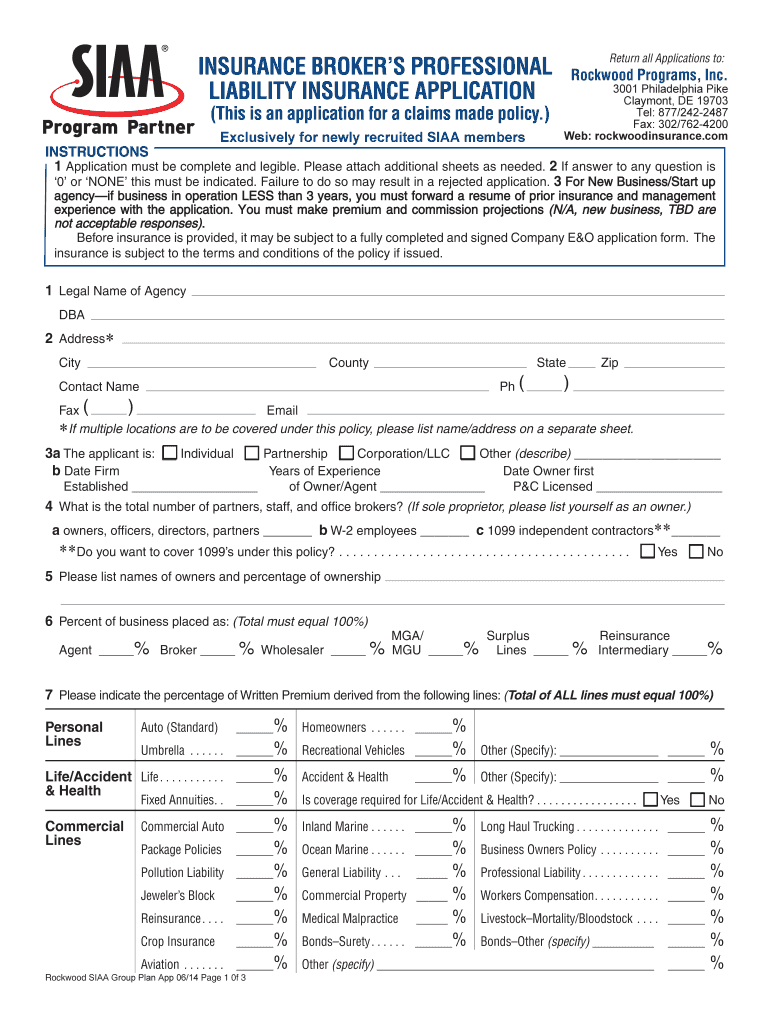

This is an Application for a Claims Made Policy 2014-2026

Understanding the claims made policy application

The claims made policy application is a crucial document for individuals and businesses seeking insurance coverage that responds to claims made during the policy period. This type of insurance is particularly relevant in professional fields where liability claims may arise after services have been rendered. The application typically requires detailed information about the applicant's business, including its history, the types of services offered, and any previous claims or incidents. Understanding the nuances of this application is essential for ensuring that coverage aligns with specific needs and risks.

Steps to complete the claims made policy application

Completing the claims made policy application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including business details and any relevant history of claims. Carefully read through the application to understand each section and the information required. Fill out the application thoroughly, providing clear and concise answers. Once completed, review the document for any errors or omissions before submission. Ensuring that all information is accurate helps in avoiding delays in processing and potential issues with coverage.

Legal considerations for the claims made policy application

When submitting a claims made policy application, it is important to be aware of the legal implications. The application must comply with state and federal regulations governing insurance practices. Providing false or misleading information can lead to legal repercussions, including denial of coverage or cancellation of the policy. Additionally, understanding the legal definitions and requirements associated with claims made policies can help applicants navigate potential challenges. Consulting with a legal or insurance professional may provide valuable insights into the legal landscape surrounding this type of insurance.

Required documents for the claims made policy application

To successfully complete the claims made policy application, certain documents are typically required. These may include proof of prior insurance coverage, financial statements, and documentation of any past claims or incidents. Depending on the nature of the business, additional documents such as licenses or certifications may also be necessary. Gathering these documents ahead of time can streamline the application process and ensure that all necessary information is readily available for review.

Common scenarios for claims made policy applications

Various scenarios may prompt individuals or businesses to submit a claims made policy application. For instance, professionals in fields such as healthcare, legal services, or consulting often require this type of insurance to protect against potential liability claims. Additionally, businesses expanding their operations or introducing new services may seek coverage to mitigate risks associated with these changes. Understanding the specific scenarios that warrant a claims made policy can help applicants make informed decisions about their insurance needs.

Quick guide on how to complete this is an application for a claims made policy

Complete This Is An Application For A Claims Made Policy effortlessly on any gadget

Online document organization has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage This Is An Application For A Claims Made Policy on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to modify and eSign This Is An Application For A Claims Made Policy with ease

- Locate This Is An Application For A Claims Made Policy and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign This Is An Application For A Claims Made Policy while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this is an application for a claims made policy

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is SIAA insurance and how does it work?

SIAA insurance refers to the insurance solutions provided through the SIAA (Strategic Insurance Agency Alliance). It creates a network of independent insurance agencies, allowing members to access a variety of insurance products and services to best meet their clients' needs. With SIAA insurance, agencies can enhance their offerings and competitive edge in the market.

-

What are the benefits of choosing SIAA insurance?

Choosing SIAA insurance provides numerous benefits, including access to a wide range of insurance products, competitive pricing, and enhanced support services. Members of the SIAA network can leverage collective buying power to obtain better rates, which can lead to cost savings for their clients. Additionally, the alliance offers training and resources to help agencies grow and succeed.

-

How does SIAA insurance pricing work?

SIAA insurance pricing is competitive and varies based on the specific insurance products and services being offered. Agencies often benefit from reduced rates due to the collective bargaining power of the SIAA network, allowing them to provide their clients with affordable options. It's advisable for agencies to consult with SIAA representatives for detailed pricing structures.

-

What features does SIAA insurance offer to agencies?

SIAA insurance offers a variety of features, including access to a broad portfolio of insurance products, marketing support, and training resources. Agencies benefit from a robust technology platform that simplifies the insurance process and enhances customer engagement. These features enable agencies to operate more efficiently and effectively serve their clients.

-

Can I integrate airSlate SignNow with SIAA insurance solutions?

Yes, airSlate SignNow can be integrated with SIAA insurance solutions to streamline document signing and management. This integration allows agencies to easily send and eSign insurance documents, improving overall efficiency and client experience. By combining these powerful tools, agencies can enhance their workflow and focus on delivering exceptional service.

-

What kind of support does SIAA insurance provide to its members?

SIAA insurance provides comprehensive support to its members, including training, marketing assistance, and access to industry experts. Members can take advantage of networking opportunities and collaborative resources that help them stay informed about industry trends. This support structure is designed to help agencies thrive in a competitive environment.

-

How can SIAA insurance help my agency grow?

SIAA insurance can signNowly help your agency grow by providing access to a wide range of resources, competitive pricing, and networking opportunities with other agencies. The alliance promotes collaboration and sharing of best practices among its members, which can lead to enhanced business strategies. Additionally, SIAA membership offers tools and training that empower agencies to attract and retain clients.

Get more for This Is An Application For A Claims Made Policy

- Attachment to proof of service form

- Essential forms 42 for windows california courts cagov

- Fillable online pos 030d fax email print pdffiller form

- Form pos 040p fill online printable fillable blankpdffiller

- Proof of service civil form

- Attachment to pos 040 fill online printable fillable blank form

- Pos 040p form

- Forms santa clara superior court

Find out other This Is An Application For A Claims Made Policy

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement