Form 4136 for 2011

What is the Form 4136 For

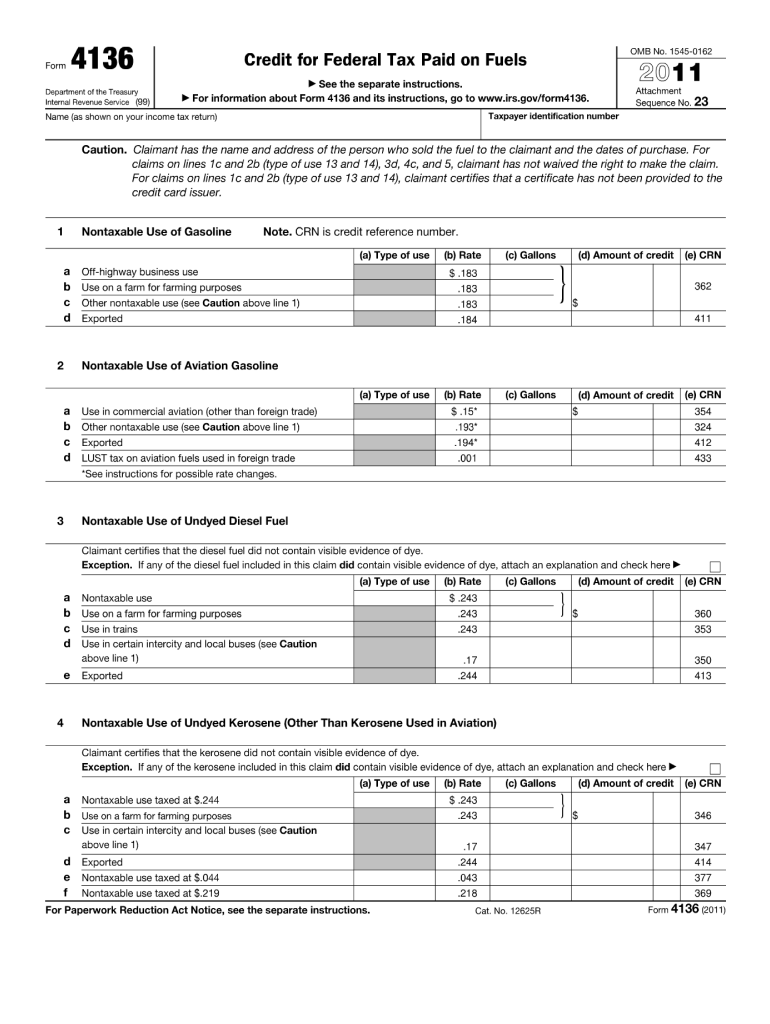

The Form 4136 is a tax form used by taxpayers in the United States to claim a credit for the federal excise tax on gasoline and special fuels. This form is particularly relevant for individuals and businesses that use these fuels for non-highway purposes, such as farming or certain types of commercial transportation. By filing this form, eligible taxpayers can recover some of the taxes paid on fuels that are not used on public highways, thus providing financial relief and encouraging the use of alternative fuel sources.

How to use the Form 4136 For

Using Form 4136 involves several straightforward steps. First, gather all necessary information regarding the fuel purchases, including the total gallons purchased and the amount of excise tax paid. Next, accurately complete the form by entering your details, including your name, address, and taxpayer identification number. Ensure that you provide the correct figures for the gallons of fuel used and the corresponding tax amounts. After completing the form, it should be submitted along with your tax return to the Internal Revenue Service (IRS) for processing.

Steps to complete the Form 4136 For

Completing Form 4136 requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by downloading the form from the IRS website or accessing it through tax software.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Document the total gallons of fuel purchased during the tax year.

- Calculate the total excise tax paid on the fuel and enter this amount on the form.

- Review all entries for accuracy before submission.

- Submit the completed form with your annual tax return or as a standalone document if applicable.

Legal use of the Form 4136 For

The legal use of Form 4136 is governed by IRS regulations. To be eligible to claim the credit, taxpayers must ensure that the fuel was used for qualified purposes, such as farming or off-highway business activities. It is essential to maintain accurate records of fuel purchases and usage to substantiate claims made on the form. Failure to comply with IRS guidelines may result in penalties or denial of the credit.

Filing Deadlines / Important Dates

Filing deadlines for Form 4136 align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of each year. If you are claiming a credit using Form 4136, ensure that it is submitted by this date to avoid late penalties. Additionally, if you require an extension for your tax return, be aware that the extension does not automatically apply to the Form 4136, which must still be filed on time to claim the credit.

Required Documents

To complete Form 4136 accurately, certain documents are necessary. These include:

- Receipts or invoices for fuel purchases to verify the amount of fuel used.

- Records of the excise tax paid on the fuel.

- Any previous tax returns that may be relevant to the current filing.

Having these documents on hand will facilitate a smoother filing process and ensure that all claims are substantiated.

Quick guide on how to complete form 4136 for 2011

Prepare Form 4136 For effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your files quickly without delays. Manage Form 4136 For on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 4136 For without stress

- Find Form 4136 For and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 4136 For and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4136 for 2011

Create this form in 5 minutes!

How to create an eSignature for the form 4136 for 2011

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 4136 For and how can airSlate SignNow assist with it?

Form 4136 For is a document used for claiming certain federal tax credits related to fuel. airSlate SignNow provides an efficient platform to eSign and manage this form, ensuring you can easily submit it without hassle. Our solution simplifies the signing process, making it quicker and more convenient for your business.

-

Is airSlate SignNow suitable for filling out Form 4136 For?

Absolutely! airSlate SignNow is designed to handle various types of documents, including Form 4136 For. Our user-friendly interface allows you to fill, sign, and securely send this form, streamlining your document management process.

-

What are the pricing options for airSlate SignNow when using Form 4136 For?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs. When managing Form 4136 For, you can choose from our subscription plans that provide access to features that enhance document workflow efficiency. You can also try our services with a free trial to see how it works for your needs.

-

What features does airSlate SignNow offer for managing Form 4136 For?

airSlate SignNow includes features such as templates, custom fields, and unlimited electronic signatures for efficiently managing Form 4136 For. Additionally, our platform allows real-time tracking, ensuring you know the status of your documents at all times. These features make it easier to compile, sign, and send your forms seamlessly.

-

How does airSlate SignNow ensure the security of Form 4136 For?

The security of your documents, including Form 4136 For, is a top priority for airSlate SignNow. We employ industry-standard encryption, secure cloud storage, and compliance with legal regulations to protect your sensitive information. You can trust that your forms are handled safely and securely.

-

Can I integrate airSlate SignNow with other applications to manage Form 4136 For?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems and cloud storage services. This functionality allows you to manage Form 4136 For alongside your existing tools. Streamlining your workflow becomes easier when all your applications work in harmony.

-

What are the benefits of using airSlate SignNow for Form 4136 For?

Using airSlate SignNow for Form 4136 For provides several benefits, including speed and convenience in document signing and management. Our intuitive platform reduces the time taken to complete and send forms while ensuring compliance. By choosing airSlate SignNow, you enhance your productivity and improve document handling efficiency.

Get more for Form 4136 For

- Identity theft prevention package iowa form

- Iowa theft form

- Identity theft by known imposter package iowa form

- Organizing your personal assets package iowa form

- Essential documents for the organized traveler package iowa form

- Essential documents for the organized traveler package with personal organizer iowa form

- Postnuptial agreements package iowa form

- Letters of recommendation package iowa form

Find out other Form 4136 For

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure