Www Irs Govpubirs Pdf2021 Form 4136 Internal Revenue Service 2021

Understanding IRS Form 4136

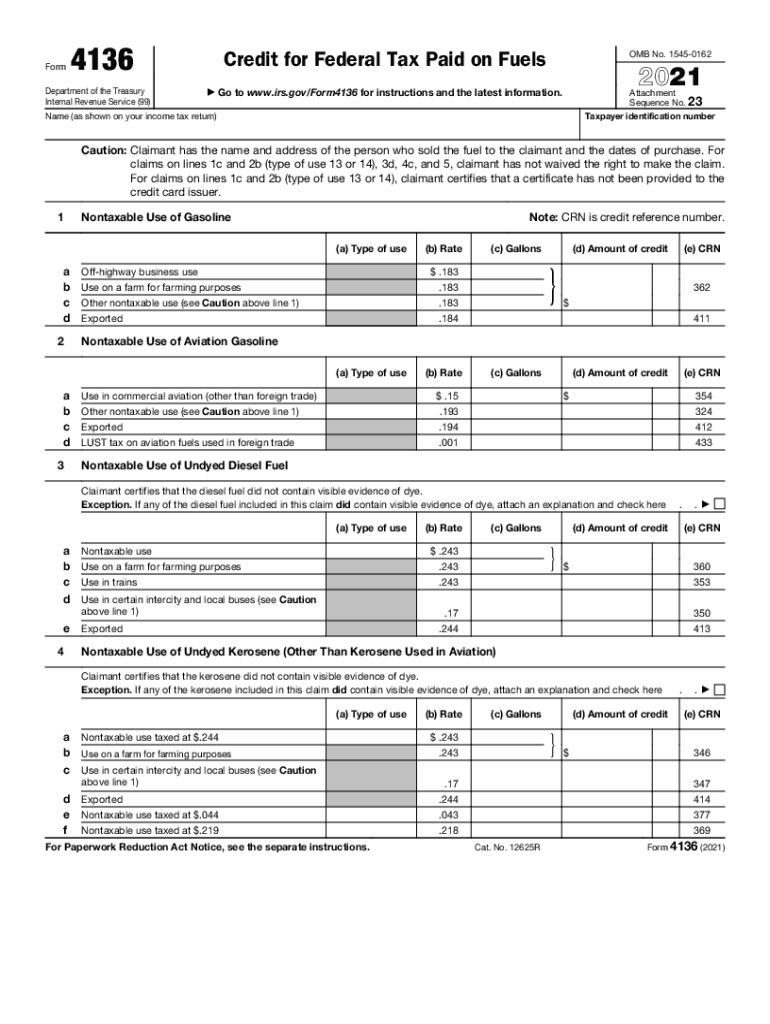

IRS Form 4136, also known as the Credit for Federal Tax Paid on Fuels, is a tax form used by businesses and individuals to claim a credit for federal excise tax paid on certain fuels. This form is particularly relevant for those who use fuel for non-highway purposes, such as farming, fishing, or other qualifying activities. By completing this form, taxpayers can potentially recover some of the fuel taxes they have paid throughout the year, making it an important tool for managing fuel costs effectively.

Steps to Complete IRS Form 4136

Completing IRS Form 4136 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts for fuel purchases and any relevant tax records. Next, fill out the form by providing details such as the type of fuel used, the amount of federal excise tax paid, and the purpose for which the fuel was used. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form with your tax return, ensuring that it is filed by the appropriate deadline to avoid penalties.

Eligibility Criteria for IRS Form 4136

To qualify for the credits available on IRS Form 4136, taxpayers must meet specific eligibility criteria. Generally, the form is available to individuals and businesses that have paid federal excise tax on fuels used for off-highway purposes. This includes fuel used in farming, fishing, and certain types of commercial transportation. Additionally, the claimant must have documentation proving the amount of tax paid and the intended use of the fuel. Understanding these criteria is essential for ensuring that you can successfully claim the credit.

Filing Deadlines for IRS Form 4136

Filing deadlines for IRS Form 4136 align with the standard tax filing deadlines. Typically, taxpayers must submit their completed forms by April 15 of the following tax year. However, if you file for an extension, you will have additional time to submit your form. It is important to be aware of these deadlines to avoid any potential late fees or penalties. Keeping track of these dates ensures that you can maximize your credits without running into compliance issues.

Legal Use of IRS Form 4136

The legal use of IRS Form 4136 is governed by federal tax laws, which stipulate the conditions under which taxpayers can claim credits for fuel taxes. To ensure compliance, it is essential to accurately report the amount of federal excise tax paid and the specific uses of the fuel. Misrepresentation or errors in filing can lead to audits or penalties. Utilizing a reliable electronic signature solution for submitting the form can enhance the legal validity of your submission, ensuring that all parties involved are properly authenticated.

Key Elements of IRS Form 4136

Key elements of IRS Form 4136 include sections that require detailed information about the fuel used, the federal excise tax paid, and the purpose of the fuel consumption. The form also includes a section for claiming credits based on the total tax paid. Understanding these elements is crucial for accurately completing the form and maximizing potential tax credits. Additionally, taxpayers should be aware of the importance of maintaining supporting documentation to substantiate their claims.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 4136 internal revenue service

Complete Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly, without any procrastination. Handle Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service effortlessly

- Locate Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service and click Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of your documents or black out sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details thoroughly and click on the Done button to preserve your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service and guarantee seamless communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 4136 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 4136 internal revenue service

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is the form 4136, and why is it important?

The form 4136 is a crucial document for claiming refunds of excise taxes on certain fuel types. Businesses and individuals who pay these taxes can use form 4136 to request refunds efficiently. Understanding how to fill out this form correctly can save you time and money.

-

How does airSlate SignNow support the signing of form 4136?

airSlate SignNow offers a user-friendly platform for electronically signing form 4136, ensuring that you can complete your transactions efficiently. Our eSignature solution allows you to send, sign, and manage documents securely, streamlining the process of submitting important tax forms like form 4136.

-

What features does airSlate SignNow provide for managing form 4136?

With airSlate SignNow, you can easily create, edit, and collaborate on form 4136 and other documents. Our platform includes features such as templates, unlimited eSignatures, and the ability to track document status. These features make it easy to keep your paperwork organized and compliant.

-

Is airSlate SignNow a cost-effective solution for dealing with form 4136?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses processing documents like form 4136. Our competitive pricing plans provide you with all the tools necessary to manage your forms efficiently, helping you reduce operational costs while ensuring compliance.

-

Can I integrate airSlate SignNow with other tools for form 4136 processing?

Absolutely! airSlate SignNow integrates seamlessly with many popular business applications, enhancing the workflow for processing form 4136. Whether you use CRM systems, document management solutions, or accounting software, you can easily integrate our eSignature solution to improve efficiency.

-

How secure is the information provided in form 4136 when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for form 4136, your personal and financial information is protected by advanced encryption methods. We comply with the highest industry standards to ensure your data remains private and secure during the signing process.

-

What are the benefits of using airSlate SignNow for form 4136?

Using airSlate SignNow for form 4136 offers several benefits, including time savings, increased efficiency, and reduced paper usage. Our platform allows for quick document turnaround and facilitates easy collaboration among multiple signers, ultimately enhancing your productivity.

Get more for Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service

Find out other Www irs govpubirs pdf2021 Form 4136 Internal Revenue Service

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship