Form 4136 Credit for Federal Tax Paid on Fuels 2020

What is the Form 4136 Credit For Federal Tax Paid On Fuels

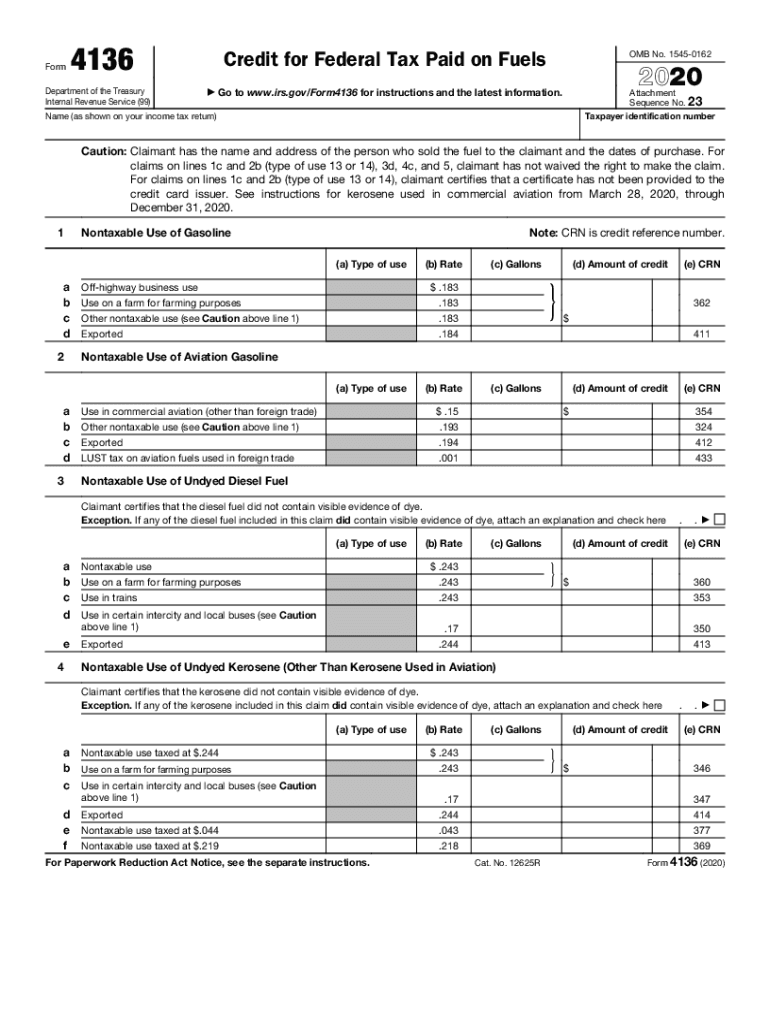

The IRS Form 4136 is used to claim a credit for federal tax paid on fuels. This credit is available to individuals and businesses that have paid federal excise taxes on fuel used for specific purposes, such as off-highway business use, farming, or certain types of transportation. The form allows taxpayers to receive a refund for the taxes paid on fuels that were not used on public highways, effectively reducing their overall tax burden. Understanding the eligibility criteria and how to accurately complete this form is essential for maximizing potential refunds.

Steps to Complete the Form 4136 Credit For Federal Tax Paid On Fuels

Completing the IRS Form 4136 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts and records of fuel purchases. Next, fill out the form by providing details such as the type of fuel, the quantity used, and the purpose of the fuel usage. It is crucial to calculate the credit amount correctly based on the federal excise tax rates applicable to the fuel types. Once completed, review the form for any errors before submission. Accurate completion can help avoid delays in processing your credit claim.

Eligibility Criteria

To qualify for the credit on IRS Form 4136, taxpayers must meet specific eligibility requirements. Generally, the credit is available to individuals and businesses that have paid federal excise tax on fuels used for off-highway purposes or in specific vehicles. Eligible uses include farming, certain types of commercial transportation, and other non-highway applications. It is important to maintain proper documentation of fuel purchases and usage to substantiate claims made on the form. Taxpayers should also ensure they are not claiming credits for fuel used on public highways, as this would disqualify them from receiving the credit.

Filing Deadlines / Important Dates

When filing IRS Form 4136, awareness of important deadlines is essential to ensure timely processing. The form is typically filed alongside your annual tax return. For most taxpayers, this means submitting the form by April fifteenth of the following year. However, if you are filing for an extension, be sure to check the extended deadline. Staying informed about these dates helps prevent missed opportunities for claiming the credit and ensures compliance with IRS regulations.

Form Submission Methods

IRS Form 4136 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed electronically as part of your annual tax return using compatible tax software. Alternatively, taxpayers may choose to print and mail the completed form directly to the IRS. It is important to follow the specific instructions provided by the IRS regarding submission methods to ensure proper processing. Each method has its own advantages, such as faster processing times for electronic submissions.

Key Elements of the Form 4136 Credit For Federal Tax Paid On Fuels

Understanding the key elements of IRS Form 4136 is crucial for accurate completion. The form requires information about the taxpayer, including name, address, and taxpayer identification number. Additionally, it includes sections to detail the types of fuel used, the quantity, and the specific purposes for which the fuel was utilized. Taxpayers must also calculate the total credit based on applicable federal excise tax rates. Ensuring that all required fields are completed accurately can help facilitate a smooth filing process.

Quick guide on how to complete 2020 form 4136 credit for federal tax paid on fuels

Effortlessly Prepare Form 4136 Credit For Federal Tax Paid On Fuels on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 4136 Credit For Federal Tax Paid On Fuels on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Form 4136 Credit For Federal Tax Paid On Fuels with Ease

- Find Form 4136 Credit For Federal Tax Paid On Fuels and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages your document management needs in just a few clicks from any device you choose. Modify and eSign Form 4136 Credit For Federal Tax Paid On Fuels and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 4136 credit for federal tax paid on fuels

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 4136 credit for federal tax paid on fuels

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the IRS fuel form 4136 2018 and who needs it?

The IRS fuel form 4136 2018 is used by taxpayers to claim a credit for the federal excise tax on gasoline and special fuels. Businesses that operate vehicles or machinery that use these fuels and pay the federal excise tax may need this form to receive the credit.

-

How can airSlate SignNow help with the IRS fuel form 4136 2018?

airSlate SignNow provides a convenient way to electronically sign and securely send the IRS fuel form 4136 2018. This simplifies the submission process, ensuring timely and accurate filings for tax credits.

-

What features does airSlate SignNow offer for managing the IRS fuel form 4136 2018?

With airSlate SignNow, you can easily create templates for the IRS fuel form 4136 2018, streamline workflows, and track document status. This efficiency helps reduce errors and saves time, allowing you to focus more on your business.

-

Is airSlate SignNow cost-effective for filing the IRS fuel form 4136 2018?

Yes, airSlate SignNow offers cost-effective solutions for managing documents like the IRS fuel form 4136 2018. Our pricing plans are designed to cater to businesses of all sizes, ensuring you get maximum value for your eSignature needs.

-

Can I integrate airSlate SignNow with accounting software for the IRS fuel form 4136 2018?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, making it easier to manage your records and simplify the filing of the IRS fuel form 4136 2018. This integration ensures your data stays synchronized and organized.

-

What benefits does airSlate SignNow provide for filing the IRS fuel form 4136 2018?

The primary benefits include enhanced speed, security, and ease of use when filing the IRS fuel form 4136 2018. By utilizing eSignatures, you can expedite the process, reduce paper waste, and maintain compliance with federal regulations.

-

Is it easy to get started with airSlate SignNow for the IRS fuel form 4136 2018?

Yes, getting started with airSlate SignNow is straightforward. You can sign up for a free trial, customize templates for the IRS fuel form 4136 2018, and start sending documents for eSignature in minutes without any technical skills.

Get more for Form 4136 Credit For Federal Tax Paid On Fuels

Find out other Form 4136 Credit For Federal Tax Paid On Fuels

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure