About Form 4136, Credit for Federal Tax Paid on Fuels 2022

About Form 4136, Credit For Federal Tax Paid On Fuels

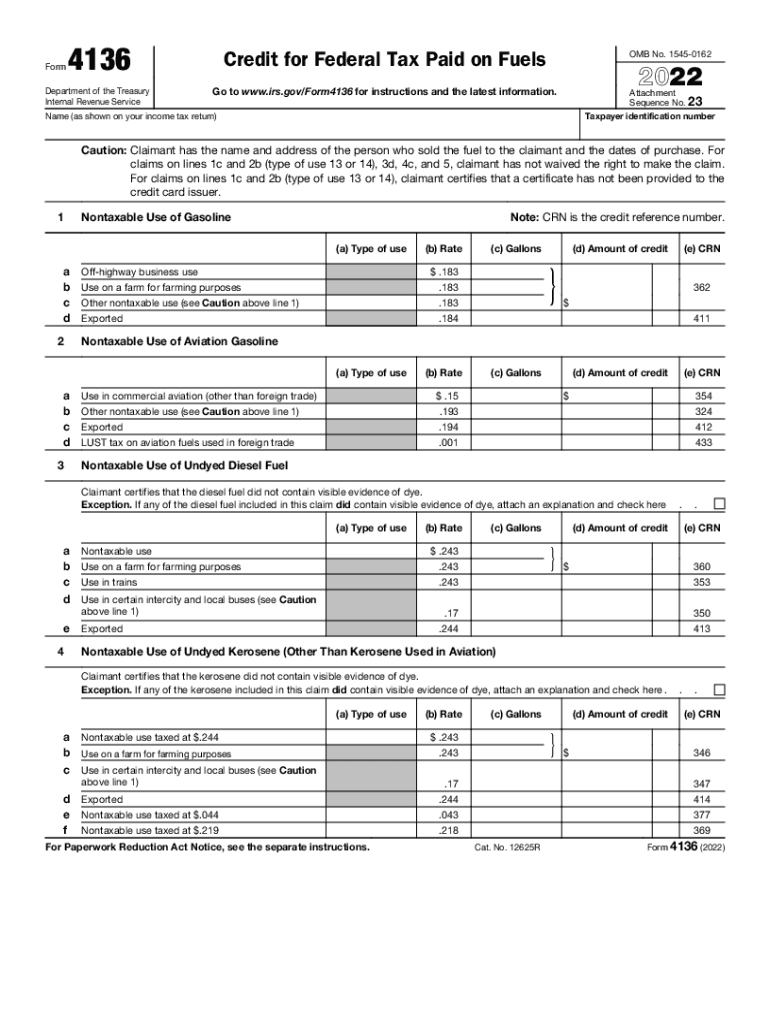

Form 4136 is utilized to claim a credit for federal tax paid on fuels. This form is particularly relevant for taxpayers who have incurred fuel expenses in their business operations or personal use, allowing them to recover some of the federal fuel taxes they have paid. The credit can apply to various types of fuels, including gasoline, diesel, and kerosene, and is designed to alleviate the financial burden on those who use these fuels for specific qualified purposes.

How to Obtain Form 4136

Taxpayers can obtain Form 4136 from the Internal Revenue Service (IRS) website or through tax preparation software that supports IRS forms. The form is available for download in PDF format, which can be printed and filled out manually. Additionally, many tax professionals can assist in obtaining and completing this form as part of their services. It is essential to ensure that you are using the correct version of the form for the tax year you are filing.

Steps to Complete Form 4136

Completing Form 4136 involves several key steps:

- Gather all necessary documentation related to fuel purchases, including receipts and invoices.

- Fill out your personal information, including your name, address, and taxpayer identification number.

- Provide details about the fuel used, including the type of fuel and the amount for which you are claiming a credit.

- Calculate the total credit by applying the appropriate rates for the fuel types listed.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 4136

The IRS has specific guidelines regarding the use of Form 4136. Taxpayers must ensure they meet the eligibility criteria for claiming the credit, which includes using the fuel for qualified purposes. The IRS also outlines the record-keeping requirements, emphasizing the importance of maintaining accurate records of fuel purchases and usage. It is advisable to consult the IRS instructions for Form 4136 to understand all requirements and ensure compliance.

Filing Deadlines for Form 4136

Form 4136 must be filed in accordance with the IRS deadlines for tax returns. Typically, the deadline for filing your federal tax return is April 15 of the following year, unless you have filed for an extension. It is crucial to submit Form 4136 along with your tax return to ensure that you receive the credit in a timely manner. Late submissions may result in the forfeiture of the credit.

Eligibility Criteria for Form 4136

To qualify for the credit on Form 4136, taxpayers must meet specific eligibility criteria. This includes being the purchaser of the fuel and using it for qualified purposes, such as in a trade or business, or for certain exempt uses. Additionally, the fuel must have been subject to federal excise tax. Understanding these criteria is essential to ensure that your claim is valid and can withstand scrutiny from the IRS.

Quick guide on how to complete about form 4136 credit for federal tax paid on fuels

Effortlessly Prepare About Form 4136, Credit For Federal Tax Paid On Fuels on Any Device

Managing documents online has gained prominence among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Handle About Form 4136, Credit For Federal Tax Paid On Fuels on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and eSign About Form 4136, Credit For Federal Tax Paid On Fuels Easily

- Find About Form 4136, Credit For Federal Tax Paid On Fuels and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign About Form 4136, Credit For Federal Tax Paid On Fuels to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4136 credit for federal tax paid on fuels

Create this form in 5 minutes!

How to create an eSignature for the about form 4136 credit for federal tax paid on fuels

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4136 2021 credit and how does it relate to airSlate SignNow?

The 4136 2021 credit is a tax credit that helps eligible businesses offset certain costs. By using airSlate SignNow, you can easily manage and eSign documents related to this credit, ensuring a smooth and efficient process that saves you time and resources.

-

How can airSlate SignNow help me claim the 4136 2021 credit?

airSlate SignNow streamlines the documentation process for claiming the 4136 2021 credit. With features like electronic signatures and customizable templates, you can prepare and submit all required forms quickly and securely, enhancing your chances of a successful claim.

-

Is airSlate SignNow a cost-effective solution for managing the 4136 2021 credit documents?

Yes, airSlate SignNow offers a cost-effective solution tailored to businesses of all sizes. By reducing the time spent on paperwork through its eSigning capabilities, businesses can lower operational costs while efficiently managing the documentation for the 4136 2021 credit.

-

What features does airSlate SignNow offer for handling the 4136 2021 credit?

airSlate SignNow includes features such as document templates, team collaboration, and secure cloud storage, all designed to support the management of your 4136 2021 credit documents. These features enable users to efficiently draft, review, and sign important forms without hassle.

-

Can airSlate SignNow integrate with other software for the 4136 2021 credit process?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easier to gather data and manage the documentation for the 4136 2021 credit. This integration simplifies workflows, allowing for better organization and accessibility of important tax documents.

-

What benefits do users gain from airSlate SignNow when applying for the 4136 2021 credit?

Using airSlate SignNow offers numerous benefits for businesses applying for the 4136 2021 credit, such as expedited document processing and improved accuracy. The platform ensures that all signatures and approvals are obtained promptly, reducing the risk of delay or errors in your credit application.

-

Is it easy to get started with airSlate SignNow for managing the 4136 2021 credit?

Getting started with airSlate SignNow is very easy. With a user-friendly interface and an intuitive setup process, you can begin managing your 4136 2021 credit documents in no time, even if you're not tech-savvy.

Get more for About Form 4136, Credit For Federal Tax Paid On Fuels

Find out other About Form 4136, Credit For Federal Tax Paid On Fuels

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History