Form 4136 2014

What is the Form 4136

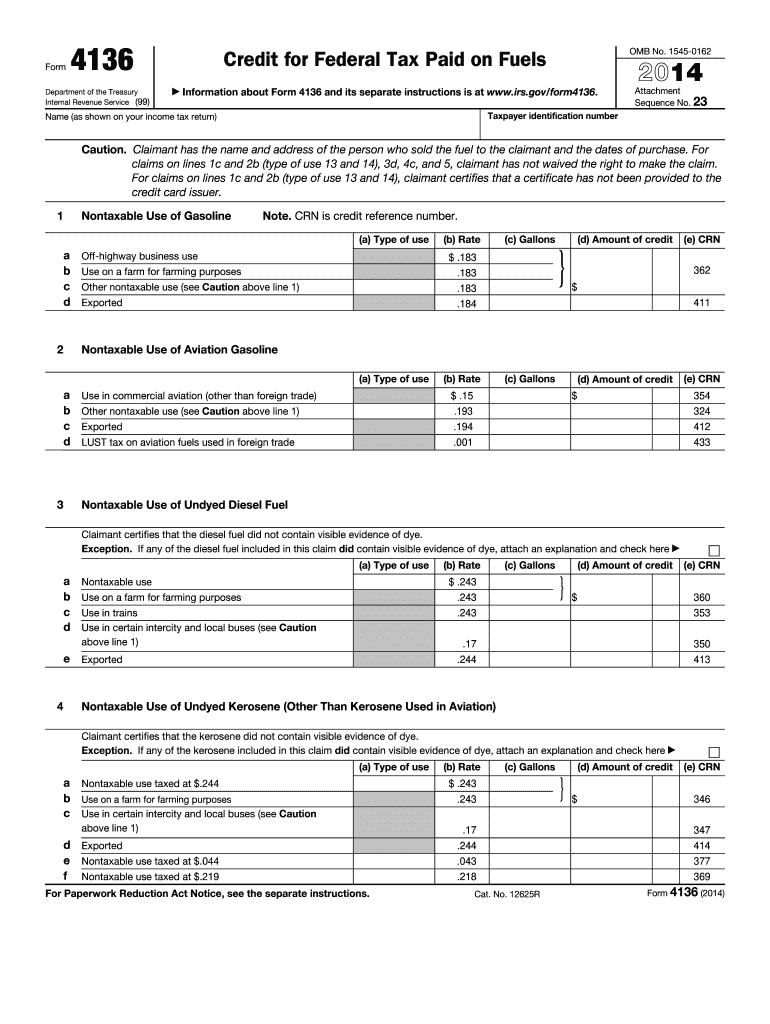

The Form 4136, officially known as the "Credit for Federal Tax Paid on Fuels," is a tax form used by individuals and businesses in the United States to claim a credit for federal excise taxes paid on certain fuels. This form is particularly relevant for those who use fuel for non-highway purposes, such as farming, fishing, or other off-road activities. By filling out this form, taxpayers can potentially receive a refund for the federal taxes they have paid on fuel that was not used for taxable purposes.

How to use the Form 4136

Using the Form 4136 involves several steps to ensure accurate completion and submission. Taxpayers must first gather relevant information, including details about the fuel purchased and the federal excise taxes paid. After filling out the necessary sections of the form, individuals should review their entries for accuracy. Once completed, the form can be submitted along with the tax return or filed separately, depending on the taxpayer's situation. Proper usage of this form can lead to significant tax savings.

Steps to complete the Form 4136

Completing the Form 4136 requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including receipts for fuel purchases and records of federal excise taxes paid.

- Fill out the form by providing your personal information, such as name, address, and taxpayer identification number.

- Detail the type and amount of fuel used, ensuring to specify the purpose for which the fuel was utilized.

- Calculate the total credit by multiplying the gallons of fuel by the applicable federal excise tax rate.

- Review the completed form for accuracy before submission.

Legal use of the Form 4136

The legal use of the Form 4136 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report the fuel used and the federal excise taxes paid. The form must be completed truthfully, as providing false information can lead to penalties. The IRS allows the use of this form for claiming credits on fuel used in specific non-highway activities, making it essential for eligible taxpayers to understand their rights and responsibilities under the law.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4136 are typically aligned with the annual tax return deadlines. Taxpayers should be aware of key dates, including:

- The standard deadline for individual tax returns, which is usually April 15.

- Extensions may be available, but any credits claimed must still be submitted within the appropriate timeframe.

- Specific state deadlines may also apply, so it is important to check local regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 4136 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is often the fastest and most efficient method.

- Mailing a paper copy of the form to the appropriate IRS address, which may take longer for processing.

- In-person submission at designated IRS offices, although this method is less common and may require an appointment.

Quick guide on how to complete 2014 form 4136

Complete Form 4136 seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and store it securely on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 4136 on any device using airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to edit and eSign Form 4136 effortlessly

- Find Form 4136 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Decide how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4136 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 4136

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 4136

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Form 4136 and how can airSlate SignNow help with it?

Form 4136 is used for claiming a credit for the federal excise tax on gasoline and special fuels. airSlate SignNow simplifies the process of filling out and eSigning Form 4136, ensuring that you can submit it quickly and accurately. With our user-friendly interface, you can easily manage all your documents, including Form 4136, from any device.

-

Is there a cost associated with using airSlate SignNow for Form 4136?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who frequently handle Form 4136. Our pricing is designed to be affordable and provides excellent value for businesses looking to streamline their document management processes. You can choose a plan that fits your budget and start eSigning Form 4136 effortlessly.

-

What features does airSlate SignNow offer for managing Form 4136 documents?

airSlate SignNow provides several features to enhance your experience with Form 4136, including customizable templates, automatic reminders, and secure cloud storage. These features ensure that you can efficiently manage your Form 4136 submissions and never miss a deadline. Additionally, our platform supports seamless collaboration with team members when working on Form 4136.

-

Can I integrate airSlate SignNow with other software for processing Form 4136?

Absolutely! airSlate SignNow integrates with a variety of popular software applications, allowing you to streamline your workflow when dealing with Form 4136. By connecting with tools like CRM systems and project management apps, you can automate the document flow and improve productivity while handling Form 4136.

-

How does airSlate SignNow ensure the security of my Form 4136?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect your Form 4136 and other sensitive documents. You can rest assured that your data is safe with us, enabling you to focus on completing your Form 4136 without worrying about security bsignNowes.

-

What are the benefits of using airSlate SignNow for Form 4136 compared to traditional methods?

Using airSlate SignNow for Form 4136 offers numerous benefits over traditional methods, such as increased efficiency, reduced paper waste, and faster turnaround times. Our platform allows you to eSign and submit Form 4136 electronically, eliminating the need for printing and mailing. This not only saves time but also helps your business stay organized and environmentally friendly.

-

Can I track the status of my Form 4136 submissions using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 4136 submissions in real-time. You will receive notifications when your documents are viewed, signed, or completed. This visibility helps you stay updated and ensures that your Form 4136 is processed promptly.

Get more for Form 4136

- Enf 6enf06 engpdf form

- Pptc 040 e adult general passport application for canadians 16 years of age or over applying in canada or the usa form

- Vehiclequeensland regulated ship cancellation of form

- Vehicle details inspection sheet department of transport form

- Statutory declaration form

- B333 smallcraft arrival report b333 smallcraft arrival report form

- Doc residential accommodation complaint form consumer affairs victoria

- Pdf imm 1283 f valuation de la situation financire canadaca form

Find out other Form 4136

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template