1040ez 2017-2026

What is the 1040EZ?

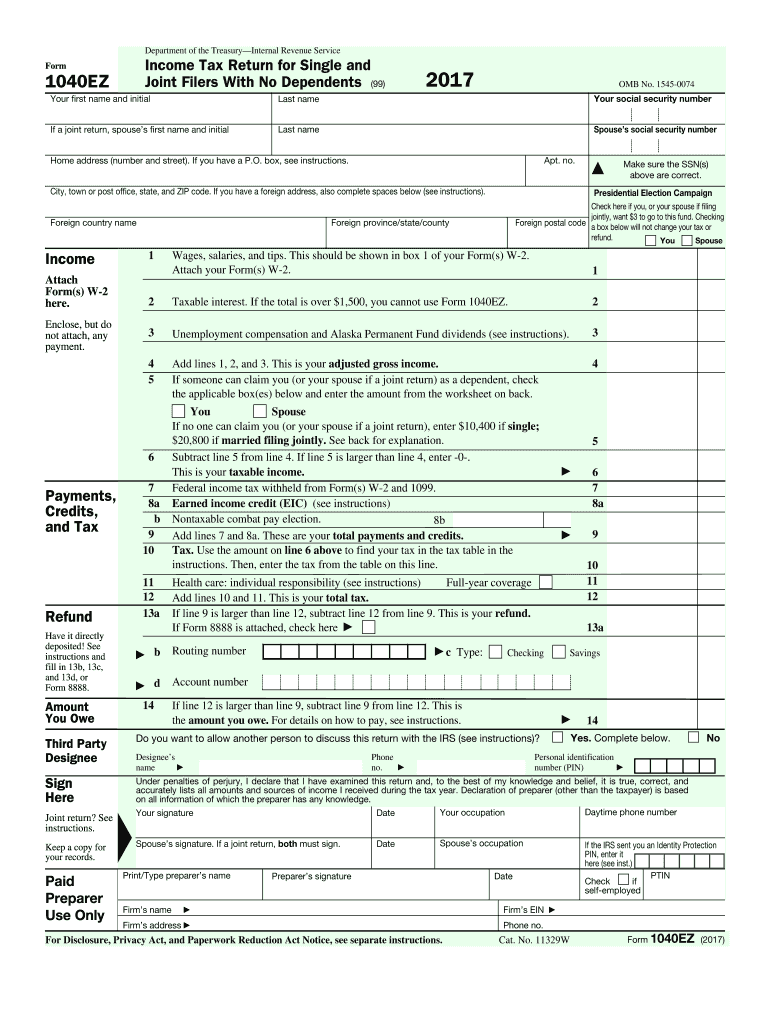

The 1040EZ is a simplified tax form designed for individuals in the United States who meet specific criteria. It allows taxpayers to report their income and calculate their tax liability in a straightforward manner. This form is particularly beneficial for those with uncomplicated financial situations, such as single filers or married couples without dependents. Key eligibility requirements include having a taxable income of less than $100,000, no dependents, and limited interest income. The 1040EZ is often the first tax form used by young adults and those new to filing taxes.

Steps to complete the 1040EZ

Filling out the 1040EZ involves several clear steps. Begin by gathering necessary personal information, including your Social Security number and filing status. Next, enter your total income, which may include wages, tips, and taxable interest. After calculating your tax, report any payments or credits you may have, such as withholding from your paycheck. Finally, determine if you are due a refund or if you owe additional taxes. Ensure you sign and date the form, which makes it legally binding.

How to obtain the 1040EZ

You can easily obtain the 1040EZ form from the Internal Revenue Service (IRS) website or through various tax preparation software. Many tax professionals also provide this form to their clients. If you prefer a physical copy, you can request one from the IRS or find it at local libraries and post offices. Ensure you are using the correct version for the tax year you are filing.

IRS Guidelines

The IRS provides specific guidelines for completing the 1040EZ. It is essential to follow these instructions carefully to avoid errors that could delay your refund or result in penalties. The IRS outlines eligibility requirements, acceptable income types, and how to report various credits. Familiarizing yourself with these guidelines can help ensure a smooth filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 1040EZ typically align with the standard tax filing dates in the United States. Generally, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to be aware of these dates to avoid penalties and interest on any unpaid taxes.

Required Documents

To complete the 1040EZ, you will need several key documents. These include your W-2 forms from employers, any 1099 forms for additional income, and records of any taxable interest. Having these documents ready will streamline the process and help ensure accuracy when reporting your income and calculating your taxes.

Quick guide on how to complete 1040 ez forms 2017 2018

Uncover the simplest method to complete and endorse your 1040ez

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers an improved way to finalize and endorse your 1040ez and similar forms for public services. Our intelligent electronic signature solution provides you with all the tools necessary to handle paperwork efficiently and in compliance with official standards - comprehensive PDF editing, managing, safeguarding, signing, and sharing capabilities are all available through a user-friendly interface.

Only a few steps are needed to finalize and endorse your 1040ez:

- Upload the editable template to the editor using the Get Form button.

- Review the information required in your 1040ez.

- Move between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Highlight the important parts or Blackout sections that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Include the Date alongside your signature and conclude your task with the Done button.

Store your completed 1040ez in the Documents folder within your profile, download it, or send it to your chosen cloud storage. Our solution also provides versatile form sharing options. There’s no need to print out your forms when you want to send them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1040 ez forms 2017 2018

FAQs

-

How does the standardized deduction in the form 1040 NR-Ez 2018 work for an H1B visa?

Obtain first an ITIN by completing a W-7. If not follow the instructions on https://www.irs.gov/pub/irs-pdf/....The standard deduction is the itemize deduction

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Do I need to fill 1040-NR-EZ again along with 1040X to amend filing the status from single to married?

Yes. According to the Form 1040X instructions section “Resident and nonresident aliens”, to amend a Form 1040NR or 1040NR-EZ, you will need to complete a corrected Form 1040NR or 1040NR-EZ, and attach it to a Form 1040X.Note that you can only file as married if you were married as of December 31 of the tax year you are amending.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

Create this form in 5 minutes!

How to create an eSignature for the 1040 ez forms 2017 2018

How to generate an eSignature for your 1040 Ez Forms 2017 2018 in the online mode

How to generate an electronic signature for your 1040 Ez Forms 2017 2018 in Google Chrome

How to create an eSignature for signing the 1040 Ez Forms 2017 2018 in Gmail

How to generate an eSignature for the 1040 Ez Forms 2017 2018 right from your smart phone

How to create an electronic signature for the 1040 Ez Forms 2017 2018 on iOS

How to create an electronic signature for the 1040 Ez Forms 2017 2018 on Android OS

People also ask

-

What is the 1040ez form and how can airSlate SignNow help?

The 1040ez form is a simplified tax return form that individuals can use if they meet specific criteria. With airSlate SignNow, you can easily fill out and eSign the 1040ez form online, making the tax filing process efficient and straightforward. Our platform ensures that your documents are securely signed and stored, streamlining your tax preparation.

-

Is airSlate SignNow suitable for filing a 1040ez?

Absolutely! airSlate SignNow is designed to facilitate various document types, including the 1040ez form. Our user-friendly interface allows you to complete, sign, and send your 1040ez form effortlessly, ensuring you meet your tax deadlines with ease.

-

What features does airSlate SignNow offer for managing the 1040ez form?

airSlate SignNow provides features like customizable templates, advanced eSignature capabilities, and document tracking specifically tailored for forms like the 1040ez. These features help you efficiently manage your tax documents, ensuring accuracy and compliance throughout the process.

-

How much does airSlate SignNow cost for filing the 1040ez?

airSlate SignNow offers competitive pricing plans that cater to individuals and businesses needing to file forms like the 1040ez. Our cost-effective solutions provide excellent value, with options that fit various budgets while ensuring you can eSign your documents without hassle.

-

Can I integrate airSlate SignNow with other tools for my 1040ez filing?

Yes, airSlate SignNow allows for seamless integration with various tools and applications, enhancing your workflow when filing the 1040ez. Whether you're using accounting software or document management systems, our integrations ensure that your eSigning process is smooth and efficient.

-

What are the benefits of using airSlate SignNow for the 1040ez form?

Using airSlate SignNow for your 1040ez form offers numerous benefits, including time savings, enhanced security, and reduced paper usage. Our platform simplifies the eSigning process, allowing you to complete your tax filings quickly and securely, which can lead to a more stress-free tax season.

-

Is it safe to use airSlate SignNow for my 1040ez form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 1040ez form and personal data are protected. We use advanced encryption and secure servers, giving you peace of mind as you eSign and manage your sensitive tax documents.

Get more for 1040ez

Find out other 1040ez

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free